- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: The 1099-NEC / Schedule C screen isn't working and I can't get past it to file. What do I do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099-NEC / Schedule C screen isn't working and I can't get past it to file. What do I do?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099-NEC / Schedule C screen isn't working and I can't get past it to file. What do I do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099-NEC / Schedule C screen isn't working and I can't get past it to file. What do I do?

Yes. That's the screen. I can't enter anything into it. And then at the bottom the page it asks people who are having issues sign up for updates on when the error will be fixed. I signed up. A week ago. There's been no fix and there hasn't been one single update. How do I file if I can't get past this screen?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099-NEC / Schedule C screen isn't working and I can't get past it to file. What do I do?

Currently there is a known issue when using TurboTax Online that is related to the program asking you to double-click to link to Schedule C.

Please review the article below and use the link in the article to enter your email address to be notified once this is resolved:

TurboTax: Why Am I Unable to Link my 1099-NEC?

Also you can review the information below for a possible steps to solve the issue.

Income reported on Form 1099-NEC must be reported on Schedule C, the program is trying to link these two forms together to be sure that it is reported correctly and on the right form.

Revisit the section where you entered the Form 1099-NEC if you entered it on its own and delete that entry, by following these steps:

- Open TurboTax.

- On the top right corner of TurboTax online screen, click on Search (or for CD/downloaded TurboTax locate the search box in the upper right corner).

- Type in “1099-NEC” (or for CD/downloaded TurboTax, click Find),

- Click on “Jump to 1099-NEC”

- Click on the blue “Jump to 1099-NEC” link

This will bring you a summary of all Form 1099-NEC that you have entered. Click Delete or the trash can icon next to each one.

Next, you will re-enter the Form 1099-NEC as part of the Schedule C so that the income is reported directly as part of your Business Income and Expenses and within the correct form and section of your return.

Follow these steps to go to the Schedule C section of your return:

- On the top right corner of TurboTax online screen, click on Search (or for CD/downloaded TurboTax locate the search box in the upper right corner).

- Type in “schedule c” (or for CD/downloaded TurboTax, click Find).

- Click on “Jump to schedule c”.

- Click on the blue “Jump to schedule c” link

If you already have created a Schedule C in your return, click on edit and go to the section to Add Income. This is where you will re-enter the Form 1099-NEC.

If you do not already have a Schedule C in your return, follow the prompts and enter the information about your work/business for which you received the Form 1099-NEC. Then continue through that section to Add Income and enter the Form 1099-NEC along with any additional income you received for that business.

Once you have completed this, the error should be eliminated.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099-NEC / Schedule C screen isn't working and I can't get past it to file. What do I do?

Thank you for trying to help me, I very much appreciate it. Unfortunately, I am stuck on the 4th step as “Jump to 1099-NEC” never comes up as an option. To be fair, I only checked the first 20 of the 469 pages that did come up.

As a side note, I already entered my 1099-NEC income. TurboTax is giving me a Schedule C screen telling me to double click and my 1099-NEC information will come over. But I can't double click on anything and the information is already there. But I can't get past this screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099-NEC / Schedule C screen isn't working and I can't get past it to file. What do I do?

The issue has been submitted and is currently under investigation. Please click on the following link and sign up for an email notification when it's fixed.

Why am I not able to link my 1099-NEC

Thank You for your patience

Beginning with the 2020 tax year, the IRS will require business taxpayers to report nonemployee compensation on the new Form 1099-NEC instead of on Form 1099-MISC. Businesses will need to use this form if they made payments totaling $600 or more to a nonemployee, such as an independent contractor. This was done to help clarify the separate filing deadlines on Form 1099-MISC and the new 1099-NEC form will be used starting with the 2020 tax year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099-NEC / Schedule C screen isn't working and I can't get past it to file. What do I do?

Yes, as I said in my previous replies, I clicked this link and signed up for email alerts that would tell me when this would be fixed. But again, we are on our second week now and I've received no email alerts and it hasn't been fixed. I really would like to file my taxes, please please, how do I get past this screen?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099-NEC / Schedule C screen isn't working and I can't get past it to file. What do I do?

This issue was resolved yesterday February 16, 2021, please see the below steps to remove the error and e-file your return:

Sign in or continue your TurboTax return.

