- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Tax Year Prior to 2020: Can't e-file for lack of EIN number (no way to get around this?)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Can't e-file for lack of EIN number (no way to get around this?)

I'm one click away from e-filing - only I can't.

So, I did a job (I'm a Sole Proprietor Business) in early 2019 and the company never sent me a 1099 and therefore I do not have their EIN number.

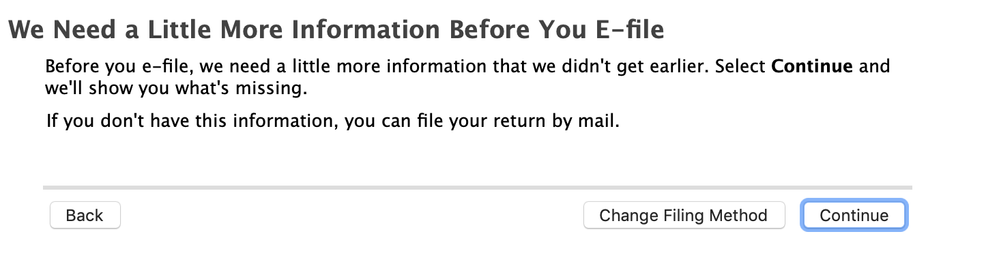

I can't get past this TuboTax screen (see attached screen capture) due to lack of an EIN number from this company.

The only option seem to be the button "change my filing method" - which brings me all the way back to the beginning. Besides, I don't want to change my filing method (I've already spent the time filling all of this out - it's correct and ready to go). In the past I have been able to e-file using TurboTax without an EIN number. Companies don't always provide this (even when you ask for the 1099 or EIN).

Also, I paid money to e-file before it was revealed to me (see screen capture) that I'd have to file by mail without EIN number form this company.

I'm feeling angry about this.

I guess I will not file my taxes today. =/

David

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Can't e-file for lack of EIN number (no way to get around this?)

If you stated that you received a 1099-misc, you would be asked for an EIN from the form. If you did not receive one, you would enter that you did not receive one, but had income from another source, such as cash. You would not be asked for an EIN in that case.

If you did receive one, you can't e-file without the EIN. If you did not, you need to go back and indicate that your worked for cash in the income section. You do not need to change any expense amounts.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Can't e-file for lack of EIN number (no way to get around this?)

I believe I typed in the name of the company in that area of Turbo Tax where one enters 1099. So, perhaps that's the issue. It was several months ago when I filled out that portion of the TurboTax forms (where one inputs 1099 income forms). I don't recall a question or area where one can enter a dollar amount of income from an unknown source.

So, I guess instead of finishing my taxes today - I need to go back and redo them again. What a PITA.

David

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Can't e-file for lack of EIN number (no way to get around this?)

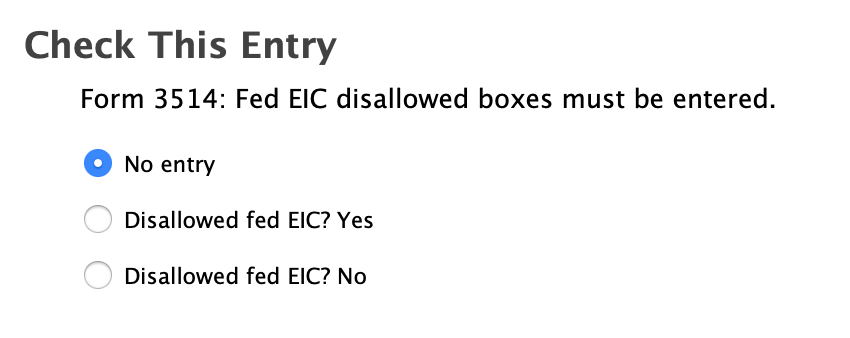

Okay, I've edited my business income - transferring the amount from the company that never provided a 1099 to some other area. Then, I made an attempt to e-file - but come up with a new issue.

I need to check Yes or No for Fed EIC.

I have absolutely no idea what this means.

These problems should have been detected in the 'check for errors' section of TurboTax - before I got to the e-filing section. =/

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Can't e-file for lack of EIN number (no way to get around this?)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Can't e-file for lack of EIN number (no way to get around this?)

Phone support was a total waste of time.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Can't e-file for lack of EIN number (no way to get around this?)

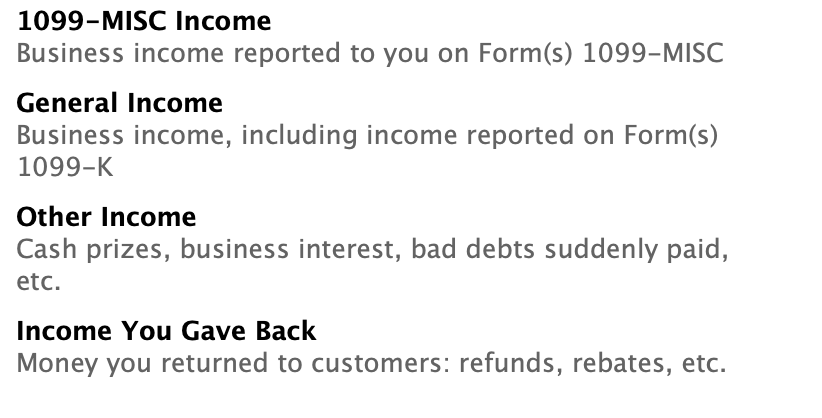

I stuck the amount I was paid (which had no accompanying 1099 form) in "Other Income". I've attached the screen capture for illustration. Side note: the examples listed under Other Income don't explicitly state a (fairly common?) case for when you haven't received a 1099.

I still can't e-file though - because I have no clue how to answer the Fed EIC question (see my previous post / screen capture)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Can't e-file for lack of EIN number (no way to get around this?)

If you didn't receive a 1099 Misc then there is no point trying to enter one. If you are not using a schedule C, then you can enter the amount by following the instructions below:

Here's how to enter other income on Form 1040 line 21 in TurboTax.

· Click the Federal Taxes tab ( Personal in the Self-Employed or Home & Business version)

· Click Wages & Income. (Personal income in the Self-Employed or Home & Business version)

· Click "I'll choose what I work on."

· On the screen "Your 2016 Income Summary," scroll all the way down to the last section, "Less Common Income."

· Click the Start or Update button for the last topic, "Miscellaneous Income, 1099-A, 1099-C."

· On the next screen, "Let's Work on Any Miscellaneous Income," scroll down and click the Start or Update button for the last topic, "Other reportable income."

· The next screen asks, "Did you receive any other taxable income." Click Yes.

· On the next screen, "Other Taxable Income," enter a description and the amount. Click Continue.

· On the next screen click Done.

The income will be reported on Form 1040 line 21 with the description that you entered.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Can't e-file for lack of EIN number (no way to get around this?)

I put my income on Sch C in the box " Not from an MISC-1099 nor from 1099-NEC, but still requiring an EIN to efile. Please advise.

Thanks,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Can't e-file for lack of EIN number (no way to get around this?)

Did you check the box that you paid employees? You need an EIN for that.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

gaspowerinc

Level 1

rprastein

Level 3

virginia-turbotax-deluxe-user

Level 1

Solar Eclipse

Level 3

user17592114376

Returning Member