- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: Tax Payment

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Payment

Critter 3 - You stated:

"However most states, if not all, do not allow state taxes owed to be paid by Direct Debit when using tax preparation software. They require the payment by Direct Debit only when using the State tax authorities website." What exactly do you mean? If I need to go to the state tax website and set up the payment myself, why didn't TT make this clear???

I paid TT $25 to electronically file my State return (tax balance due to be Direct Debit from my account.) TT confirmed the electronic filing instructions and sent me an email that the state accepted my return. I made the logical assumption everything was set up for my payment to be deducted. However, The state tax payment was scheduled to be deducted from my account today and it has not been deducted. The tax deadline is Monday, May 17. What do I need to do, if anything?

1) Did TT actually set up the direct debit payment as the Electronic Filing Instruction sheet says? Or,

2) Do I need to go to the State Tax Authority website and set up the payment myself?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Payment

I m having the same issue. Sent 3/26 and still not processed. I can't get anyone on the phone at the IRS, maybe they should resubmit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Payment

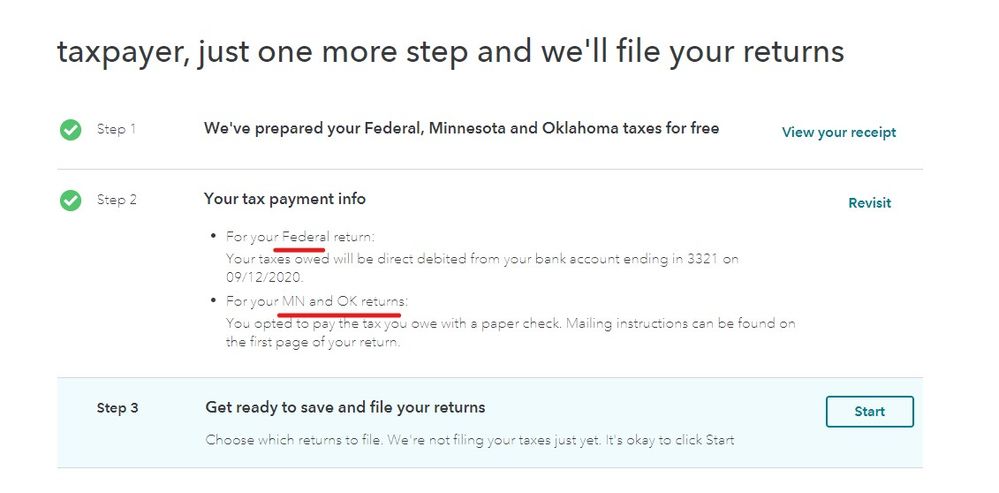

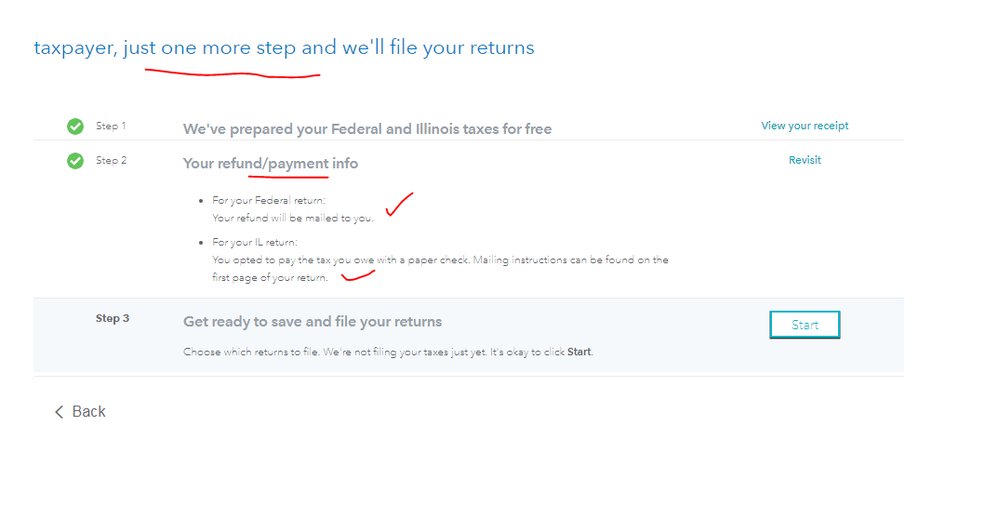

Check the filing instruction pages for the exact payment situation you signed up for and what needed to be done extra if needed ... the program not only posted the information when you made the choice in the FILE tab part 2 but also includes it in the PDF file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Payment

If you selected Direct Debit from your bank account to pay the Federal or State taxes owed, that information was sent with your e-filed federal tax return.

Look at the Federal Information Worksheet in Part V. The bank name, routing number, account number and the date you selected to pay the taxes owed will be entered. If you did not select Direct Debit from your bank account then nothing will be in Part V. Look on your Federal Filing Instruction page for how you selected to pay the Federal taxes owed.