Click on the Review tab and proceed through the screens until you see a screen titled "Delete Confirmation" for Form 1099-NEC.

Select Yes to delete the form. Delete each 1099-NEC that is being prompted.

After you have confirmed the deletion of these forms, please return to your business income to confirm all the 1099-NEC's you have received are entered.

Once you have confirmed this, return to the Review tab and complete filing your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099-NEC / Schedule C screen isn't working and I can't get past it to file. What do I do?

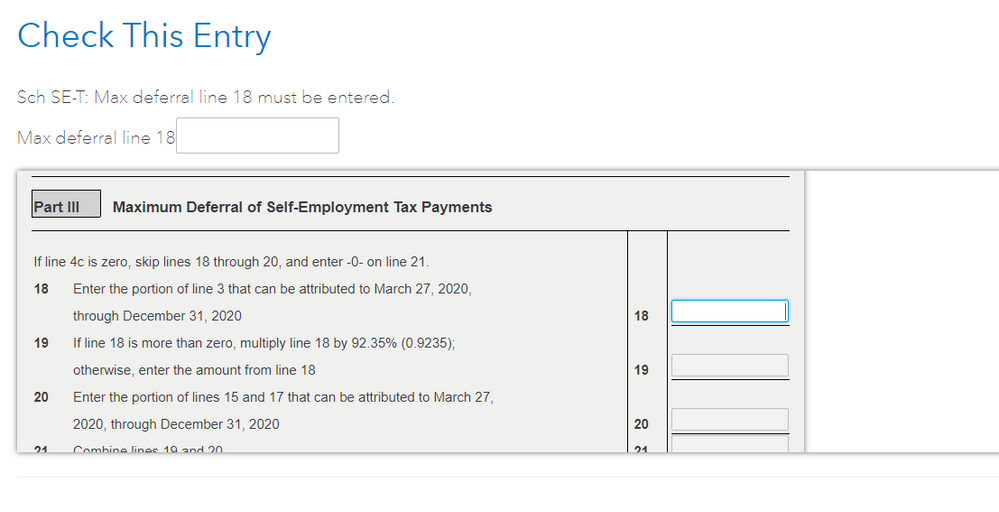

I clicked on the prompt above and it said it was resolved. So I tried what it said and now I get this box that pops up when I go to efile. I have tried deleting the 1099-NEC and re-adding, I have tried clicking continue and delete and following the directions on the link above.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099-NEC / Schedule C screen isn't working and I can't get past it to file. What do I do?

Sign in to TurboTax on a browser

Go to Tax Tools, Tools, Delete a form

Delete Form Sch-SE-T

In some cases, TurboTax is creating this form in error. In 2020 a self-employed person can select to defer their social security payments. Since that is not what you are doing, you can delete the form to resolve the error.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099-NEC / Schedule C screen isn't working and I can't get past it to file. What do I do?

Thank you for the quick reply. I have tried deleting and it says its deleted but when I go to file it still pops up.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099-NEC / Schedule C screen isn't working and I can't get past it to file. What do I do?

It will re-add the form if the election to defer self-employment taxes was made on your federal input screens. You must cancel your election to defer taxes.

Please follow these steps in TurboTax to change your election:

- Open your return.

- Click Federal on the left hand side.

- Click Deductions and Credits on the top of the page.

- On the page Tax Breaks, scroll down until you see Tax relief related to Covid-19.

- Click Revisit next to Self-employment tax deferral.

- Answer no to the question Do you want more time to pay self-employment taxes?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099-NEC / Schedule C screen isn't working and I can't get past it to file. What do I do?

OK, I am sorry this turning into such a mess, but I never said yes to the deferral, but I went in and reclicked no and then tried to delete SCH-SE-T and it still pops up with that max 18. I have already payed for TurbotTax but I am just getting frustrated that it doesn't seem to be working and I am following the directions. Thank you for helping me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The 1099-NEC / Schedule C screen isn't working and I can't get past it to file. What do I do?

Thanks, I put a 0 in the deferral instead and it worked. 🙂

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tabbgarner

New Member

Alex012

Level 1

barfiear

New Member

biggxj

Level 2

austin-ryan-brodie

New Member