- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: It is asking me to complete schedule C on my 1099-NEC - what is this

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It is asking me to complete schedule C on my 1099-NEC - what is this

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It is asking me to complete schedule C on my 1099-NEC - what is this

Beginning with the 2020 tax year, the IRS will require business taxpayers to report nonemployee compensation on the new Form 1099-NEC instead of on Form 1099-MISC. Businesses will need to use this form if they made payments totaling $600 or more to a nonemployee, such as an independent contractor.

If you are self-employed,

- You can expect to receive this new form from a business that paid you $600 or more for nonemployee compensation in tax year 2020 or later.

- You should receive these forms by January 31 each year (February 1 in 2021 on account of January 31 falling on a Sunday). and use them to prepare your tax return.

We'll automatically complete Schedule C when you set up your self-employment work in TurboTax or when you enter what the IRS considers self-employment income, which is usually reported on Form 1099-NEC or 1099-MISC.

Schedule C is supported in TurboTax Self-Employed (both online and in the mobile app) and in all personal 1040 versions of the TurboTax CD/Download software.

To set up your business:

- Open or continue your return.

- Search for schedule c and click the Jump to link in the search results.

- Answer Yes to Did you have any self-employment income or expenses?

- If you've already entered self-employment work and need to enter more, select Add another line of work.

- Follow the onscreen instructions.

If you need Schedule C to report a 1099-NEC or 1099-MISC, search for 1099-NEC or 1099-misc and select the Jump to link. Answer Yes to Did you get a 1099-NEC or 1099-MISC? We'll ask questions to find out if your 1099 income needs to go on Schedule C.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It is asking me to complete schedule C on my 1099-NEC - what is this

My husband and I both have a 1099 NEC. I have put them into Turbo Tax under income but when I try to complete my Schedule C, it does not allow me to have two separate accounts but adds them both up under one name. I have double checked the names and social security numbers and it is all correct. Any ideas?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It is asking me to complete schedule C on my 1099-NEC - what is this

Right now it appears that something is not quite right when trying to tie a specific Form 1099-NEC to a specific Schedule C when there are two taxpayers involved.

Try going back to the section where you entered the Form 1099-NEC if you entered it on its own and delete that entry. Use these steps:

- On the top row of the TurboTax online screen, click on Search (or for CD/downloaded TurboTax locate the search box in the upper right corner)

- This opens a box where you can type in “1099-NEC” and click the magnifying glass (or for CD/downloaded TurboTax, click Find)

- The search results will give you an option to “Jump to 1099-NEC”

- Click on the blue “Jump to 1099-NEC” link

This will bring you to the summary of all Form 1099-NEC that you have entered. Click Delete or the trash can icon next to each one.

Next, you will re-enter the Form 1099-NEC as part of the Schedule C so that the income is reported directly as part of the Business Income and Expenses and within the correct form and section of your return.

Use these steps to go to the Schedule C section of your return.

- On the top row of the TurboTax online screen, click on Search (or for CD/downloaded TurboTax locate the search box in the upper right corner)

- This opens a box where you can type in “schedule c” and click the magnifying glass (or for CD/downloaded TurboTax, click Find)

- The search results will give you an option to “Jump to schedule c”

- Click on the blue “Jump to schedule c” link

If you already have a Schedule C in your return, edit it and go to the section to Add Income. This is where you will re-enter the Form 1099-NEC.

If you do not already have a Schedule C in your return, follow the prompts and enter the information about your work/business for which you received the Form 1099-NEC. Then continue through that section to Add Income and enter the Form 1099-NEC plus any other income you received for that self-employed business.

Entering the Form 1099-NEC directly through a specific Schedule C will match the ownership of that Form 1099-NEC to the taxpayer who runs the Schedule C business.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It is asking me to complete schedule C on my 1099-NEC - what is this

I also ran into the problem where Step-By-Step refused to save a 1099-NEC under the name of my spouse. So I took your advice and deleted my 1099-NECs and re-created them from the Schedule C form. That worked. The NECs were created with the correct names and amounts. Our Schedule Cs have the right amount of income shown on them. When I go back to Step-By-Step mode, I can see my new 1099-NECs and they look correct - BUT the line total is stuck at zero. I called support, but they had no help. I've rebooted the program and it's still showing zero. Any ideas?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It is asking me to complete schedule C on my 1099-NEC - what is this

Yes, my suggestion is to delete the Form s1099-NEC. You can enter your cash sales without using the Form 1099-NEC if you choose.

The income can be entered directly, without using the 1099-NEC (online or desktop). The following steps will help.