To access your current or prior year online tax returns sign onto the TurboTax website with the userID you used to create the account - https://myturbotax.intuit.com/

When you sign onto your online account and land on the Tax Home web page, scroll down and click on Add a state.

This will take you back to the 2020 online tax return.

Click on Tax Tools on the left side of the online program screen. Then click on Print Center. Then click on Print, save or preview this year's return. Choose the option Include government and TurboTax worksheets

For the State taxes owed the same type of information will be on the State Information Worksheet in Part V of the worksheet and on the State Filing Instructions page.

However SOME STATES do not allow state taxes owed to be paid by Direct Debit when using tax preparation software. They require the payment by Direct Debit only when using the State tax authorities website. If this is the case for your state not only did the program tell you in the FILE tab step 2 the instructions were also included in the PDF file of the return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Payment

Also the feds & states have been slow to debit accounts and process returns so if you were filed timely and your payment information is correct then there is nothing you can do to speed up the process. Check your bank/CC for the eventual debit/payment. Expect the payment to happen anytime so don't leave the account short ... if the debit is unsuccessful then the taxing authority will send a bill with penalties and interest tacked on. (FYI ... last year the feds were still processing payments well into November so just be patient.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Payment

I am having the same problem. I really don't understand this. When I use IRS on-line direct pay, it comes out the next day. I set my withdraw to come out on May 17th, when I filed a few weeks ago, I hope I don't see a late fee.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Payment

Filed my mother return by 5/17. She gets a letter from IRS that she has not paid even though we Turbotax is set up for Direct Debit. She paid by Check. Now she have a letter saying "we misapplied payments, you still owe". Money has left her account and now we are stuck calling the IRS. What happened TurboTax???? Why didn't the direct debit work???

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Payment

When she sent in the check did she include the 1040V voucher for the right year? Or could it have been 1040ES payment slip? Those are not for the tax due.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Payment

A couple of my clients also got one of those notices ... this is just one department's computer not talking to another department's computer. Read the notice carefully to see if anything needs to be done ... sometimes a call to the number on the notice will suffice otherwise send a written response will be needed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Payment

I never had to pay processing fees. Now they want $120 for f**king up my return. I don't think so.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Payment

Received a notice that y’all will deduct payment from my account on 9 th of July won’t have funds till 22 when I get my check!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Payment

Turbo Tax says......

We understand that these are unprecedented times and we’re committed to helping our customers who are experiencing hardships. If you’re in need of assistance, call us by the Tuesday prior to your debit date at 1-888-808-1723 to speak with a trained specialist and mention “auto-debit”, or visit TurboTax Support.

From top of this FAQ

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Payment

Can the date be changed

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Payment

Good morning! My tax return was accepted 8/28/2021 & my payment hasn’t been taken out yet. I called the IRS & they also said they haven’t received any payments. Mine has been more than 10 days for sure. I don’t want to pay it again & then it try & take the money a 2nd time. Can you help?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Payment

The IRS is seriously backlogged again this year due to the new tax law changes among other things so all balance due returns are on the back burner so that the limited staff can concentrate on putting out third stimulus checks, processing returns with refunds on them , re computing returns already filed affected by the recent retroactive tax law changes AND catching up on the millions of 2019 returns that still have not been processed.

So payment debits are being delayed again this year and will not happen until they get around to actually processing the return. So if your return has been ACCEPTED for processing and you check the payment information you entered and if it is correct then write out the amount in your account on the day it was supposed to go and eventually it will be. There will be no penalties or interest if the IRS failed to make the debit on time as long as the request was done correctly on a timely filed return.

How do I review the method I chose to pay my federal income tax with, after filing with TurboTax Online?

You can verify the tax payment method you chose on the Electronic Filing Instructions for your 2020 Federal Tax Return page, next to Balance Due/Refund. To see the page, follow these instructions:

- Open your return if it’s not already open.

- On the [Your name], your 2020 federal return was accepted! screen, scroll down and select Add a State (don’t worry, we’re not adding a state) to access your tax forms and worksheets.

- On the left side select Tax Tools then Print Center.

- On the TurboTax Print Center screen, select Print, save or preview this year’s return.

- On the next TurboTax Print Center screen, select 2020 federal returns and Include government and TurboTax worksheets (optional) then select View or print forms.

- The information will be on the first page, Electronic Filing Instructions for your 2020 Federal or State Tax Return next to Balance Due/Refund.

In the future may I suggest you pay the federal (and state if allowed) directly on the fed or state websites ... this way you have the control on the timing and get an instant confirmation of the payment. https://www.irs.gov/payments

- « Previous

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

taxdrama

Level 3

nneka23

New Member

cschmidt53

New Member

iceman2usa

New Member

user17724468412

New Member