- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

You probably aren't getting taxed on all of your income in New Mexico, but the form is misleading.

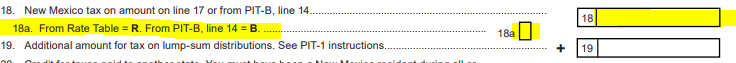

Look at Line 18a at the bottom of page 1 of Form PIT-1.

This amount should be pulling from PIT-B, New Mexico Allocation and Apportionment of Income Schedule, Line 14.

Line 14 on Form PIT-B is the tax being calculated only from your New Mexico sources.

Therefore, even though on page 1 of Form PIT-1, it seems like it is taxing on all income, but it actually isn't.

You should be able to see Code B in box 18a. This shows it only taxed income from the allocation schedule.

Please comment if you still have questions!

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 18, 2020

4:26 PM

1,412 Views