- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: My wife and I both received Letter 6419 from the IRS, with instructions to report the Advance Child Tax Credit that we received in 2021. Where do we enter this info?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My wife and I both received Letter 6419 from the IRS, with instructions to report the Advance Child Tax Credit that we received in 2021. Where do we enter this info?

Use the 6419 amounts ONLY if they are correct ... the portal will show the total under each person's name with will make the advance double if you use it's numbers. FYI ... even if you file now ALL returns with the CTC on it will NOT process prior to mid February so don't expect the refund prior to March so you are not disappointed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My wife and I both received Letter 6419 from the IRS, with instructions to report the Advance Child Tax Credit that we received in 2021. Where do we enter this info?

@Zack1982. Regardless of the other advice you receive, here is how to report. Since you have received the 6419, you should report it and the program will determine if you were eligible or not.

- Log into Turbo Tax

- Go to federal>deductions and credits

- Go to You and your family

- Select Advance payments, Child and Other Dependent Tax Credits

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My wife and I both received Letter 6419 from the IRS, with instructions to report the Advance Child Tax Credit that we received in 2021. Where do we enter this info?

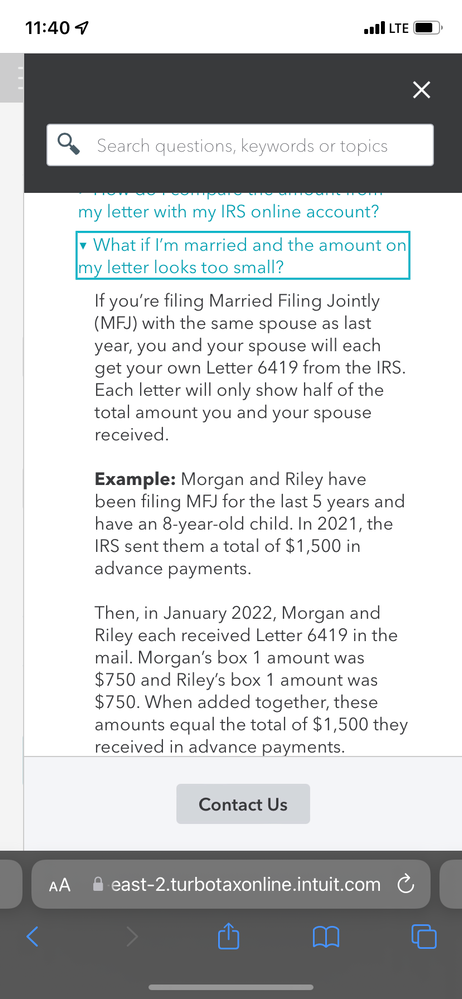

This really is going to be a huge headache. Is Turbo tax going to get clarification if both letters are identical to the full amount the family received so far (example: payments totaled $2400 over six months and each individual letter says $2400, not $1200 how it should in theory) what we should enter for each parent filing jointly? It says to enter the amount on each letter for each person, but then we’re put in the position of saying we received $4800 in the example above on the joint tax return. Common sense would say to split it when entering it, but then you aren’t putting what is on the letter. If you write what’s on the letter you are misstating receiving twice as much and shorting yourself the full amount on the form. Please turbo tax look into this and get an official answer from the IRS before everyone messes this up one way or the other!!! The funniest part about this is they know what was already sent, it’s just a technicality that could cause a lot of unneeded adjusting later.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My wife and I both received Letter 6419 from the IRS, with instructions to report the Advance Child Tax Credit that we received in 2021. Where do we enter this info?

Generally, the answer is to enter the information as it appears on the letter. However, if your numbers are definitely incorrect and are causing you to enter twice as much as you actually received, you will need to call the number on the letter and speak with the IRS to fix it. The number is 800-908-4184.

If you are sure it is incorrect, you should hold off on filing your tax return until you speak to them and get an updated corrected amount or a correct amount in the portal.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My wife and I both received Letter 6419 from the IRS, with instructions to report the Advance Child Tax Credit that we received in 2021. Where do we enter this info?

My wife's and my letter both show the total ACTC we received. When adding the 2 together, it is double the actual amount we received.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My wife and I both received Letter 6419 from the IRS, with instructions to report the Advance Child Tax Credit that we received in 2021. Where do we enter this info?

As stated by @Vanessa A you need to call the number on your letter to get the correct amount to report on your tax return. Do not file your return until you have that amount from the IRS. The processing of your return will be delayed if you report something different from what the IRS has on file.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My wife and I both received Letter 6419 from the IRS, with instructions to report the Advance Child Tax Credit that we received in 2021. Where do we enter this info?

