- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: How to Respond to Turbo Tax's Question Regarding Officer Compensation During e-Filing

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Respond to Turbo Tax's Question Regarding Officer Compensation During e-Filing

I have struggled to get my question answered so I am creating a separate thread to clarify. Please read carefully.

I am an LLC who elected SCORP status with the IRS. I am a single member LLC that paid the only >2% owner (ME) via W2. I have filled in my SCORP return using Turbox Tax for business.

During the "e-filing" part of the program I was prompted with the follow question:

"The IRS requires the following information when filing electronically.

Claiming Officer Compensation in this return (Yes/No)

Number of Officers with Compensation (expects a number)

Number of Employee W2s issued for 2019 (expects a number)

No instructions, no reference as to how to fill in, and no idea where this information is saved in the return.

Since I dont have officers I am struggling with whether to say I did or did not have officer compensation. Especially given the fact that W2/%Ownership information already exists elsewhere in the return.

I suspect I need to answer: Yes,1,1 ... but the fact that I dont have Officers is throwing me.

I really need guidance on that question and its relevance to my situation including information on why its being asked at the last minute in the return.

Thank you

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Respond to Turbo Tax's Question Regarding Officer Compensation During e-Filing

You are considered for tax purposes an Officer of the Corporation since you are the Managing Member of the LLC.

Since you paid yourself a W-2 wage you would report that one officer received wages and the amount of wages you were paid.

If you have no other employees that you pay, then number of Employees that received a W-2 is zero.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Respond to Turbo Tax's Question Regarding Officer Compensation During e-Filing

The Turbo Tax prompt does not ask for the amount of wages paid. That's why this question is so out of place and also so under-explained.

You suggest that given my circumstances I respond to the questions:

YES

1

0

Correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Respond to Turbo Tax's Question Regarding Officer Compensation During e-Filing

That is correct. You can answer Yes - 1 - 0. For purposes of reporting officer compensation, a managing member is considered an officer of the corporation. They want you to confirm that you did pay yourself a wage on a W-2 as opposed to taking your income in only payroll tax-free distributions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Respond to Turbo Tax's Question Regarding Officer Compensation During e-Filing

Yeah, thanks!

Ask Turbotax to add more information on that page or collected earlier. Nothing worse than a question like that during e-filing (last step).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Respond to Turbo Tax's Question Regarding Officer Compensation During e-Filing

The answer needs much greater explanation. Also if you look up this issue throughout this forum, a number of experts reply with completely contradicting answers.

Aren't they trying to determine of officers claimed compensation OTHER than by W2?

As mentioned above, "They want you to confirm that you did pay yourself a wage on a W-2 as opposed to taking your income in only payroll tax-free distributions. "

If that is indeed the case the answer would be NO, 0, 1.

No officer claimed comp (other than W2) and owner/officer paid himself via W2 (as I also do).

We really need clarification about this as there is no help in the program.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Respond to Turbo Tax's Question Regarding Officer Compensation During e-Filing

The answers to the following questions are in bold:

The IRS requires the following information when filing electronically.

Claiming Officer Compensation in this return (Yes/No) Yes if reasonable compensation paid on W-2

Number of Officers with Compensation (expects a number) You stated a single member LLC elected to be taxed as an S corporation. You would enter the # of officers stated in the corporation minutes.

Number of Employee W2s issued for 2019 (expects a number) Enter the # of Employee W-2s issued not including the officer compensation

The owners also should be officers of the corporation. Form 1125-E in the 1120S return would report compensation paid to officers.

An s corporation must have officers.

When you elected to be taxed as an s corporation you take on all characteristics of the s corporation, not just the ones you want.

In order to deduct the wages you paid yourself on the 1120S, you would enter those amounts reported on Form W-2 as officer compensation.

Yes, taking "cash and/or property distributions" without receiving reasonable compensation reported on Form W-2 would be quickly reclassified by IRS as compensation subject to employment taxes and assess you to late filing and late paying payroll taxes, which carry some heavy penalties.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Respond to Turbo Tax's Question Regarding Officer Compensation During e-Filing

Education is key ... here are the 1120-S instructions ... see page 16 : https://www.irs.gov/pub/irs-pdf/i1120s.pdf

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Respond to Turbo Tax's Question Regarding Officer Compensation During e-Filing

An LLC electing S-CORP tax status does not have officers but managing members. That is what is confusing. It should probably say Officers/Managing Members.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Respond to Turbo Tax's Question Regarding Officer Compensation During e-Filing

Also, doesn't the program actually ask for officers / 2% owners. The thread is from 2020. Anyway, my understanding is that the LLC does not become an SCORP its only taxes as one. Its still and LLC and it has no officers.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Respond to Turbo Tax's Question Regarding Officer Compensation During e-Filing

Gloriah, so based on your answer "Enter the # of Employee W-2s issued not including the officer compensation" the third question would be answered with a zero if the owner/officer is the ONLY person receiving W2 compensation? Thanks, MM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Respond to Turbo Tax's Question Regarding Officer Compensation During e-Filing

When you go to e-file a completed S-Corp return in TT Business, the program asks three questions that could be interpreted any number of ways. There is no help in the program.

