- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Why does the New Mexico state return list my taxable income as $30k more than I actually made...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does the New Mexico state return list my taxable income as $30k more than I actually made in New Mexico? How is that possible?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does the New Mexico state return list my taxable income as $30k more than I actually made in New Mexico? How is that possible?

You probably aren't getting taxed on all of your income in New Mexico, but the form is misleading.

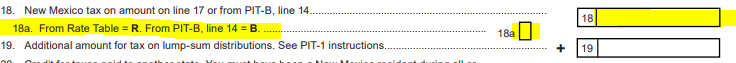

Look at Line 18a at the bottom of page 1 of Form PIT-1.

This amount should be pulling from PIT-B, New Mexico Allocation and Apportionment of Income Schedule, Line 14.

Line 14 on Form PIT-B is the tax being calculated only from your New Mexico sources.

Therefore, even though on page 1 of Form PIT-1, it seems like it is taxing on all income, but it actually isn't.

You should be able to see Code B in box 18a. This shows it only taxed income from the allocation schedule.

Please comment if you still have questions!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does the New Mexico state return list my taxable income as $30k more than I actually made in New Mexico? How is that possible?

It depends.

I recommend going back and reviewing your input under the "My Info".

- On the black panel on the left, select "My Info"

- Select "Edit" to the right of your name.

- Scroll down the page and review the answers to your questions.

- Ensure your answers to the state you lived in and any other state questions are answered correctly.

Pay special attention to the line at the bottom which asks if you earned money in another state. Confirm this entry is completed for the job which is located outside the state of residence.

Once you enter this information, you should go back into the W-2 input under income.

Select Edit for this W-2 and scroll down to box 15, State & Local Taxes.

Then go back into the state returns to prepare your nonresident return for New Mexico. Be sure to answer each question carefully. You may need to enter the amount of income earned only in New Mexico to ensure you are taxed only the income earned within the nonresident state.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does the New Mexico state return list my taxable income as $30k more than I actually made in New Mexico? How is that possible?

Yes, I have double-checked everything. The rest of the filing has all the correct information and even breaks it down by how much I made in Texas and how much I made in New Mexico which matches my W-2. The problem is with the first page where it has somehow based it on my federal adjusted gross income. I am beginning to think there is bug that may need to be looked into. I just looked at my 2018 Turbo Tax filing and last year I made $6460 in New Mexico which is clearly stated on the PIT-B Allocation schedule, but on the first page PIT-1 it says New Mexico Taxable Income $92,300, which is a combination of my Texas and New Mexico income. So sounds like there is a bug and I am getting overtaxed by New Mexico.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does the New Mexico state return list my taxable income as $30k more than I actually made in New Mexico? How is that possible?

You probably aren't getting taxed on all of your income in New Mexico, but the form is misleading.

Look at Line 18a at the bottom of page 1 of Form PIT-1.

This amount should be pulling from PIT-B, New Mexico Allocation and Apportionment of Income Schedule, Line 14.

Line 14 on Form PIT-B is the tax being calculated only from your New Mexico sources.

Therefore, even though on page 1 of Form PIT-1, it seems like it is taxing on all income, but it actually isn't.

You should be able to see Code B in box 18a. This shows it only taxed income from the allocation schedule.

Please comment if you still have questions!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dinesh_grad

New Member

user17552925565

New Member

meltonyus

New Member

Majk_Mom

Level 2

in Education

georgiesboy

New Member