- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug: Sechedule SE line 18 won't accept an appropriate number

TurboTax refuses to accept an appropriate entry on 2020 Schedule SE, line 18.

Line 18 is the portion of 2020 net profit that can be attributed to March 27 through December 31, 2020. The IRS instructions say that any "reasonable method" can be used for this calculation. In my case, most of my business expenses for 2020 were paid in January and February, while most of my collections were made in April and beyond. I use the cash method of accounting, and I earned a profit during 2020. My net income for the period before March 27 was negative (expenses > revenues), while my net income for the period March 27 and later was positive and was greater than my net income for the full year.

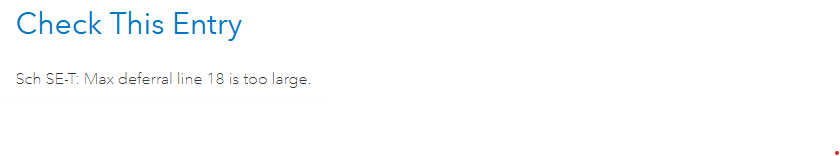

When I entered the net income for March 27 and beyond in TurboTax, it complained that the amount I entered was "too large," apparently because it was greater than my net income for the entire year:

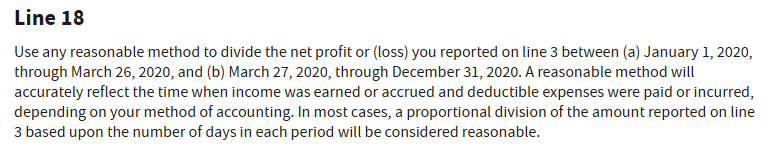

But it was greater. It was not "too large." It was what it was. Allocating my cash-basis expenses and revenue to the dates paid or received is not only "reasonable," it is necessary, and allocating income as earned and expenses as paid is specifically defined as "reasonable" in the IRS instructions:

This needs fixing. The error prevents e-filing.

In addition, the TurboTax instructions specify the period before March 20th. This is also an error. It should be before March 27th, not 20th.