- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: I filed taxes on 03/22/20 and they were accepted on 03/23/20 but still haven’t received taxes or my stimulus, has anyone had this problem and got it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed taxes on 03/22/20 and they were accepted on 03/23/20 but still haven’t received taxes or my stimulus, has anyone had this problem and got it?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed taxes on 03/22/20 and they were accepted on 03/23/20 but still haven’t received taxes or my stimulus, has anyone had this problem and got it?

There are lots of delayed federal refunds this year.

The IRS is short staffed; and they are processing millions of tax returns at the same time that they have been burdened with the task of processing millions of stimulus checks.

To check on regular tax refund status via automated phone, call 800-829-1954. (This line has no information on Economic Impact Payments.)

https://turbotax.intuit.com/tax-tools/efile-status-lookup/

TurboTax gives you an estimated date for receiving your refund based on a 21 day average from your date of acceptance, but it can take longer. Many refunds are taking longer during the pandemic.

Once your federal return has been accepted by the IRS, only the IRS has any control. TurboTax does not receive any updates from the IRS. Your ONLY source of information about your refund now is the IRS.

You need your filing status, your Social Security number and the exact amount (line 20 of your Form 1040) of your federal refund to track your Federal refund:

To track your state refund:

https://ttlc.intuit.com/questions/1899433-how-do-i-track-my-state-refund

https://ttlc.intuit.com/questions/1901548-why-do-some-refunds-take-longer-than-others

If you chose to have your TurboTax fees deducted from your federal refund, that will take some extra time, while the third party bank handles the refund processing.

https://www.irs.gov/refunds/tax-season-refund-frequently-asked-questions

https://ttlc.intuit.com/questions/2840013-does-accepted-mean-my-refund-is-approved

To call the IRS:IRS: 800-829-1040 hours 7 AM - 7 PM local time Mon-Fri

Listen to each menu before making the selection.

First choose your language. Press 1 for English.

Then do NOT choose the first choice re: "Refund", or it will send you to an automated phone line.

Instead, press 2 for "personal income tax".

Then press 1 for "form, tax history, or payment".

Then press 3 "for all other questions."

Then press 2 "for all other questions." It should then transfer you to an agent.

The IRS can look at your 2018 or 2019 return to issue a stimulus check. If they do not have a 2018 return then you may be waiting for them to finish processing 2019 before they will be able to use it to issue your stimulus check.

TurboTax has no control over your stimulus check, nor can TT track it for you or tell you when the IRS will issue it. Refer to the sites linked below:

You can call the IRS hotline at 1-800-919-9835 to get updates on your stimulus payment.

https://www.irs.gov/coronavirus/economic-impact-payment-information-center#nonfilertool

https://www.irs.gov/coronavirus/get-my-payment-frequently-asked-questions

https://ttlc.intuit.com/community/tax-topics/help/how-will-the-stimulus-package-impact-me/00/1393859

The stimulus check is an advance on a credit you can receive on your 2020 tax return. If something went wrong or you did not get the stimulus check this year, you can get it when you file your 2020 return in early 2021—if you are eligible.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed taxes on 03/22/20 and they were accepted on 03/23/20 but still haven’t received taxes or my stimulus, has anyone had this problem and got it?

Yes I filed in February and they excepted it the next day and now they are saying that they never received it...I’m over it...I need help and you can’t get no answers

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed taxes on 03/22/20 and they were accepted on 03/23/20 but still haven’t received taxes or my stimulus, has anyone had this problem and got it?

My wife an I pay our taxes yearly and because we dont allow anyone to attach to our bank accounts is my theory, we still have not received our $2400 in stimulus. Meanwhile I am an essential worker, and have watched people spending theirs like it was vacation money at hotels I maintenance. It is appalling. It has almost been a year, and i wonder why TurboTax is not offering to file the 1046/ 1046a or what ever it is called to get people their checks?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed taxes on 03/22/20 and they were accepted on 03/23/20 but still haven’t received taxes or my stimulus, has anyone had this problem and got it?

As I suspected. SO it is not a GIFT, like they have given tax dodging companies (fortune 500's) it is a loan in lean against our 2020 tax return. This is priceless. These companies dodge taxes, they won't pay anything back in, they didn't pay in to begin with. Taxation without representation at its finest.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed taxes on 03/22/20 and they were accepted on 03/23/20 but still haven’t received taxes or my stimulus, has anyone had this problem and got it?

