- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

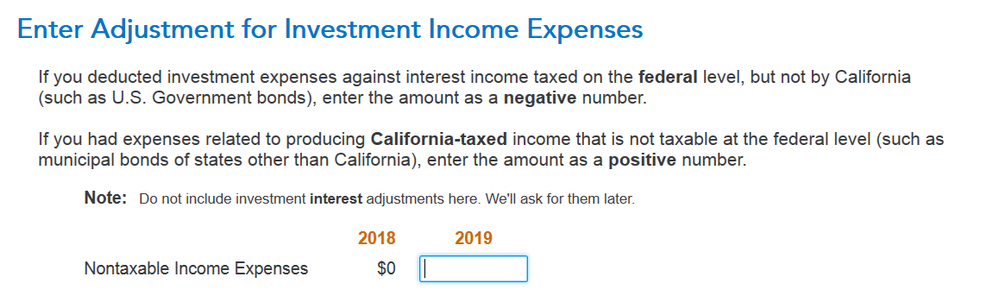

I am reading the instruction but need some help to understand it... It said "if you had expenses related to producing California-taxed income that is not taxable at the federal level.... enter the amount as a positive number". My investment is made up of CA muni bonds (tax exempt) and other bonds (taxable). I don't see which portion of the investment is not taxable at federal but taxable at CA... How should I figure out what to fill in? Can you explain a bit more. Thank you!

April 6, 2020

7:07 PM