- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- In the world of TurboTax "desktop", all versions support...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does premier have a schedule c and schedule c expenses? Or better yet, does premier have everything in Home & Business included?

I have some self-employment income and also some stock investments and Home & Business does not necessarily provide a complete solution for the investments. Curious if premier does provide both (self-employment and investments) satisfactorily?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does premier have a schedule c and schedule c expenses? Or better yet, does premier have everything in Home & Business included?

In the world of TurboTax "desktop", all versions support all the same Forms and Schedules. So, in theory, you can create an income tax return which only need the supported Forms and Schedules using any product. You might have to resort to actually entering information right on the Forms and Schedules themselves as opposed to using "interviews", but you could do it. As you go up the ladder of TurboTax versions you get more hand-holding in the form of more extensive and directed interviews, meaning you don't have to work right on the Forms and Schedules themselves.

So, to answer your question, yes the Premier version has the complete Schedule C and has all the other Forms and Schedules available to you in "Home & Business" if you are referring to a desktop product. In the online versions this is not the case. In the online versions you do need to go up to the most expensive product - "Self-Employed" - to be able to create a full Schedule C that includes expenses.

I think you're wrong about Home & Business not necessarily being as complete or as comprehensive as Premier when it comes to support for reporting of investments. Unless something has changed this year that I'm not aware of, as you go up the chain of desktop versions the changes are all additive. That is a higher version isn't weakened or downgraded in certain areas with respect to lower versions of the product. Do you have some indication that my understanding is incorrect?

Tom Young

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does premier have a schedule c and schedule c expenses? Or better yet, does premier have everything in Home & Business included?

In the world of TurboTax "desktop", all versions support all the same Forms and Schedules. So, in theory, you can create an income tax return which only need the supported Forms and Schedules using any product. You might have to resort to actually entering information right on the Forms and Schedules themselves as opposed to using "interviews", but you could do it. As you go up the ladder of TurboTax versions you get more hand-holding in the form of more extensive and directed interviews, meaning you don't have to work right on the Forms and Schedules themselves.

So, to answer your question, yes the Premier version has the complete Schedule C and has all the other Forms and Schedules available to you in "Home & Business" if you are referring to a desktop product. In the online versions this is not the case. In the online versions you do need to go up to the most expensive product - "Self-Employed" - to be able to create a full Schedule C that includes expenses.

I think you're wrong about Home & Business not necessarily being as complete or as comprehensive as Premier when it comes to support for reporting of investments. Unless something has changed this year that I'm not aware of, as you go up the chain of desktop versions the changes are all additive. That is a higher version isn't weakened or downgraded in certain areas with respect to lower versions of the product. Do you have some indication that my understanding is incorrect?

Tom Young

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does premier have a schedule c and schedule c expenses? Or better yet, does premier have everything in Home & Business included?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does premier have a schedule c and schedule c expenses? Or better yet, does premier have everything in Home & Business included?

<a rel="nofollow" target="_blank" href="https://ttlc.intuit.com/questions/1899287-how-many-stock-transactions-can-turbotax-online-handle">ht...>

hasn't changed from last year as far as I can tell. But if you're really doing that many stock trades then you probably should be reporting the bulk of that in a "summary" fashion, sending in hard copy of the detail to the IRS using Form 8453, (or no form at all, depending on what's being reported).

On the page "Tell us about your [Broker name] 1099-B" tick "I'll enter a summary for each sales category". That way you just enter summary figures for proceeds and basis. BE SURE AND CLICK ON AND READ each piece of "On Demand Tax Guidance" you come across (the blue hyperlinks) as you're doing this as TurboTax's interview in this area is pretty weak and you need that "On Demand" guidance to know exactly what to enter and how to enter it as well as how to use Form 8453, if needed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does premier have a schedule c and schedule c expenses? Or better yet, does premier have everything in Home & Business included?

I bought the 2019 version of TurboTax Home & Business at either Costco or Sam's with some special price. NOWHERE do I see a Schedule C on this thing at all, and was led to believe it was in this!

How do you get to it if it is there?

Please advise, because the other answer on here does not explain that!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does premier have a schedule c and schedule c expenses? Or better yet, does premier have everything in Home & Business included?