@SMPII wrote:

My wife an I pay our taxes yearly and because we dont allow anyone to attach to our bank accounts is my theory, we still have not received our $2400 in stimulus. Meanwhile I am an essential worker, and have watched people spending theirs like it was vacation money at hotels I maintenance. It is appalling. It has almost been a year, and i wonder why TurboTax is not offering to file the 1046/ 1046a or what ever it is called to get people their checks?

Only the IRS controls when or if a stimulus payment is distributed. TurboTax is not involved in any way.

You can get the Recovery Rebate Credit (stimulus payment) when filing the 2020 Federal tax return Form 1040. The credit is entered on Line 30 of the Form 1040.

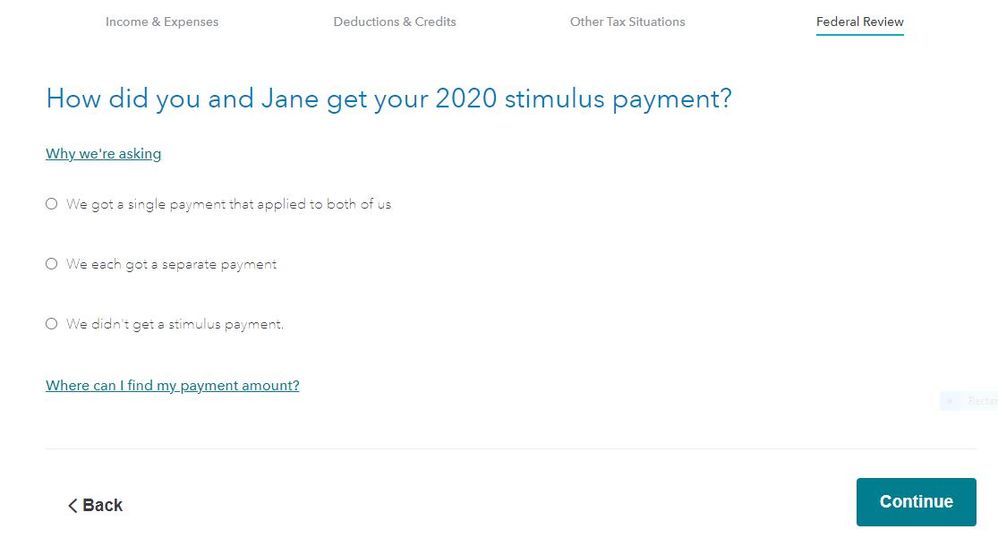

Using TurboTax the program asks about the stimulus payment in the Federal Review section of the program.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed taxes on 03/22/20 and they were accepted on 03/23/20 but still haven’t received taxes or my stimulus, has anyone had this problem and got it?

@SMPII wrote:As I suspected. SO it is not a GIFT, like they have given tax dodging companies (fortune 500's) it is a loan in lean against our 2020 tax return. This is priceless. These companies dodge taxes, they won't pay anything back in, they didn't pay in to begin with. Taxation without representation at its finest.

It is not a loan. The Stimulus Check is really based on your 2020 return we are filing in 2021. So any amount you already got will be reconciled on your 2020 return line 30. If you qualify for more it will be added to your return. But the good news is if they paid you too much they won't take it back.

See this thread, it has good information and a screen shot

See these 3 IRS questions on reporting it on your 2020 return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed taxes on 03/22/20 and they were accepted on 03/23/20 but still haven’t received taxes or my stimulus, has anyone had this problem and got it?

Yes I've had the same problem and have had the Gov hot line tell me 5 completely different things to do! And i still haven't seen either one!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I filed taxes on 03/22/20 and they were accepted on 03/23/20 but still haven’t received taxes or my stimulus, has anyone had this problem and got it?

Please review this Turbo Tax article to determine if you are eligible for the first and second round stimulus payments. If you qualify, you can receive a Rebate Recovery Credit from the IRS by filing a 2020 tax return.

- Log into turbo tax

- Click on Federal Review

- Let's make sure you got the right stimulus amount>continue

- Next screen asks Did you get a stimulus payment? NO

- Then the next screen will let you know if you are eligible for the payment and the amount of the credit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kazionlittle24

New Member

allidevins17

New Member

Dancarmo

Returning Member

mcfoley52

New Member

user17615824249

New Member