- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Turbo tax made a mistake and now I'm being told I owe more money.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax made a mistake and now I'm being told I owe more money.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax made a mistake and now I'm being told I owe more money.

Turbotax will pay the penalties and interest assessed (but not the taxes you would have owed anyhow), *****IF***** the software made a calculation error.

If you simply missed entering something...or put it in the wrong place....then that's not the Software's fault..

.............But.......the procedure for filing a claim starts here:

https://ttlc.intuit.com/questions/2566201-what-is-the-turbotax-100-accurate-calculation-guarantee

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax made a mistake and now I'm being told I owe more money.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax made a mistake and now I'm being told I owe more money.

turbo tax filed my oregon state tax wrong as a retired federal empoyee i dont pay state tax o 88.2 percent of my federsl income

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo tax made a mistake and now I'm being told I owe more money.

It depends.

It sounds like you may have forgotten to indicate that your retirement income was from your work as a federal employee. This is an input that you would have needed to enter when you completed your return.

You will need to prepare an amended return to correct your return.

Once you start the amended return, you will need to correct your input in the following sections.

Go back to the Federal section of the program.

- Select Income & Expenses

- Select "IRA,401(k), Pension Plan Withdrawals (1099-R)

- Select "Edit" under the appropriate 1099-R form

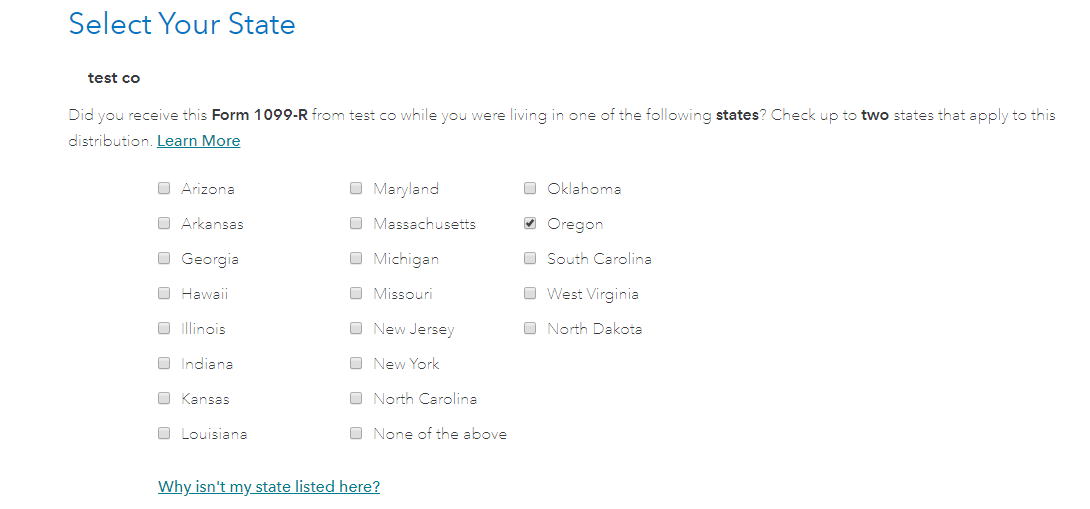

- Proceed to answer through the screens until you see "Select Your State". (You should see this after enter your details from the 1099-R, and the question asking if you are a public safety officer.

Make sure you have selected Oregon here in order to have the state return exclude any nontaxable retirement income.

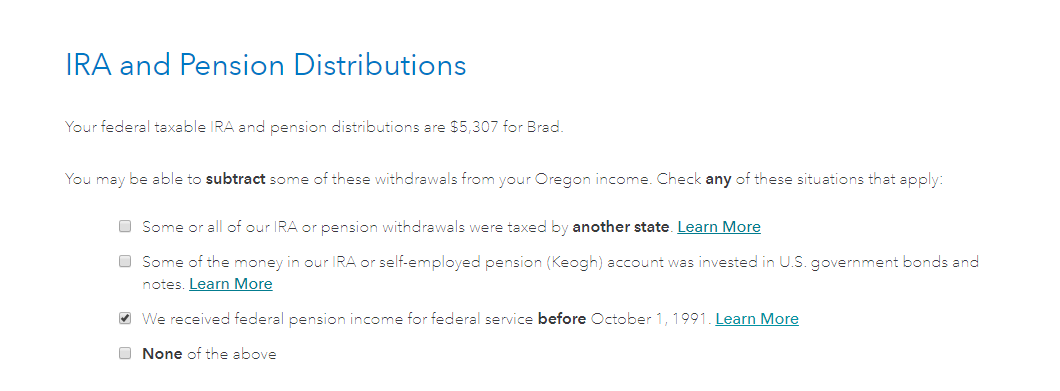

Now, go to your state input for the Oregon return. When you go through the interview process, you will see the following question. You will need to ensure you mark yourself as being a retired federal employee in this section.

If you did not check the box above as indicated, the program will not know that the income was excluded from taxation in Oregon.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

yatabolden92

New Member

VAer

Level 4

RamGoTax

New Member

Major1096

New Member

tandtrepairservices2020

New Member