- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: Bug: Sechedule SE line 18 won't accept an appropriate number

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug: Sechedule SE line 18 won't accept an appropriate number

TurboTax refuses to accept an appropriate entry on 2020 Schedule SE, line 18.

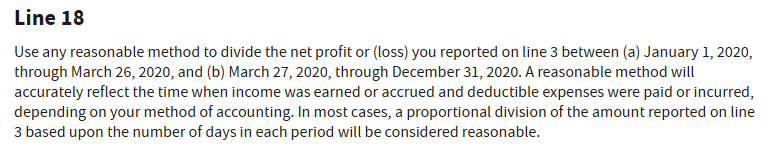

Line 18 is the portion of 2020 net profit that can be attributed to March 27 through December 31, 2020. The IRS instructions say that any "reasonable method" can be used for this calculation. In my case, most of my business expenses for 2020 were paid in January and February, while most of my collections were made in April and beyond. I use the cash method of accounting, and I earned a profit during 2020. My net income for the period before March 27 was negative (expenses > revenues), while my net income for the period March 27 and later was positive and was greater than my net income for the full year.

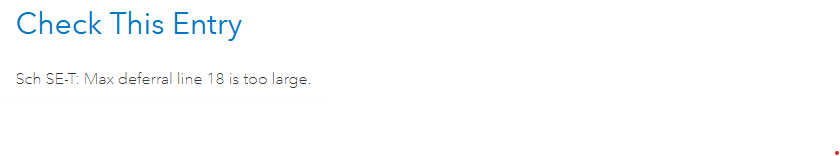

When I entered the net income for March 27 and beyond in TurboTax, it complained that the amount I entered was "too large," apparently because it was greater than my net income for the entire year:

But it was greater. It was not "too large." It was what it was. Allocating my cash-basis expenses and revenue to the dates paid or received is not only "reasonable," it is necessary, and allocating income as earned and expenses as paid is specifically defined as "reasonable" in the IRS instructions:

This needs fixing. The error prevents e-filing.

In addition, the TurboTax instructions specify the period before March 20th. This is also an error. It should be before March 27th, not 20th.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug: Sechedule SE line 18 won't accept an appropriate number

@J9999 wrote:

Line 18 is the portion of 2020 net profit that can be attributed to March 27 through December 31, 2020.

As you said, it is asking for a PORTION of the annual profit. It is NOT asking for the profit for that period.

So you need to take a PORTION of your annual profit. In your case, it sounds like it will be 100% of your annual profit was attributed to that period.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug: Sechedule SE line 18 won't accept an appropriate number

@J9999 wrote:

Line 18 is the portion of 2020 net profit that can be attributed to March 27 through December 31, 2020.

As you said, it is asking for a PORTION of the annual profit. It is NOT asking for the profit for that period.

So you need to take a PORTION of your annual profit. In your case, it sounds like it will be 100% of your annual profit was attributed to that period.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug: Sechedule SE line 18 won't accept an appropriate number

On further consideration, I think we're both partially right and both partially wrong.

I think it is indeed the net profit for the period (the revenue for the period less the expenses for the period), but I agree that it's necessarily limited to the net profit for the year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug: Sechedule SE line 18 won't accept an appropriate number

Have you looked at what the portion of Schedule SE does? It involves the deferral of part of the Social Security tax. That portion is to calculate the percentage of your total SE tax applies to the March 27th-December 31st.

You can't defer more than 100% of the maximum amount, so 100% of the profit is the maximum you can enter.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug: Sechedule SE line 18 won't accept an appropriate number

I have this issue as well. The business in question has a loss. I attempted to enter a negative number and it will not take it. I also attempted to enter 0 and I get the message: Sch SE-T: Max deferral line 18 is too large. If 0 is too large and I cannot enter a negative number, what am I supposed to enter?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug: Sechedule SE line 18 won't accept an appropriate number

Leave it BLANK.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug: Sechedule SE line 18 won't accept an appropriate number

When I blank it out and try to leave it blank I still get the error. I tried all solutions I could find in all threads about this and none of them ended up with a clean review. So I finally blanked it out and then did not re-run the review, but submitted my taxes. I don't like doing that because I don't know if that error will flag after I submit, but that seems to have worked. It is unnerving to not be able to run the review and have no errors before submitting the taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug: Sechedule SE line 18 won't accept an appropriate number

There was a workaround, but from your other thread posted, you tried this, as well. Regarding whether the return was filed with an error, check your tax return whether there was any portion of self-employment taxes that were deferred on Schedule SE, Part III.

If you actually did not want to defer any portion of Sch SE and a portion was deferred, or otherwise want to amend the 2020 tax return, I have included the workaround steps with enhancements.

Amending the federal return can be done electronically once Form 1040-X becomes available in another few weeks. However, unless you live in Georgia, Michigan, New York, or Vermont, any state amended return must be paper filed.

You are correct, the amount for Line 18 of Sch SE-T Part III should be an allocation of income earned between March 27 and December 31, 2020. This would be needed to properly calculate deferring 50% of self-employment taxes.

If the program is not accepting No, I do not wish to defer any self-employment taxes, but needs to update, it may be from the following scenario:

- While the return was in a balance due, the tax return was eligible for the Cares Act self-employment tax deferral option. This section was completed.

- However, as more details were entered and the results changed to a refund, the SE tax deferral option was no longer available.

Try beginning the amendment by fully updating the device you are using:

- In TurboTax Online: Close the program and the browser window completely. Re-open using Chrome, incognito on a PC. Do not use a Chromebook or iPad in this case.

- In TurboTax CD/Download: Check Online or Help depending on the level of TurboTax being used to find Check for Updates.