Actually schedule C is in all the Desktop versions. All the Desktop programs have the same forms. You just get more help and guidance in the higher versions.

Do you need to update the program? Go up to Online-Check for updates. Are you on Windows or Mac?

oh, can you find the personal 1040 return? When you start a new return in the Desktop Home & Business version you have to pick which kind of return. Either to prepare W2 & 1099 forms to give out or to do an Individual tax return. Maybe you are picking the wrong one.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does premier have a schedule c and schedule c expenses? Or better yet, does premier have everything in Home & Business included?

IN the H&B version the Sch C is the FIRST point of business in the BUSINESS tab ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does premier have a schedule c and schedule c expenses? Or better yet, does premier have everything in Home & Business included?

To fill out schedule C in the Home & Business version

You can just type Schedule C into the search bar at the top of your return and it should give you a JUMP TO link to go directly to it.

To add another business or Schedule C….

Go to Business tab-Continue

Choose Jump to Full List -or I'll choose what I work on

Business Income and Expenses - Profit or Loss from Business, click Start or Update.

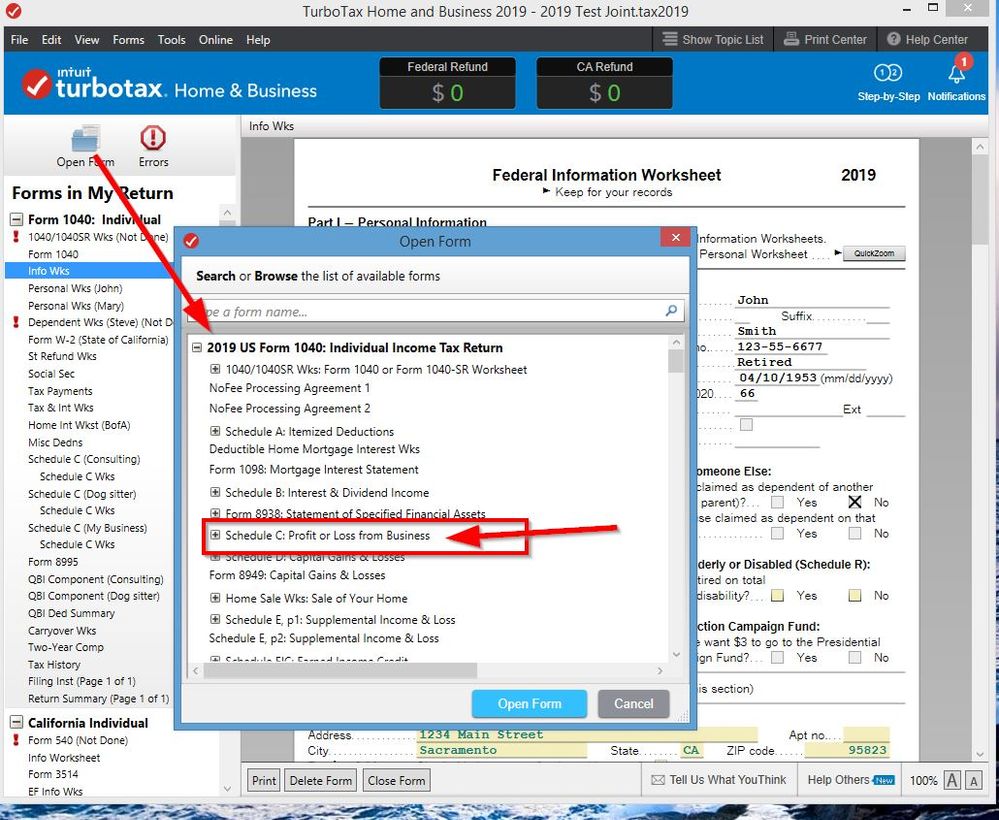

Or to open the actual Schedule C form......Switch to Form Mode. Click Forms in the upper right for Windows or left for Mac. Then click on Open Form and pick Schedule C out of the US list of forms. See screen shot

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

drj838

Level 1

_John__

New Member

trostlechet

New Member

i-nejabat

New Member

user17638037803

New Member