- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: When will turbotax 2022 (for the 2021 tax year) be released?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will turbotax 2022 (for the 2021 tax year) be released?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will turbotax 2022 (for the 2021 tax year) be released?

Most likely in the November to December time period.

However, the product is unlikely to be fully functional until January of 2022.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will turbotax 2022 (for the 2021 tax year) be released?

Most likely in the November to December time period.

However, the product is unlikely to be fully functional until January of 2022.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will turbotax 2022 (for the 2021 tax year) be released?

TurboTax would normally have the 2021 tax year desktop software available in mid-November 2021. The 2021 tax year online editions would normally be available in early December 2021.

Note the the initial release of the software does not have every form and schedule finalized at the release. The final forms and schedules for all federal and state returns are usually available by the end of January, wholly dependent on the IRS and the various states providing their final forms.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will turbotax 2022 (for the 2021 tax year) be released?

IMHO, by now it should be available on the web site to buy and download. I can't find it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will turbotax 2022 (for the 2021 tax year) be released?

@photobug56 wrote:

IMHO, by now it should be available on the web site to buy and download. I can't find it.

Try the link below.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will turbotax 2022 (for the 2021 tax year) be released?

Every year I try to find on on Turbotax.com. I log in, can't find it, just the record from the previous year. Then I remember, log into Intuit.com, etc. But thanks - it's a good link to post!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will turbotax 2022 (for the 2021 tax year) be released?

Bookmark it for future use.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will turbotax 2022 (for the 2021 tax year) be released?

Over time I've accumulated a huge number of bookmarks! But maybe next year I'll remember to use the Intuit website. Of course, I've come to the conclusion that Intuit should either merge the 2 sites or, when one longs into the TurboTax site, to actually have TT available there too! 🙂

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will turbotax 2022 (for the 2021 tax year) be released?

I too have many many bookmarks ... and I have learned to save them in separate categories and even purge old ones I don't need. Good luck cleaning up your files.

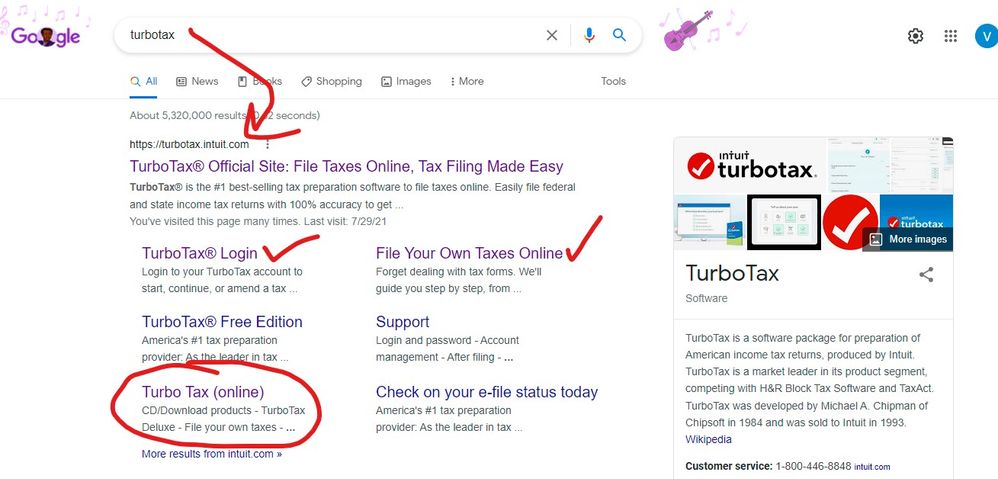

Of course if you just google Turbotax the first one at the top of the list is the one you want ... not sure how you can get lost ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will turbotax 2022 (for the 2021 tax year) be released?

you want TurboTax 2021 for tax year 2021.

If you are looking for TurboTax 2022 you won't find it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will turbotax 2022 (for the 2021 tax year) be released?

In your opinion? Seriously?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will turbotax 2022 (for the 2021 tax year) be released?

