What previously was a landing page for FAQ content is now a dynamic self-help hub with FAQs, community content, and tutorials for TurboTax Online and TurboTax Desktop.

TurboTax Help Hub!

As users are navigating through the pages, there’s been two additions:

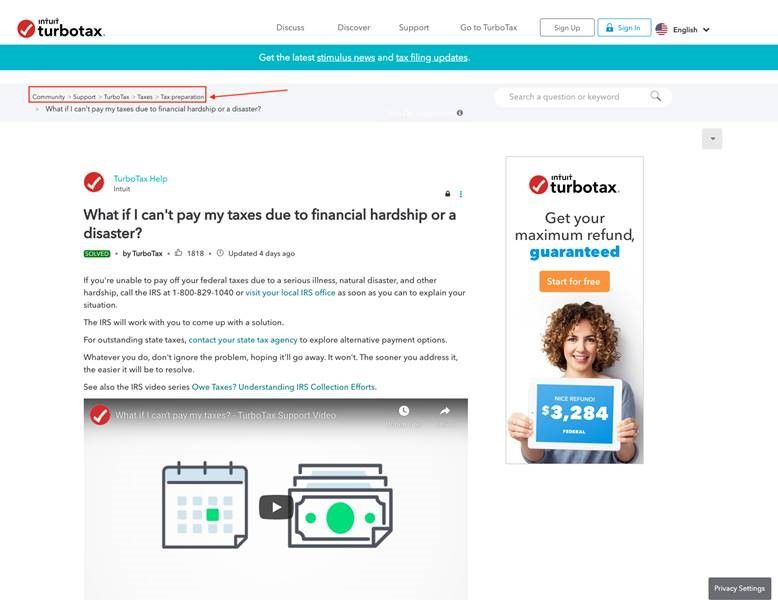

- A “Breadcrumb” at the top of the article pages, that will allow users to more easily to navigate up and down the taxonomy to find answers.

- A “View All Articles” navigation page that can be sorted by product.

We hope you explore and enjoy the new experience!