SCENARIO: If you are the sole owner/officer of the S-Corp and you pay yourself a W2 and take no other money or compensation out of the business, what should your answers be to these questions and WHY?

1. Claiming officer compensation? Y or N. Does this mean compensation from W2 forms or are they specifically looking for compensation OTHER than W2?

2. Number of officers with compensation? If you claim YES on Q1, this line requires a numerical response. Again, does this mean compensation from W2 forms or are they specifically looking for compensation OTHER than W2?

3. Number of employee W2's issued? Does this include the W2 for the owner/officers or only employees OTHER than owner/officers?

Thanks! MM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Respond to Turbo Tax's Question Regarding Officer Compensation During e-Filing

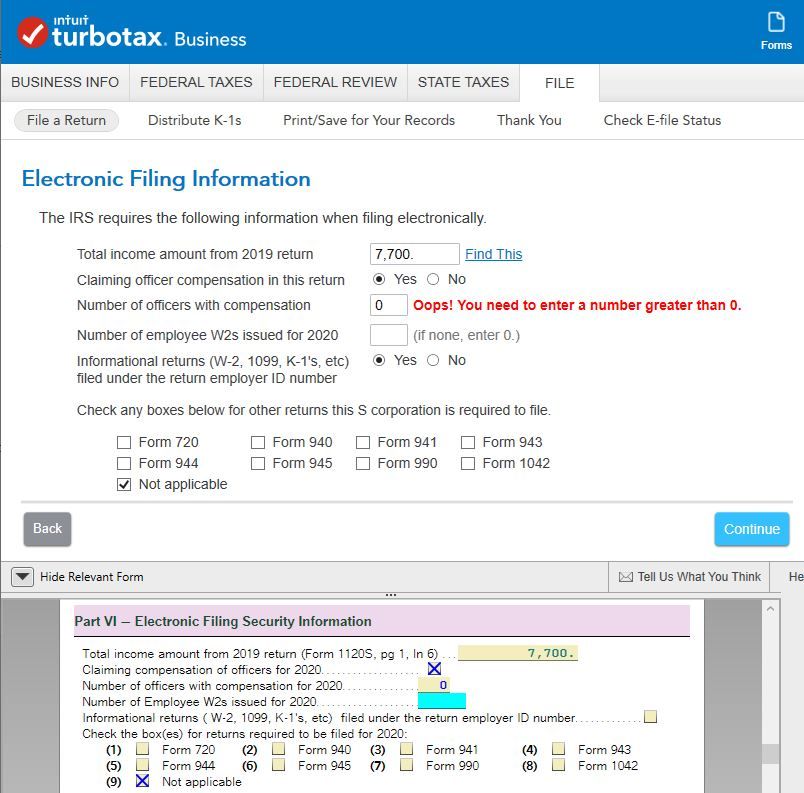

SAMPLE SCREEN:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Respond to Turbo Tax's Question Regarding Officer Compensation During e-Filing

I reported this confusion to Intuit in 2020 and its still there for 2021. Clearly, those that do the QC do not know what they are doing or they assume that the user is a CPA with complete tax knowledge. Your point is correct, and this area needs to be cleaned up. Wording matters and assumptions have no place in a tax program.

This forums is run by Intuit and we should be able to report issues and have them addressed by Intuit quickly. I reported a similar issue I could recreate. One about how their implementation was unclear. I have yet to have a acknowledgement.

Mostly those that respond answer their own question and not the one asked. Keep at it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to Respond to Turbo Tax's Question Regarding Officer Compensation During e-Filing

I agree.

It was deadline, so I went with Gloria's advice above, but I'm guessing that every user of the expensive TT Business/Corp product runs into this screen and must be just as confused.

You are absolutely correct that problems in their software such as this, once reported, should be taken seriously by the company and should be addressed, updated and fixed in their software.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17552925565

New Member

Majk_Mom

Level 2

in Education

ddm_25

Level 1

kruthika

Level 3

admin

New Member