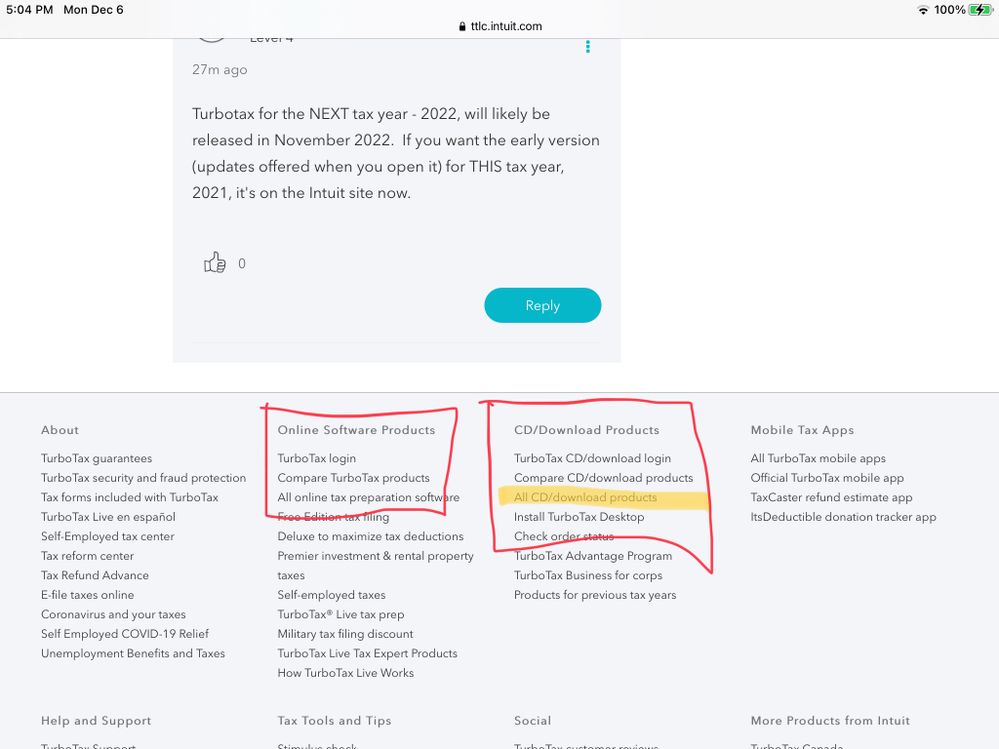

Turbotax for the NEXT tax year - 2022, will likely be released in November 2022. If you want the early version (updates offered when you open it) for THIS tax year, 2021, it's on the Intuit site now.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will turbotax 2022 (for the 2021 tax year) be released?

Probably on most Turbo Tax or Intuit web pages you can scroll down to the bottom and get to the pages to buy and other places

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will turbotax 2022 (for the 2021 tax year) be released?

when will I be able to complete my taxs for 2021 ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will turbotax 2022 (for the 2021 tax year) be released?

Although TurboTax may allow you to e-filed some returns as early as 1/6/22 (IF the forms in your return are ready for filing … see info below) they are NOT actually sent to the IRS. TurboTax stores those early filed returns in a holding “POOL” until the IRS opens for business and “drains the pool” for processing ... only then will you get an e-mail telling you if the return was accepted or rejected by the IRS.

Only the simplest returns can be transmitted to TurboTax early. Some forms will not be finalized until Jan 25 and some later than that.

https://ttlc.intuit.com/questions/1908854-forms-availability-table-for-turbotax-federal-products-exc...

Why does TurboTax allow early filing? Because their competitors do - It is a marketing ploy to capture market share.

Filing early with TurboTax before the IRS opens is a really BAD IDEA for many reasons...

1) If you discover something that is wrong on your return, receive a W-2 that is different, receive some other tax document that was not on the return that you filed then there is NOTHING that you can do about it other than wait to see if the IRS accepts or rejects the return after they open. If rejected you can correct and file again, but if accepted then the only remedy is to amend which can take 4 months to process.

2) You must remember to check back after the IRS opens (or check for an e-mail) to confirm that the IRS has accepted or rejected the return. If rejected, then it was never filed at all and must be corrected and re-filed. Every year many taxpayers that file early, forget to check back and only discover months later that they never actually filed because if was rejected by the IRS but they had forgotten about checking back after filing with TurboTax.

3) While the IRS does conduct some pre-opening tests and does accept some returns early (ONLY for TESTING purposes), they will not actually process those until after the official opening date. There is a reason to test and that is to discover any problems with it's systems. A couple of years ago a test went bad and several thousand "test" returns were lost. The IRS was able to recover those but it delayed refunds for some by months.

There is no real advantage to file before the IRS opens but there are several disadvantages to do so.

When will my forms be ready?

Historically, IRS tax forms start becoming available in January, with a few stragglers (most notably Form 1040X) getting finalized in February.

State tax forms can become available for filing any time between December and late February, depending on the state and the tax form.

For specific forms and dates, refer to the Forms Availability Table for your TurboTax product, see the related information below.

Can I Still Work On My Return Before My Forms are Ready?

Yes, according to the following:

Federal Taxes

You can still work on your return and finish most of it. Once your forms become available, we’ll create the forms and include all of your info.

You’ll only be able to e-file or print your return once the forms are available.

While you’re working on your return, we’ll ask if you want to receive email updates when your forms become available.

State Taxes

If your forms aren’t available, you’ll get a message asking you to return once they become available.

While you’re working on your return, you’ll have a chance to let us know you want to receive email updates when your forms become available.

Related Information:

- IRS forms availability table for TurboTax individual (personal) tax products

- State forms availability table for TurboTax individual (personal) tax products

- Which IRS forms are not included in TurboTax?

- TurboTax 2020 release notes for Windows personal tax software

- State forms availability table for TurboTax Business

- IRS forms availability table for TurboTax Business

Click on the REVIEW tab and the program will tell you what in your return is still NOT ready and the estimated date it will be (subject to change of course ) ... you can put in for an email alert when they are ready ....

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

gate99

Returning Member

eugenehanks2

Returning Member

dzungductran

New Member

jim

New Member

williamhein

New Member