- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

It depends.

It sounds like you may have forgotten to indicate that your retirement income was from your work as a federal employee. This is an input that you would have needed to enter when you completed your return.

You will need to prepare an amended return to correct your return.

Once you start the amended return, you will need to correct your input in the following sections.

Go back to the Federal section of the program.

- Select Income & Expenses

- Select "IRA,401(k), Pension Plan Withdrawals (1099-R)

- Select "Edit" under the appropriate 1099-R form

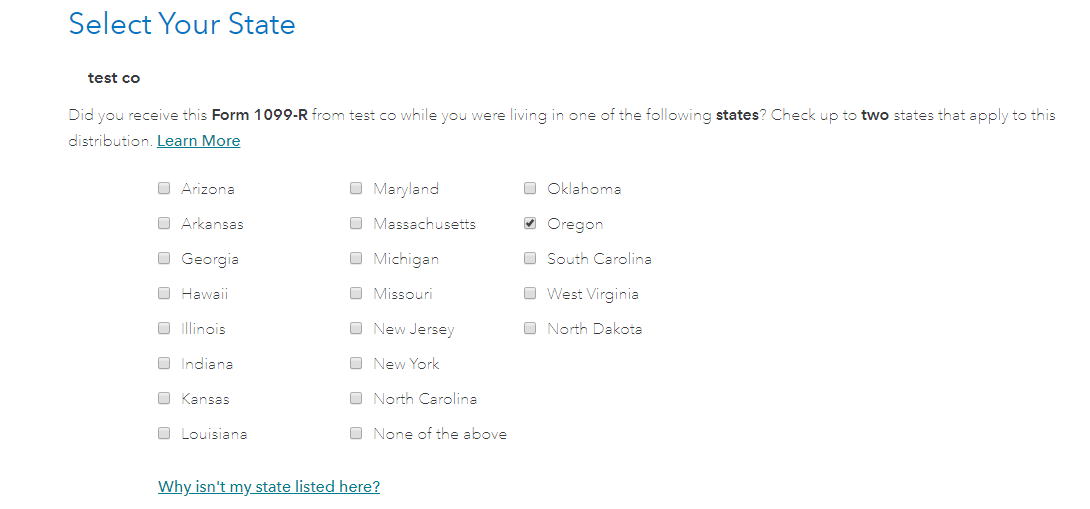

- Proceed to answer through the screens until you see "Select Your State". (You should see this after enter your details from the 1099-R, and the question asking if you are a public safety officer.

Make sure you have selected Oregon here in order to have the state return exclude any nontaxable retirement income.

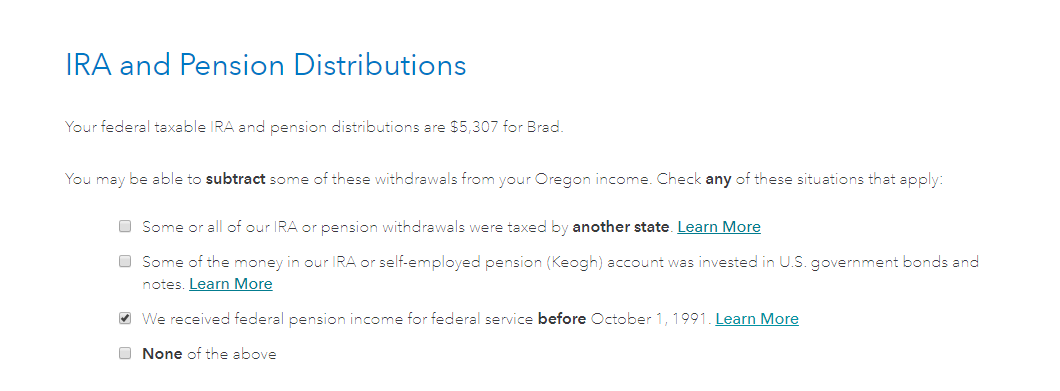

Now, go to your state input for the Oregon return. When you go through the interview process, you will see the following question. You will need to ensure you mark yourself as being a retired federal employee in this section.

If you did not check the box above as indicated, the program will not know that the income was excluded from taxation in Oregon.

**Mark the post that answers your question by clicking on "Mark as Best Answer"