- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- How to file a capital loss carryover in previous years not filed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file a capital loss carryover in previous years not filed?

For 2014, 2015 or 2016 I have not filed a return due to low income which based on the IRS online questionnaire. The questionnaire did not ask about capital losses. However, I think it is better file return(s) that document losses now rather than file later. For 2014 and 2016 I have Capital losses from stock I want to carryover for when my income increases in the future.

Should I file all the past returns 2014-16 and 2017 or just compile all losses on the 2017 return with capital loss carryover? If just 2017, what supporting documentation should I provide i.e the Carryover Worksheet in Turbo Tax ?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file a capital loss carryover in previous years not filed?

Yes, to claim losses for carry-forward treatment, you will need to file tax returns for all previous years. The losses will accumulate until until the loss is used up, either by reducing your taxable income or netted against capital gains.

You can deduct up to $3,000 in capital losses each year ($1,500 if you're married filing separately).

For additional info, see: How do I enter my capital loss carryover?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file a capital loss carryover in previous years not filed?

What if filed each year for other income, but I didn't know about the ability to file for capital losses with my other business venture over the past 4 years when I lost money each year?

Can I file an amendment to my tax returns for all those years with a max of $3,000, and receive the deductions and a refund from the IRS for overpaying?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file a capital loss carryover in previous years not filed?

To fix this mistake you must either file the returns you did not file OR amend the ones you did. Each return must be mailed in separate envelopes so they are processed properly. Also amend/prepare the oldest year first so the carry forward loss can be calculated correctly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file a capital loss carryover in previous years not filed?

Something similar happened to me, but I don’t see anywhere on the 1040X where you fill out to amend carryover losses. Example I did not carryover my losses from 2019 on my 2020 due to a glitch on turbo tax. Reporting this 2019 carryover amount will have no affect on my 2020 tax return (as far as the other the other data reported for 2020) as I had losses in 2020 and received the standard $3000 for capital loss. I just need these losses to carryover for future returns should and when it would apply. So is there a way to just include that carryover loss from 2019 when I file my 2021 taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file a capital loss carryover in previous years not filed?

