- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: Sale of Vehicle Used for Business less than 50% of time from day one entered into service. Turbotax shows gain on sale is owned, but that seems wrong.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vehicle Used for Business less than 50% of time from day one entered into service. Turbotax shows gain on sale is owned, but that seems wrong.

I had a personal vehicle purchased new in 2001 that I started using for business in 2011. All years of service were less than 50% and Turbotax determined depreciation based on straight-line method. I stopped using the vehicle on 1/1/2019 and then sold it on 4/05/2019. The vehicle still shows in my business expenses so I entered all zeros for use and told Turbotax I stopped using the it. No 4562 was created since there was no business use in 2019. I used the Sale of Business Property to record the sale (since it was not generated from questions under business expenses). I don't think it matters which way I create the 4797.

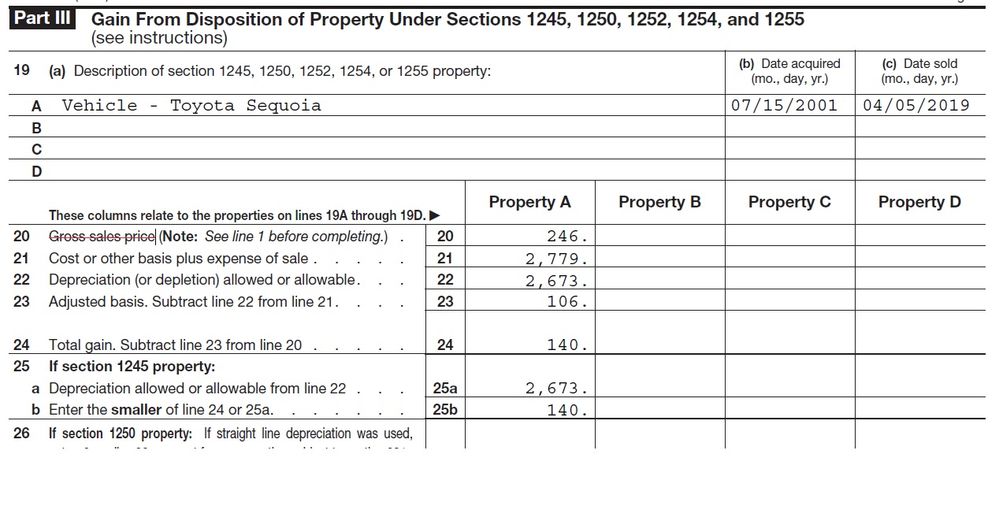

MY QUESTION: In order to determine my true business use, I added up all business miles driven and divided it by total odometer miles when sold. That gave me a 6.14% business use over the life of the car. I multiplied this by the sales price of $4000 for a business sales price of $246 (line 20 of 4797). I used the same business percentage on the original sales price to determine the cost basis (line 21 of 4797). That gave me $2779. Then the form asks for Depreciation Allowed or Allowable (line 22 of 4797). I assumed this mean the total depreciation Turbotax deducted since using the vehicle. I added this up from all my past tax forms 4562 and the total was $2673. Then Turbotax showed my Adjusted Basis (line 23 of 4797) of $106 and a total gain of $140 (line 24 of 4797). IS THIS RIGHT?? I guess I'm a little surprised I owe a gain on the sale of this 'old' vehicle.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vehicle Used for Business less than 50% of time from day one entered into service. Turbotax shows gain on sale is owned, but that seems wrong.

TurboTax is horrible for this type of situation.

Step 1: Determine if you have a Gain.

- Using your original cost and the total miles since you bought the vehicle, determine the business percentage.

- Apply that business percentage to the purchase price and selling price. Use ALL depreciation.

- Is there a gain? If not, go to Step 2.

Step 2: Determine if you have a deductible Loss.

- Using the Fair Market Value when it was converted to business use and the total miles since you started using it for business, determine the business percentage.

- Apply that business percentage to the purchase price and selling price. Use ALL depreciation.

- Is there a gain? If not, go to Step 3.

Step 3: You don't have a Gain or a deductible Loss. Just tell the program you converted the vehicle to personal use, and that is all you need to do.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vehicle Used for Business less than 50% of time from day one entered into service. Turbotax shows gain on sale is owned, but that seems wrong.

Since you never used the vehicle 100% for business, that means you took the "per mile" deduction each year it was "in service" at whatever percentage. As you know, the per mile deduction changes each year. Now included in that per-mile deduction is depreciation per mile, which also changes each year. Again, as you know the total depreciation has to be recaptured in the tax year you sell the vehicle. To get the correct amount of depreciation, see the "depreciation per mile" chart at https://www.smbiz.com/sbrl003.html#dsm which covers all tax years back to 2000.

Remember, this is like you're reporting the sale of two vehicles. For the business portion sale you'll use the average business use percentage to determine what percentage of the cost basis is business use. The overall cost basis is not what you paid for it originally. It's the FMV of the vehicle on the date it was placed in service, and you[ll use whatever business use percentage of that as your cost basis for the business side of the sale.

End the end, because it's a given that you did not sell at a profit, you will be taxed on all recaptured depreciation at least up to the sale price allocated to the business side - whichever is higher.

So if you have $2500 of depreciation and you sold the vehicle for $2000, you can expect to be taxed on $2000.

Whereas if you have $2500 of deprecation and you sold for $3000, you can expect to be taxed on $3000.

