- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

RERUN WITH YOUR RECOMMENDATIONS:

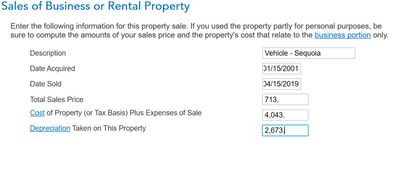

I reran the sale with the FMV and average percentage of business usage. I determined FMV based on comparables from KBB. I also averaged the percentages of business use over the life I used the vehicle from all past 4562's. I still used the depreciation taken from all past 4562's. Once I run these numbers, Turbotax said there was No Gain on the sale and deleted the form. See numbers below:

Also, on recapture. Since I used the less than 50% usage with the straight-line depreciation expense, I understand I don't have to recapture. I did not take any upfront depreciation under section 179.

Information on Recapture:

"When Recapture Rule Does Not Apply"

"The recapture rule does not apply to property that has been depreciated using straight-line depreciation from the date it was placed in service.

This statement is true for my situation.

Sorry for the wordy notes. Just trying to make sure Turbotax and I are doing this right.