- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Can I deduct investment expense on my California 2018 taxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I deduct investment expense on my California 2018 taxes

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I deduct investment expense on my California 2018 taxes

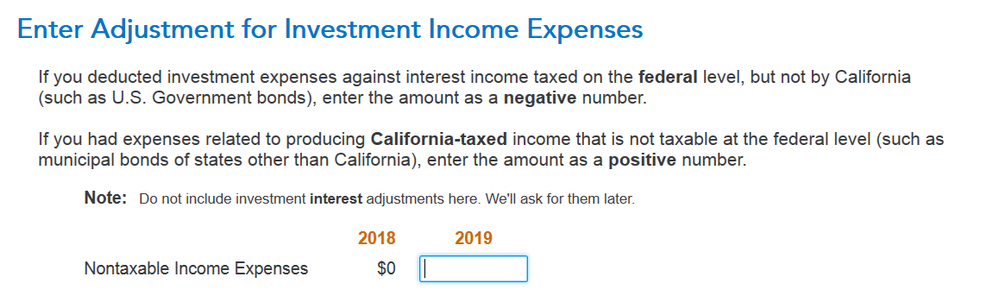

Yes. With your CA state open in the TT Desktop interview, use the "Show Topic List" menu to go to "Adjustments to Income".

You will see a place for "Investment Income Expenses" around the middle of the page.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I deduct investment expense on my California 2018 taxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I deduct investment expense on my California 2018 taxes

This answer is not correct. The Investment Management Fees and other Miscellaneous Deductions are handled by Turbo Tax at the bottom of the CA form in the California return. Go to the Forms view and then to Schedule A inj California and you will see where it is added back to the Federal Itemized deductions after allowing for the 2% threshold.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I deduct investment expense on my California 2018 taxes

If you didn't originally add the non-federally-deductible investment expenses (to be fair there is a help message that, if you clicked, would have told you you should add them so they can then be used for state returns), you must amend the Federal return by adding the expense. You need to select an update in the second half of the options for amending page (adjustments to income?). THEN select a second update to amend the state return, and simply click through because the necessary data has already been added and it then flows through to the amended state return.

So far so good, but now you are stuck in amended return hell if you originally filed electronically because it's an "error" to have electronic filing status for an amended return. So you finally just continue, at which point it's a simply a matter of printing it all out...NOT!

There is no attempt whatsoever to be helpful with double-sided printing. There are single page special instructions inserted before the federal 1040X (which really shouldn't be needed because those non-deductible expenses ARE NOT PRINTED anywhere, and certainly don't affect the original 1040 tax results). In the case of the state return that single page comes in front of the federal return attached behind the state return, completely messing up the pagination.

But in the end it works and you get the deduction and lower tax and all will be well.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I deduct investment expense on my California 2018 taxes

I am reading the instruction but need some help to understand it... It said "if you had expenses related to producing California-taxed income that is not taxable at the federal level.... enter the amount as a positive number". My investment is made up of CA muni bonds (tax exempt) and other bonds (taxable). I don't see which portion of the investment is not taxable at federal but taxable at CA... How should I figure out what to fill in? Can you explain a bit more. Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I deduct investment expense on my California 2018 taxes

You would need to determine what percentage of the ca muni bonds vs total bonds and then use that same percentage X $30 as a positive number. if you are not sure of the totals, just leave this portion blank since it won't significantly impact your return for that small amount of expense listed there.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I deduct investment expense on my California 2018 taxes

Thanks Dave. But why x$30? The advisory fee is actually a few thousand dollars so it is not a small amount. The ratio of taxable interest to non-taxable interest is about 36% to 64%. Hope to fill this out right but I can't quite understand the guideline. Can you explain a bit more? Many thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I deduct investment expense on my California 2018 taxes

@CYY the original post is referring to a 2018 (twenty eighteen) tax return. But your add-on post is apparently asking about a 2019 tax return based on the image you posted. You risk confusing everyone in this thread, including those trying to provide answers. It's best you start your own thread.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I deduct investment expense on my California 2018 taxes

OK thanks! I thought my question was exactly the same as the original question. The rules for 2018 & 2019 are the same. Anyway, I can start a new thread.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Thomasketcherside2

New Member

anonymouse1

Level 5

in Education

currib

New Member

anil

New Member

RE-Semi-pro

New Member