On average, the vehicle is entirely depreciated in 5 years (or the business use portion of the vehicle is fully depreciated in 5 years). It just depends on the actual business miles driven and has nothing to do with the percentage of business use when it comes to the recapture of depreciation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vehicle Used for Business less than 50% of time from day one entered into service. Turbotax shows gain on sale is owned, but that seems wrong.

Thanks for your reply.

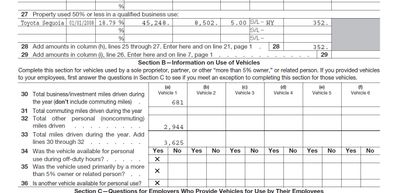

Turbotax always figured the vehicle deduction on both standard and straight-line depreciation with expenses and chose the straight-line as it had more benefit. Below is a sample of a past 4562.

At the time I setup this vehicle for business use, Turbotax always asked "What did you pay for this vehicle" and not the FMV. So I have been using that all along. I can change it to FMV with the average, which will probably be somewhat of a wash.

So if I sold the vehicle for anything more than the depreciation I took over the years then I have to pay tax on the full sales price? That doesn't seem right?? It will be as if I didn't get any tax break for using the car at all?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vehicle Used for Business less than 50% of time from day one entered into service. Turbotax shows gain on sale is owned, but that seems wrong.

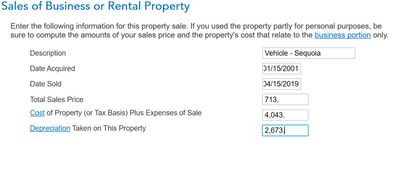

RERUN WITH YOUR RECOMMENDATIONS:

I reran the sale with the FMV and average percentage of business usage. I determined FMV based on comparables from KBB. I also averaged the percentages of business use over the life I used the vehicle from all past 4562's. I still used the depreciation taken from all past 4562's. Once I run these numbers, Turbotax said there was No Gain on the sale and deleted the form. See numbers below:

Also, on recapture. Since I used the less than 50% usage with the straight-line depreciation expense, I understand I don't have to recapture. I did not take any upfront depreciation under section 179.

Information on Recapture:

"When Recapture Rule Does Not Apply"

"The recapture rule does not apply to property that has been depreciated using straight-line depreciation from the date it was placed in service.

This statement is true for my situation.

Sorry for the wordy notes. Just trying to make sure Turbotax and I are doing this right.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vehicle Used for Business less than 50% of time from day one entered into service. Turbotax shows gain on sale is owned, but that seems wrong.

TurboTax is horrible for this type of situation.

Step 1: Determine if you have a Gain.

- Using your original cost and the total miles since you bought the vehicle, determine the business percentage.

- Apply that business percentage to the purchase price and selling price. Use ALL depreciation.

- Is there a gain? If not, go to Step 2.

Step 2: Determine if you have a deductible Loss.

- Using the Fair Market Value when it was converted to business use and the total miles since you started using it for business, determine the business percentage.

- Apply that business percentage to the purchase price and selling price. Use ALL depreciation.

- Is there a gain? If not, go to Step 3.

Step 3: You don't have a Gain or a deductible Loss. Just tell the program you converted the vehicle to personal use, and that is all you need to do.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vehicle Used for Business less than 50% of time from day one entered into service. Turbotax shows gain on sale is owned, but that seems wrong.

I have a bit of a unique problem and I am trying to solve it. I have talked to three Turbo Tax experts online, and none of them could help solve my problem. I sold my old car on 8/24. I am an independent contractor who uses a personal vehicle less than 50% of the time for business. I have always taken the standard deduction for mileage and I have never used form 179 to depreciate the vehicle in any year. As I am itemizing my expenses for schedule C, for my vehicle expenses, I am being asked to detail the information about the car I am taking out of service. The dealership offered me $500 for my old car. I used it 24.71% in 2020, meaning $124 applied as a business gain, which I entered. Then, I get taken to a screen that asks me about "vehicle Cost". I am assuming this was the original cost of the vehicle, when I bought it in 2008, so I entered that cost of $35000. I then got a screen to determine basis of loss/gain. I originally bought this car for $35000, and traded in a car that was worth $23000 (new in 2003), so I list my gain as $12000. The next screen asks me for my prior depreciation equivalent, which is $31116. The next screen tells me that my Gain on Sale is $124. When I go to my main page of income and expenses, it lists the "Sale of Business Property" as $5808. Nobody can tell me why that number is popping as income, and nobody can tell me what I am entering wrong. Can you help?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vehicle Used for Business less than 50% of time from day one entered into service. Turbotax shows gain on sale is owned, but that seems wrong.

What if you have a business vehicle that was used over 50% every year but was sold early in the year (end of January) so turbo tax puts it as property used 50% or less & calculates an extremely low basis for depreciation so you definitely get the error that the depreciation allowed is too much. I found if I change the date to 07/01/2020 it moves it back to the used over 50% & the depreciable basis is a lot higher & the error goes away. Why does the date matter because the month it was used for the year was 95%.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vehicle Used for Business less than 50% of time from day one entered into service. Turbotax shows gain on sale is owned, but that seems wrong.

@kschoendorf1 Go back through the questions and look for the one that asks if you kept track of personal miles. Say YES.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

risman

Returning Member

evltal

Returning Member

Viking99

Level 2

gavronm

New Member

joebisog

New Member