My wife & I never received the 6419 form. We are filing married jointly. We have 2 children. Age 2 & 3. We never received the advanced payments. So when we put 0 and it asks how many children qualify. But is also states for spouse & taxpayer. So would we both put 1 beside taxpayer & spouse? That way is equals 2? Whats the difference in taxpayer & spouse? I am so confused.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My wife and I both received Letter 6419 from the IRS, with instructions to report the Advance Child Tax Credit that we received in 2021. Where do we enter this info?

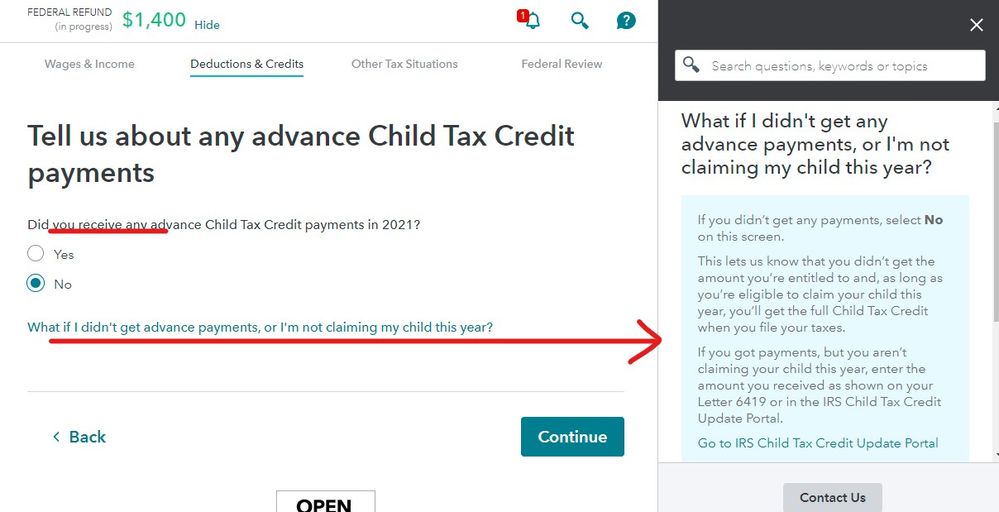

If you got no advance payments then you just need to say NO on this screen then you will not see that other screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My wife and I both received Letter 6419 from the IRS, with instructions to report the Advance Child Tax Credit that we received in 2021. Where do we enter this info?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My wife and I both received Letter 6419 from the IRS, with instructions to report the Advance Child Tax Credit that we received in 2021. Where do we enter this info?

So my wife and I got our letters and they are for the correct amount. But when i enter the correct amounts into turbo tax and click thru the questions and say done. It takes me back to the summary of the tax breaks, and the amount is $1000 higher than i entered.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My wife and I both received Letter 6419 from the IRS, with instructions to report the Advance Child Tax Credit that we received in 2021. Where do we enter this info?

Don't look at the summary or the refund meter as both can be confusing ... look at the actual form 1040 line 28.

You can peek at only the Federal form 1040 and the summary of the state info by going here:

1) lower- Left side of the screen...click to the left side of the "Tax Tools" text selection.

2) then select "Tools"

3) then select "View Tax Summary" from the pop-up

4) then back to the left-side and "Preview 1040"

Then hit the "Back" on the left side to get back to your tax entries.

To view your entire return using the online editions (including the state) before you file, you will need to pay for your online account.

To pay the TurboTax online account fees by credit card, without completing the 2021 return at this time, click on Tax Tools >>> Tools and then Print Center. Then click on Print, save or preview this year's return. On the next page, to pay by credit card, click Continue. On the next screen it will ask if you want Audit Defense, if you do not want this option just click on the Continue button. The next screen will ask for all your credit card information so you can pay for the account.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My wife and I both received Letter 6419 from the IRS, with instructions to report the Advance Child Tax Credit that we received in 2021. Where do we enter this info?

It might be showing you the rest of the credit you are getting.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My wife and I both received Letter 6419 from the IRS, with instructions to report the Advance Child Tax Credit that we received in 2021. Where do we enter this info?

THink you were right. the 1040 reflect the correct amount. wierd that summary is different...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My wife and I both received Letter 6419 from the IRS, with instructions to report the Advance Child Tax Credit that we received in 2021. Where do we enter this info?

Was it accepted? I'm in the same boat as you and was going to file today but wanted to wait for a update.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My wife and I both received Letter 6419 from the IRS, with instructions to report the Advance Child Tax Credit that we received in 2021. Where do we enter this info?

yes, both Federal and State were accepted

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

courtmattina

New Member

Kellyriley890

New Member

20rualcung

New Member

kazionlittle24

New Member

Tiffany22115

New Member