- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

Thanks for your reply.

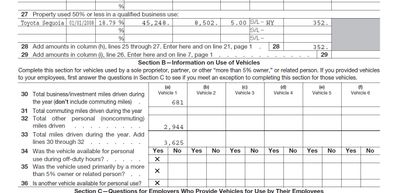

Turbotax always figured the vehicle deduction on both standard and straight-line depreciation with expenses and chose the straight-line as it had more benefit. Below is a sample of a past 4562.

At the time I setup this vehicle for business use, Turbotax always asked "What did you pay for this vehicle" and not the FMV. So I have been using that all along. I can change it to FMV with the average, which will probably be somewhat of a wash.

So if I sold the vehicle for anything more than the depreciation I took over the years then I have to pay tax on the full sales price? That doesn't seem right?? It will be as if I didn't get any tax break for using the car at all?

February 18, 2020

10:33 PM