- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Unemployment tax refund amount

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment tax refund amount

Several months ago I was able to log into my TurboTax account and view the updated tax refund coming from the CARES Act. However, since then I have forgotten how to view it and don't know if it was a one time viewing or something else. How can I view my updated tax refund amount?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment tax refund amount

When the program was updated for the unemployment exclusion and you logged in you may have seen the updated return however they quickly reversed this for those who had filed before the change so the return once again shows as originally filed so that next year the correct AGI from the original return would be transferred properly thus avoiding IRS rejects for the AGI being incorrect.

If you promise to save a PDF & .taxfile of the originally filed return so you have that information you can log in and scroll down and click on ADD A STATE to open the return then complete the unemployment section again so it updates. HOWEVER if anything else changes (like credits you did not have on the original return) then you may need to amend the return. Column A of the amended return must reflect the IRS changes and you cannot file this until the IRS has processed your original return and the correction which are sent separately ... do not jump the gun... wait for both checks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment tax refund amount

When the program was updated for the unemployment exclusion and you logged in you may have seen the updated return however they quickly reversed this for those who had filed before the change so the return once again shows as originally filed so that next year the correct AGI from the original return would be transferred properly thus avoiding IRS rejects for the AGI being incorrect.

If you promise to save a PDF & .taxfile of the originally filed return so you have that information you can log in and scroll down and click on ADD A STATE to open the return then complete the unemployment section again so it updates. HOWEVER if anything else changes (like credits you did not have on the original return) then you may need to amend the return. Column A of the amended return must reflect the IRS changes and you cannot file this until the IRS has processed your original return and the correction which are sent separately ... do not jump the gun... wait for both checks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment tax refund amount

Thanks, that was what I was looking for. Still playing the waiting game for now...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment tax refund amount

Can someone explain this, tell me how to find out how much and when we will receive or money?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment tax refund amount

I cannot find refund amount please help me!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment tax refund amount

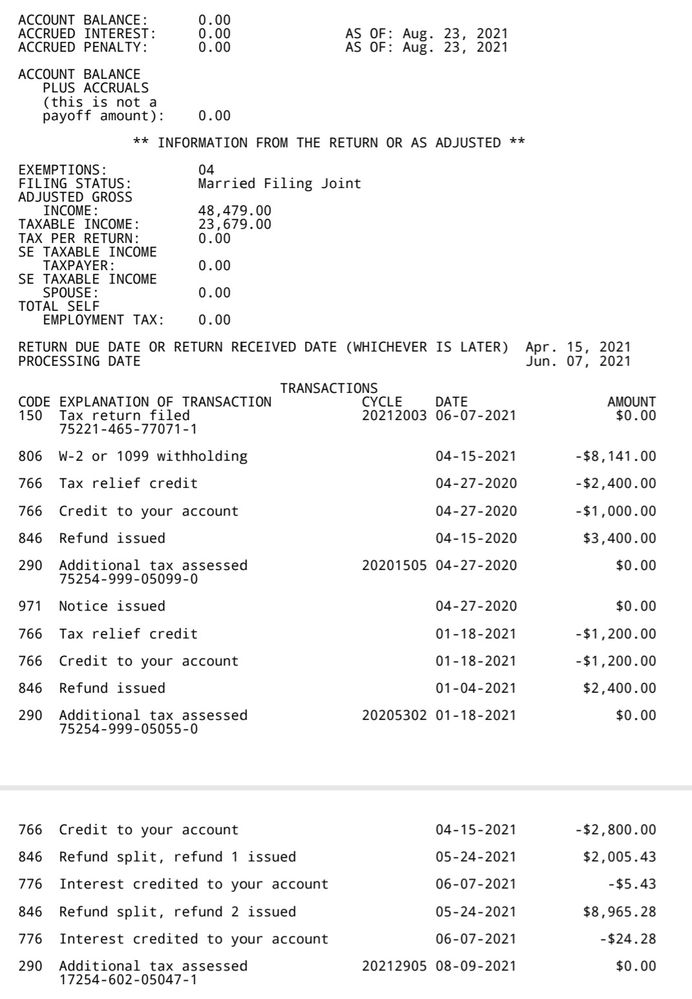

Stimulus #1 & stimulus #2

and then the first refund check including interest for the delay in processing (compare this with your tax return) followed by the second refund amount including interest for the delay in processing which should represent the adjustments to your return for the unemployment exclusion and/or PTC plus adjustments to the credits already claimed on the original return.

Based on the dates for the refunds you should have gotten them months ago unless the refunds were intercepted for a debt like back taxes or child support.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment tax refund amount

I still have not gotten my unemployment tax refund. I had a very simple return and don’t owe IRS any money. I can’t contact IRS by phone since they don’t answer. What should I do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment tax refund amount

So far the IRS has issued over 8 million of those “extra” refunds for tax on unemployment. The IRS has not announced when the next batch will be sent out, but they are still working on them.

The IRS is recalculating refunds for people whose AGI is $150K or below and who filed before the tax law that changed the amount of unemployment that is taxable on a federal return became effective.

The IRS began to send out the additional refund checks for tax withheld from unemployment in May. The refunds are being sent out in batches—starting with the simplest returns first. If you are eligible for the extra refund for federal tax that was withheld from your unemployment the IRS will be sending you an additional refund sometime during the next several months. TurboTax cannot track or predict when it will be sent. The IRS has not provided a way for you to track it, so all you can do is wait for the refund to arrive.

Please read this news from the IRS:

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

starkyfubbs

Level 4

jenniferheuberger10

New Member

mste1602

New Member

vimaljain73

New Member

ningji

Level 2