- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- I did not receive a 1099-B because a bank or brokerage was not involved in the sale of the stock. TT still asks me to upload my 1099-B for the IRS. What do I do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I did not receive a 1099-B because a bank or brokerage was not involved in the sale of the stock. TT still asks me to upload my 1099-B for the IRS. What do I do?

In the sales section when entering the specifics of the sale, I chose the option "Long term did not receive 1099-B form".

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I did not receive a 1099-B because a bank or brokerage was not involved in the sale of the stock. TT still asks me to upload my 1099-B for the IRS. What do I do?

If you did not receive a Form 1099-B then skip the step to import the form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I did not receive a 1099-B because a bank or brokerage was not involved in the sale of the stock. TT still asks me to upload my 1099-B for the IRS. What do I do?

Ok, after I skip that part, I'm asked "How do you plan on submitting your 1099-B to the IRS?". The two options are:

- I'm going to mail a paper copy of my 1099-B to the IRS

- I'm planning to upload a PDF copy of my 1099-B later

I cannot skip this step. I have to choose one of these options. Do I just choose one and forget about it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I did not receive a 1099-B because a bank or brokerage was not involved in the sale of the stock. TT still asks me to upload my 1099-B for the IRS. What do I do?

@nicholasverduin wrote:

Ok, after I skip that part, I'm asked "How do you plan on submitting your 1099-B to the IRS?". The two options are:

- I'm going to mail a paper copy of my 1099-B to the IRS

- I'm planning to upload a PDF copy of my 1099-B later

I cannot skip this step. I have to choose one of these options. Do I just choose one and forget about it?

It may be better if you follow this procedure instead -

To enter an investment sale other than from a brokerage account (1099-B), follow the steps below.

- Click on Federal Taxes (Personal using Home and Business)

- Click on Wages and Income (Personal Income using Home and Business)

- Click on I'll choose what I work on (if shown)

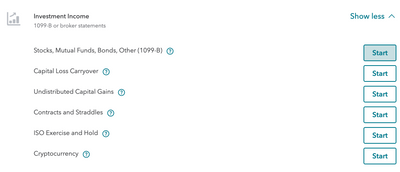

- Under Investment Income

- On Stocks, Mutual Funds, Bonds, Other, click the start or update button

Or enter investment sales in the Search box located in the upper right of the program screen. Click on Jump to investment sales

On the screen Did you sell stocks, mutual funds, bonds, or other investments in 2019? click Yes

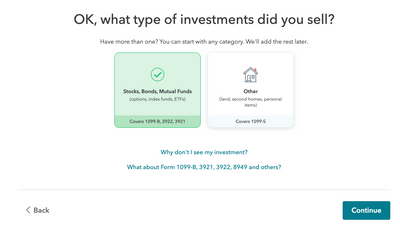

On the screen OK, what type of investments did you sell? choose either option and Continue

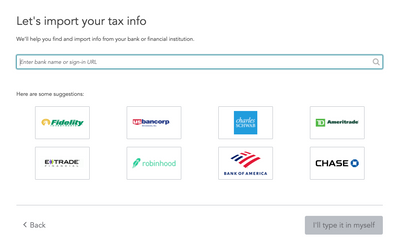

On the screen Let's import your tax info click on I'll type it in myself

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I did not receive a 1099-B because a bank or brokerage was not involved in the sale of the stock. TT still asks me to upload my 1099-B for the IRS. What do I do?

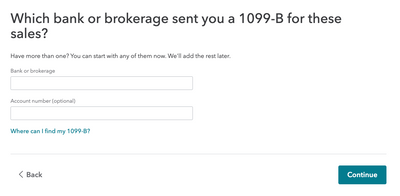

@DoninGA

I followed your instructions, but I ended up at the same place I did before:

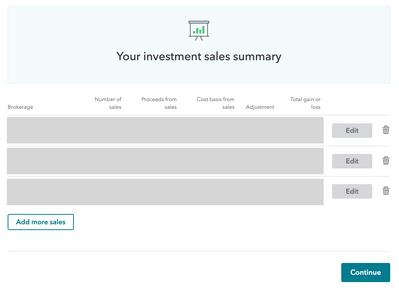

I chose to "Add more sales, then:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I did not receive a 1099-B because a bank or brokerage was not involved in the sale of the stock. TT still asks me to upload my 1099-B for the IRS. What do I do?

To get past this screen just enter 'No Bank' in the bank or Brokerage box and continue.

You don't need an account number

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I did not receive a 1099-B because a bank or brokerage was not involved in the sale of the stock. TT still asks me to upload my 1099-B for the IRS. What do I do?

I have the exact same scenario. I sold a QSB stock in a private company (through a tender offer) that did not involve any bank. I did not receive 1099-B.

Even if I provide "No bank" to get past the screen above, I end up in the following screen to choose one.

- I'm going to mail a paper copy of my 1099-B to the IRS

- I'm planning to upload a PDF copy of my 1099-B later

Is there a clean flow where I can specify I did not receive 1099-B?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I did not receive a 1099-B because a bank or brokerage was not involved in the sale of the stock. TT still asks me to upload my 1099-B for the IRS. What do I do?

Choose either option as it doesn't matter.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I did not receive a 1099-B because a bank or brokerage was not involved in the sale of the stock. TT still asks me to upload my 1099-B for the IRS. What do I do?

I'm finding that if I continue as if I had a 1099-b, and select typing it myself, I eventually get to the screen that offers a dropdown of "sales sections," one of which is "short-term did not receive 1099-b form," and another is "long-term did not receive 1099-b form." I'm no expert, but it looks like this is the right path to follow. I agree it is obtuse because there's language before this point that implies you have one.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I did not receive a 1099-B because a bank or brokerage was not involved in the sale of the stock. TT still asks me to upload my 1099-B for the IRS. What do I do?

Yes, you are entering this correctly. Perhaps the instructions could be a little clearer.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

fiorentino-mary

New Member

bjw5017

New Member

AE_1989

New Member

mread6153

New Member

ilenearg

Level 2