- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: Why is it saying my total miles must be greater that my professional miles when my truck is 1...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is it saying my total miles must be greater that my professional miles when my truck is 100% business and all miles are business related. There are no commuter miles.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is it saying my total miles must be greater that my professional miles when my truck is 100% business and all miles are business related. There are no commuter miles.

Can you clarify if you are entering actual expenses or using the standard mileage deduction? TurboTax will allow 100% business use- you may want to re-check your entries.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is it saying my total miles must be greater that my professional miles when my truck is 100% business and all miles are business related. There are no commuter miles.

Standard mileage deduction.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is it saying my total miles must be greater that my professional miles when my truck is 100% business and all miles are business related. There are no commuter miles.

Inadvertently, something was answered incorrect in the interview. Here's the steps to correct the error.

- Open TurboTax.

- In the left black panel select Tax Tools > Tools > Delete a form.

- Delete Schedule C > Car and Truck Expense Worksheet > Continue.

- Federal > Wages & Income > Self-employment income and expenses > Edit/Add.

- Select the line of work > Edit.

- Expenses > Vehicle > Start.

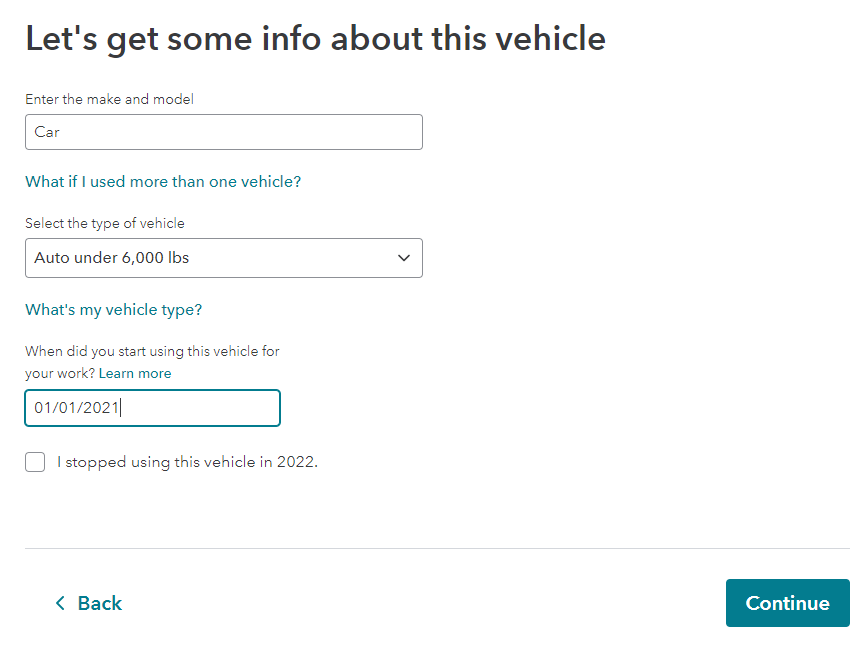

- Enter the information about the vehicle > Continue.

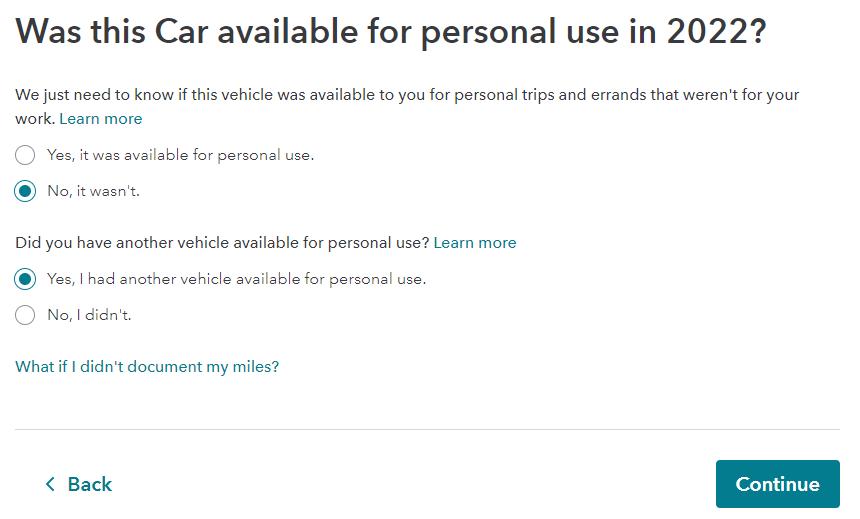

8. On the screen below, make the same entries > Continue.

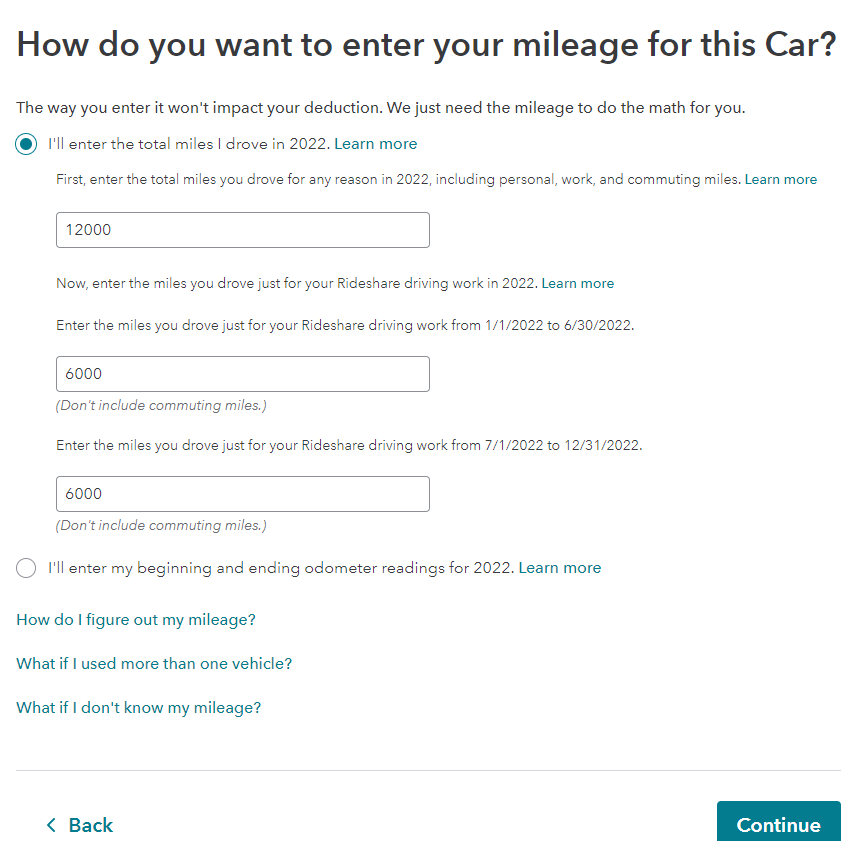

9. On the screen below enter the total miles driven > Miles driven between 01/01/2022 and 06/30/2022 > Miles driven between 07/01/2022 and 12/21/2022.

10. Complete this section.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jrosarius

New Member

Stevie1derr

New Member

in Education

m32956559

New Member

AS70

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

claytoncramer

New Member