- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vehicle Used for Business less than 50% of time from day one entered into service. Turbotax shows gain on sale is owned, but that seems wrong.

I had a personal vehicle purchased new in 2001 that I started using for business in 2011. All years of service were less than 50% and Turbotax determined depreciation based on straight-line method. I stopped using the vehicle on 1/1/2019 and then sold it on 4/05/2019. The vehicle still shows in my business expenses so I entered all zeros for use and told Turbotax I stopped using the it. No 4562 was created since there was no business use in 2019. I used the Sale of Business Property to record the sale (since it was not generated from questions under business expenses). I don't think it matters which way I create the 4797.

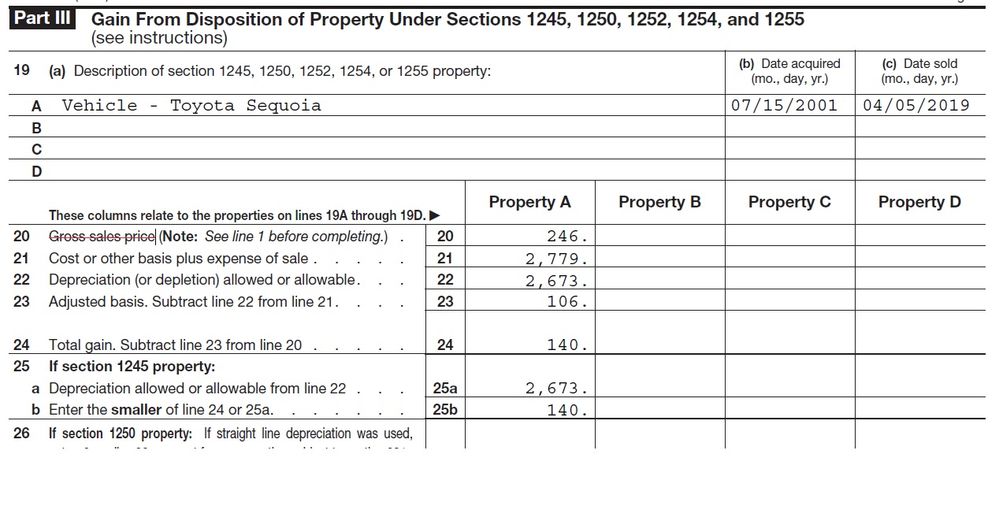

MY QUESTION: In order to determine my true business use, I added up all business miles driven and divided it by total odometer miles when sold. That gave me a 6.14% business use over the life of the car. I multiplied this by the sales price of $4000 for a business sales price of $246 (line 20 of 4797). I used the same business percentage on the original sales price to determine the cost basis (line 21 of 4797). That gave me $2779. Then the form asks for Depreciation Allowed or Allowable (line 22 of 4797). I assumed this mean the total depreciation Turbotax deducted since using the vehicle. I added this up from all my past tax forms 4562 and the total was $2673. Then Turbotax showed my Adjusted Basis (line 23 of 4797) of $106 and a total gain of $140 (line 24 of 4797). IS THIS RIGHT?? I guess I'm a little surprised I owe a gain on the sale of this 'old' vehicle.