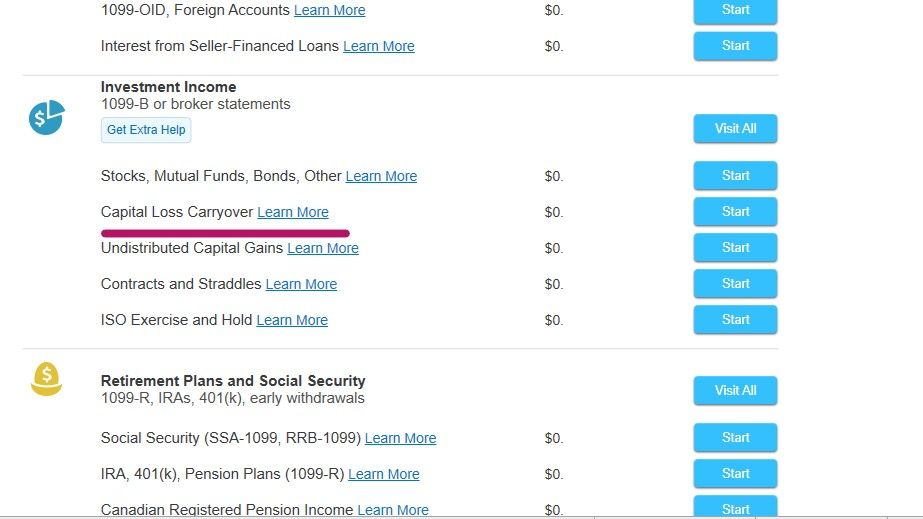

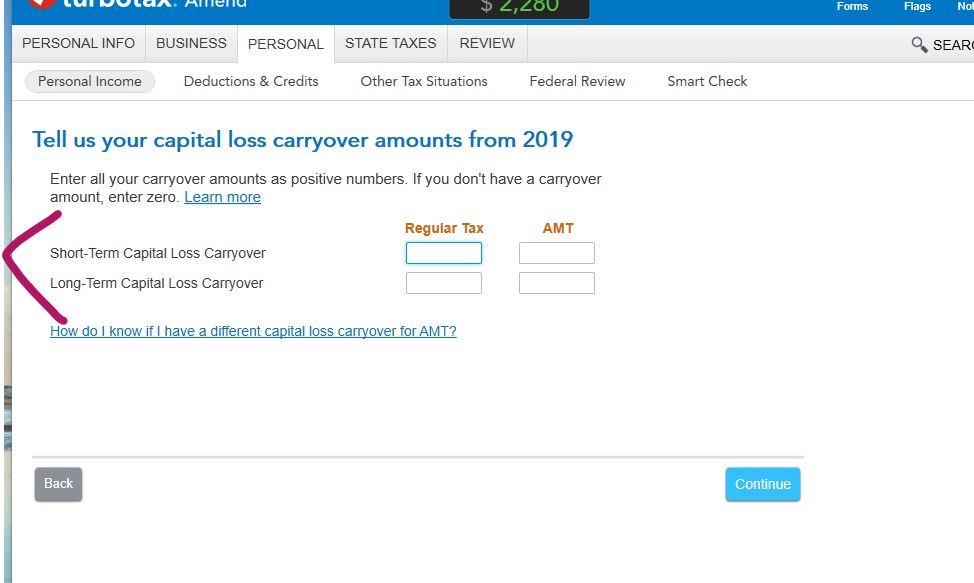

Look for this section in the program ... follow the interview screens to enter in the prior year carryover amounts ... but you must amend the 2020 return to get the correct 2021 carryover amounts (screenshots are from the 2020 program but will be the same in the 2021 program) :

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file a capital loss carryover in previous years not filed?

I just found out the same exact thing happened to my 2020 return as I was wrapping up 2021 return. The loss carryover amount was not transferred from 2019 tax file to 2020 and the return was filed without the loss carryover on 2020 return. So what do I do now? Should I amend 2020 return first and file an extension for 2021 return?

Mei

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file a capital loss carryover in previous years not filed?

If you know what your carryover loss amount should be for 2021, you can enter it and file your 2021 return.

Generally, you use 3K of your Capital Loss Carryover each year.

You have three years to Amend your 2020 return to claim the loss.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file a capital loss carryover in previous years not filed?

Both 2020 and 2021 we are only taking $3000.00 as our capital gains was not enough to offset the large loss carryforward from 2019 and beyond. I was surprised IRS did not pick up the inconsistency in the schedule D from 2019 to 2020. Here are some of my considerations about this whole mess.

1. I called Turbotax when I first found out this problem and was told by your customer service (maybe not a tax expert?) that I should file extension for 2021 and amend 2020 return (per case#[phone number removed]).

2. I heard that IRS does not want amended return if it does not affect the refund or liability, should I write on 2020 1040X "FOR INFORMATION ONLY" when I submit it?

3. If I filed 2021 with what I know as the correct amount of loss carryover (after I corrected 2020) and file the return, how likely will IRS pick up the inconsistency in schedule D from 2020 (before amending) to 2021?

What will your Tax Expert service charge if I turn the whole mess to your department for help? I am a cancer patient since March of 2021, and I am still undergoing therapy. I would like to have some help and not have to deal with the stress.

I really appreciate your quick response and hope to get some more advise if you will.

Thanks,

Mei

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to file a capital loss carryover in previous years not filed?

You're correct that the IRS does not require amendments that don't change the Refund/Tax Due amount.

You could enter the correct amount of your Capital Loss Carryover in your 2021 return and file your own return, as you suggested. Keep records of your calculations you did to arrive at that amount just in case.

It's hard to say what the likelihood of the IRS picking up the difference between the Loss Carryover from 2020 to 2021. Probably about the same as the likelihood that they picked it up from 2019 to 2020. However, it is common for users to have to calculate/enter the Capital Loss Carryover amount if TurboTax calculated/reported it incorrectly.

This link has some discussion on Incorrect Capital Loss Carryover.

Click this link for various options/prices for guidance through TurboTax Live or Full Service.

Good luck to you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

garne2t2

Level 1

user17524121432

Level 1

in [Event] Ask the Experts: Investments: Stocks, Crypto, & More

titan7318

Level 1

mjtax20

Returning Member

epiciocc12

Level 2