Then, force the system to update by deleting the necessary Schedule SE.

- Delete the Sch SE that applies--(Sch SE-T is for Taxpayer, Sch SE-S for Spouse)--by following these steps:

- From the left menu, select Tax Tools.

- Select Tools.

- Scroll to Delete a Form.

- Scroll to Sch SE-T and/or Sch SE-S and select Delete and Delete Selected Form and Continue.

- Return to the self-employment income & expenses interview in the Income & Expenses section and select Edit/Add.

- Select Edit for your business.

- Scroll down to Done so that the Sch SE is recalculated.

- Finish any other questions in the self-employment interview and click Continue.

- Review the return again.

If you are still experiencing unexpected results, the Workaround:

Temporarily trigger a balance due by adding income long enough to decline the SE tax deferral option, then remove the extra income.

1. Enter a temporary amount as income in the self-employment section that will result in you not having a refund.

- From the left menu, select Federal.

- From the Income & Expenses, scroll to Self-employment income & expenses and Edit/Add.

- At Your 2020 work summary, select Edit.

- Under INCOME, select Add income for this work.

- Add Other self-employed income, includes 1099-K, cash, and checks and Continue.

- At Type of income, enter Temp income to remove deferral and enter a large amount, such as $100,000 and Continue.

2. Decline to defer any self-employment tax.

- From the left menu, click on Federal.

- Click the second tab from the left, Deductions & Credits.

- Scroll down to Tax Relief related to Covid-19 and Revisit.

- Select Self-employment tax deferral and select Revisit.

- Answer Yes at the next screen to get back to Let's start by getting your eligible income.

- Enter 280/366ths of your income to reflect the income from March 27-December 31, 2021.

- This amount should be calculated and entered without the false added income, and will post to Line 18 of Sch SE

- Select Continue.

- At Tell us how much you'd like to defer,

- Enter 0.

- Enter 280/366ths of your income to reflect the income from March 27-December 31, 2021.

3. Remove the temporary income.

- From the left menu, select Federal.

- From the Income & Expenses, scroll to Self-employment income & expenses and Edit/Add.

- At Your 2020 work summary, select Edit.

- Under INCOME, select the Trash can icon next to Temp income to remove deferral and Continue.

4. Run the review again.

[Edited 03/08/2021 | 11:33 AM PST]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug: Sechedule SE line 18 won't accept an appropriate number

Yes, I did try that work-around and it did not work either. I am using the desktop version, but was still able to follow your steps and give it a try. I checked my return and it appears the schedule SE that was giving me so much trouble did not get included; just the one for the business that actually did need to pay self-employment taxes. That one worked fine. My husband and I both are self-employed, his business lost money last year and that was the one that was causing all the issues. Mine seems to have worked fine. Nothing was deferred because there was nothing eligible to be deferred. All taxes were paid as estimated during the year. My SE looks accurate. So I believe all is good. Thank you for your reply.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug: Sechedule SE line 18 won't accept an appropriate number

I can't get this to work correctly. I had a business loss that was carried through on the SE form in lines 4c. The instructions say if 4c is zero to leave lines 18-20 blank and put a 0 in line 21.

The system won't accept a 0. I appreciate your comments. Can I just leave this as an error and move on?

The workaround is too complicated for me to follow.

Thanks for you assistance. I appreciate it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug: Sechedule SE line 18 won't accept an appropriate number

If you can, leave it blank but it may help to delete the form and begin again.

Schedule SE Line 18

Depreciation is the annual deduction you must take to recover the cost or other basis of business or investment property having a useful life substantially beyond the tax year. Land is not depreciable.

Depreciation starts when you first use the property in your business or for the production of income. It ends when you deduct all your depreciable cost or other basis or no longer use the property in your business or for the production of income.

See the Instructions for Form 4562 to figure the amount of depreciation to enter on line 18.

You must complete and attach Form 4562 only if you are claiming:

-

Depreciation on property first placed in service during 2020;

-

Depreciation on listed property (defined in the Instructions for Form 4562), including a vehicle, regardless of the date it was placed in service; or

-

A section 179 expense deduction or amortization of costs that began in 2020.

How do I view and delete forms in TurboTax Online?

- Open or continue your return in TurboTax.

- In the left menu, select Tax Tools and then Tools.

- In the pop-up window Tool Center, choose Delete a form.

- Select Delete next to the form/schedule/worksheet in the list and follow the instructions.

@airvantwo

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug: Sechedule SE line 18 won't accept an appropriate number

That is the exact situation I was in - a loss on line 4c and the system would not accept 0 or a negative number. I ended blanking out the field for line 18 and ignoring the error. (None of the work-arounds worked for me - I tried them all.) When I submitted my return, the schedule SE for the business in question was not included. Make sure you have fixed all other issues, but it seems safe to ignore this one if your business had a loss and no Self Employment taxes are due. Hopefully TurboTax will fix it before too much more time goes by. Good luck!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug: Sechedule SE line 18 won't accept an appropriate number

Schedule SE line 18 doesn't have anything to do with depreciation - it is the portion of the net profit that is potentially eligible to be considered for deferred Self Employment Tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug: Sechedule SE line 18 won't accept an appropriate number

I have the same issue with a negative income and it won't accept 0. I called online and they thought they fixed it by blanking out everything but it doesn't work and I have an added complication that it mixes foreign tax credits from forms 1116 into the SE form later.

Now for two hours I get no one to answer the phone. Very frustrating.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug: Sechedule SE line 18 won't accept an appropriate number

Delete the 0 and leave that field blank. @Cal-questions Some fields will accept a zero and some won't.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Tamlea222

New Member

import32

Level 1

johnmayorga912

New Member

jsdelnigro

New Member

mrtate1965

New Member