- Sign into your TurboTax account > Select Wages & Income

- Scroll to Self-Employment Income and Expenses > Edit/Add

- Select Add/Edit beside the self-employment activity

- Enter your Additional Income receipts for 2020 (see image below)

- Retain your Form 1099-NEC with your files.

Delete the Form 1099-NEC you previously entered. The IRS does not required the actual form entry, only that all income is included in your return. Keep the document with your tax records.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It is asking me to complete schedule C on my 1099-NEC - what is this

Hello @RayW7

TT Deluxe created a schedule C for me but I can't get out of the smart check b/c it wants me to enter a business name on line C (there is none as my wife just works as a freelancer) or check the box on top of the top of Schedule C to indicate that the taxpayer's name and business name are the same. I have no idea what box TT is talking about. I don't see it.

Any suggestions?

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It is asking me to complete schedule C on my 1099-NEC - what is this

If your wife works as a freelancer, then she is essentially running her own business offering her services to her clients. If there is not a separate business name established that she uses, then just check the box saying that the business name and address is her name and address. There does not have to be a separate business name. If you do not see any box to check in the Smart Check process, then go back to the Schedule C section of your return and go through the initial questions about the Schedule C. One of those will cover the business name and address.

Also, if she has any business expenses she incurred as a freelancer, then you can claim those on the Schedule C. However, it will require that you upgrade to a higher version of TurboTax to do so.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It is asking me to complete schedule C on my 1099-NEC - what is this

Thank you @AnnetteB6

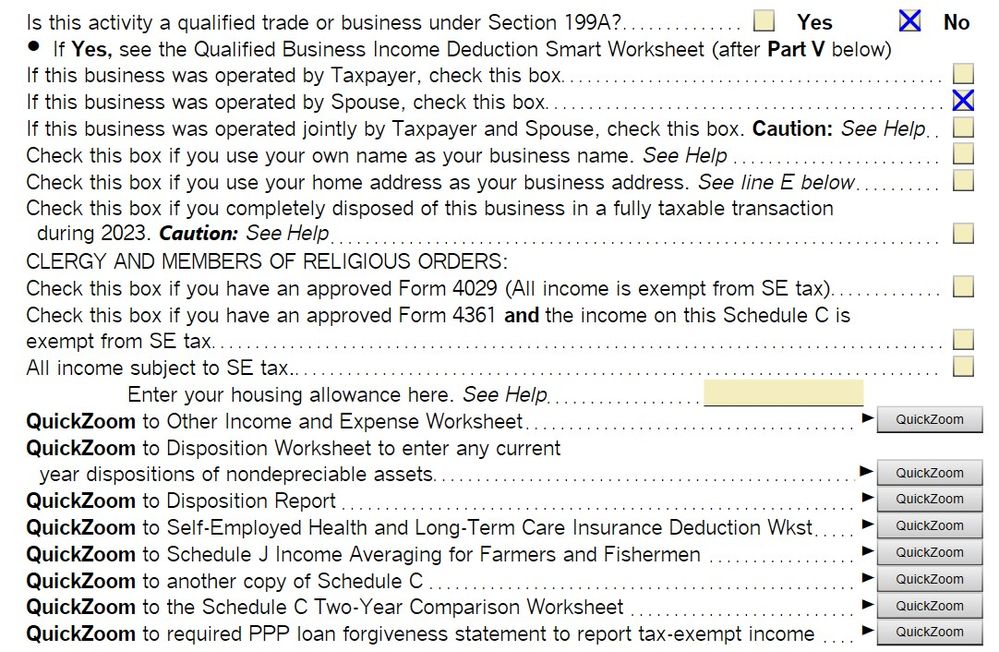

Unfortunately I still don't see that box. Below is the top of Schedule C as shown to me by TT:

Can I simply type her name into Business Name line and be done with it?

A couple of additional questions if I may:

Does the answer in the top line matter? My wife works as a legal assistant we make less than 360K.

She does some of her work from home. Can we take a home office deduction? Do we need to upgrade TT or there is a way generate form 8829 in Deluxe?

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It is asking me to complete schedule C on my 1099-NEC - what is this

Try skipping the next box and check the 2 boxes below the operated by spouse box that is checked,

....if you use your own name

.....if you use your home address

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

It is asking me to complete schedule C on my 1099-NEC - what is this

Great! That worked! TT told me "on top" and I took it literally.

Could you answer about home office deductions?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

swick

Returning Member

Opus 17

Level 15

drewdippold

Level 1

dmcrory

Returning Member

ew19

New Member