- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Refund Processing Fee

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Processing Fee

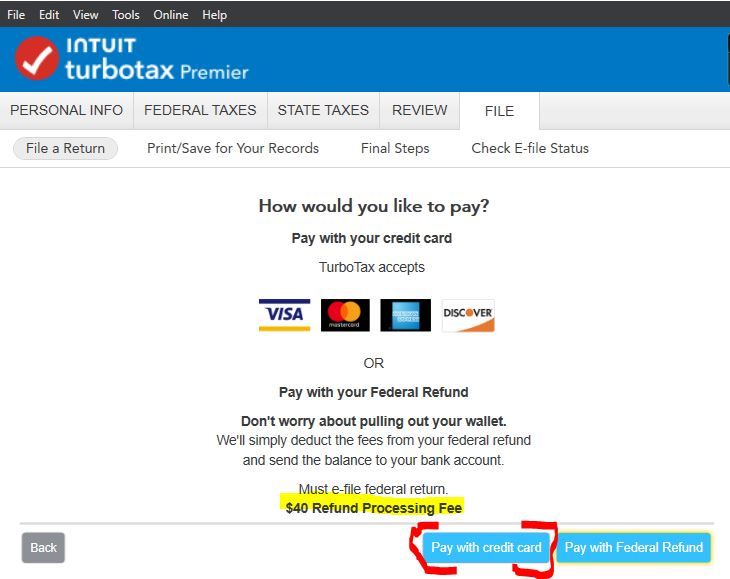

I am confused, I bought Turbo Tax software at Costco and the software says it comes with 5 Federal e-files. Why would I pay $40 for a Refund Processing Fee? Can't this just be deposited into my account that I provided? Also, when I do pay with credit (which I'm not sure why I would be paying) it always error out and I cannot finish filing my taxes. HELP!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Processing Fee

If you are e-filing a state return there is a $25 state e-file fee. If you then choose to pay that $25 by having it deducted from your federal refund, you incur another EXTRA "refund processing" fee of $40. Do not do that. If you are paying for state e-filing---pay upfront with a credit card or debit card. Or avoid the state e-file fee by printing and mailing the state.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Processing Fee

I am only filing Federal because I live in WA and we don't have state taxes. However, it still says $40 Refund Processing Fee or pay by card. If you click pay by card, I always get an error, and it instantly logs me out.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Processing Fee

No one in the user forum can resolve a billing issue. If you have a question about your TurboTax fees or billing, make sure you use the word “billing” in your request for help. Do not use the word “refund.”

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Processing Fee

Also, the "free" (or included) tax returns comes with the Turbotax program that you download and install on your own computer. The box should contain a code to do that. Once you install the program, the only additional fees would be additional states (you get one free) and state e-filing is extra.

But, if you bought the box but then did your taxes on the web site, that is a completely different program and has different fees, and you did not pay for it already. You would need to install the program on your own computer and then start over or download your file from the web site to finish on the computer to get the benefit of the software you paid for.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Processing Fee

Personally I think Turbo Tax misrepresenting its product and cost. You pay for the program and it says $25 to file state - fair enough but when you are in the middle of typing in bank routing and account numbers and $40 processing fee pops up!

Total misrepresenting of the cost of the product. Will take this into consideration when i look for tax program for next year,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Processing Fee

The $40 Refund Processing Fee is for the bank that handles your refund, if you elected to 'pay TurboTax fees from your refund'.

Here's more info on Refund Processing Fee.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Processing Fee

Baloney!! Pure profit.

I would click on Thumbs Down if there was one!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Processing Fee

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Processing Fee

Yes whole thing pops up after spending hours inputing information. An ethical company would disclose this upfront.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Processing Fee

Why Do I have to pay a processing fee of $40 to e-file my federal tax return after purchasing Turbo Tax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Processing Fee

I just submitted my return. Once I clicked "Pay with Credit Card" and entered the card information, the next page showed the amount owed without the extra $40 charge. So as long as you pay with a card, you should not have the extra $40 charge.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Processing Fee

There is not a fee to e-file your tax return or to have direct deposit of your refund.

Did you choose to pay for using TurboTax by having the fee taken out of your federal refund? That means you will pay an EXTRA FEE of $40 ($45 in CA) to have a third party bank receive your refund from the IRS, take out enough to pay TT, and then send you the rest of the refund. ( The third party bank keeps the $40 or $45 fee for itself.)

You do not have to do that. Pay upfront BEFORE you file --- pay using a credit or debit card.

REMOVE REFUND PROCESSING FEE

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Refund Processing Fee

Yes,there are many ways TT makes this confusing to folks.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17721493695

New Member

rsantiago473

New Member

jowinachary

New Member

Marcianna-Yang

New Member

WilliamHowell

New Member