- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: e-file rejected

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e-file rejected

in 2018 a 1040X was sent in but the IRS is not seeing or not using it. The incorrect filling has a AGI as 191676 (INCORRECT) The 1040X has a AGI of158870 (CORRECT). Do I have to change it back to the incorrect AGI? Can I re-efle after this change,or send by mail? When I e-filed I set up for automatic payment from my checking. What happens to this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e-file rejected

You would use the AGI from your original 2018 tax return. Do not use the amount from your amended return.

When your return gets rejected no information is sent to the IRS, so your payment information has not gone through.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e-file rejected

You can check your e-file status yourself:

How do I check my e-file status?

Sign in to TurboTax to check your current status. You'll find it in Tax Home after sign in.

If you've got an Alexa device, you can enable it to check for you.

If you used TurboTax CD/Downloadyou can check your e-file status by opening the File menu and selecting Check E-filing status or by opening your return, selecting the File tab, and selecting the Check E-file Status header.

Keep in mind:

- E-filing status is what stage of the process your return is in.

- Refund status is when you can expect you refund. If that’s what you’re interested in, go to Where's My Refund?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e-file rejected

Where do I correct my 2018 AGI in TurboTax Online?

To revisit the 2018 AGI section in TurboTax Online:

- Sign in and open your return, if you haven't already done so.

- From the left menu, select File (tap in the upper-left corner to expand the menu on mobile devices).

- Select Start next to Step 3 (if needed, revisit Steps 1 and/or 2 to activate Step 3).

- Select I want to e-file.

- Continue until you see the place to enter your 2018 AGI.

---------------------------------

How do I correct my 2018 AGI in the TurboTax CD/Download software?

To correct your 2018 AGI in TurboTax, open your return and then:

- Click the File tab and continue until you reach the To continue, select from the options below screen.

- Enter your corrected AGI in Enter last year's AGI here.

- Click Continue and keep following the screens until you've re-transmitted your return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e-file rejected

You would use the AGI from your original 2018 tax return. Do not use the amount from your amended return.

When your return gets rejected no information is sent to the IRS, so your payment information has not gone through.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e-file rejected

Yes the replay helped me. I changed it back to the original 2018 AGI and re-efiled. I have not heard if the corrected e-filing has been received. Wished I had mailed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e-file rejected

You can check your e-file status yourself:

How do I check my e-file status?

Sign in to TurboTax to check your current status. You'll find it in Tax Home after sign in.

If you've got an Alexa device, you can enable it to check for you.

If you used TurboTax CD/Downloadyou can check your e-file status by opening the File menu and selecting Check E-filing status or by opening your return, selecting the File tab, and selecting the Check E-file Status header.

Keep in mind:

- E-filing status is what stage of the process your return is in.

- Refund status is when you can expect you refund. If that’s what you’re interested in, go to Where's My Refund?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e-file rejected

used wrong e file pin -- I have correct one how do I correct

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e-file rejected

Where do I correct my 2018 AGI in TurboTax Online?

To revisit the 2018 AGI section in TurboTax Online:

- Sign in and open your return, if you haven't already done so.

- From the left menu, select File (tap in the upper-left corner to expand the menu on mobile devices).

- Select Start next to Step 3 (if needed, revisit Steps 1 and/or 2 to activate Step 3).

- Select I want to e-file.

- Continue until you see the place to enter your 2018 AGI.

---------------------------------

How do I correct my 2018 AGI in the TurboTax CD/Download software?

To correct your 2018 AGI in TurboTax, open your return and then:

- Click the File tab and continue until you reach the To continue, select from the options below screen.

- Enter your corrected AGI in Enter last year's AGI here.

- Click Continue and keep following the screens until you've re-transmitted your return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e-file rejected

Hello,

I have the same issue, I used the amended agi and failed. I used my credit card $24.99. Now I am going to fixed it and re-send it. It seems that I am going to be re-charged again?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e-file rejected

@zhshqzyc wrote:

Hello,

I have the same issue, I used the amended agi and failed. I used my credit card $24.99. Now I am going to fixed it and re-send it. It seems that I am going to be re-charged again?

No, you should not have to enter your CC information again to e-file the state tax return since the first e-filing was rejected. Nor should be you be charged the $24.99 again when e-filing the corrected tax returns.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e-file rejected

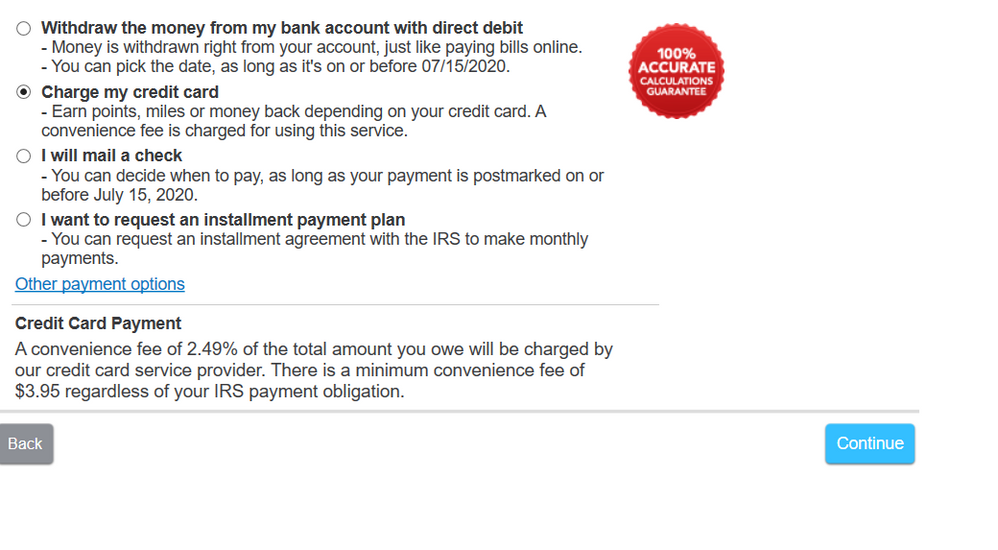

But I am in the page which asks me to input CC information. Please see the images.

I am confused.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e-file rejected

@zhshqzyc Contact TurboTax support for this issue. If you already entered your CC information for e-filing the state tax return and you were charged $24.99 on the card, then you should not be charged again since the first e-file was rejected. Verify on your CC account that there is a $24.99 charge and if there is contact support.

To contact TurboTax customer service/support use their contact website during business hours. Use the key words billing issues

Use this website to contact TurboTax support during business hours - https://support.turbotax.intuit.com/contact/

Support can also be reached by messaging them on these pages https://www.facebook.com/turbotax/ and https://twitter.com/TeamTurboTax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e-file rejected

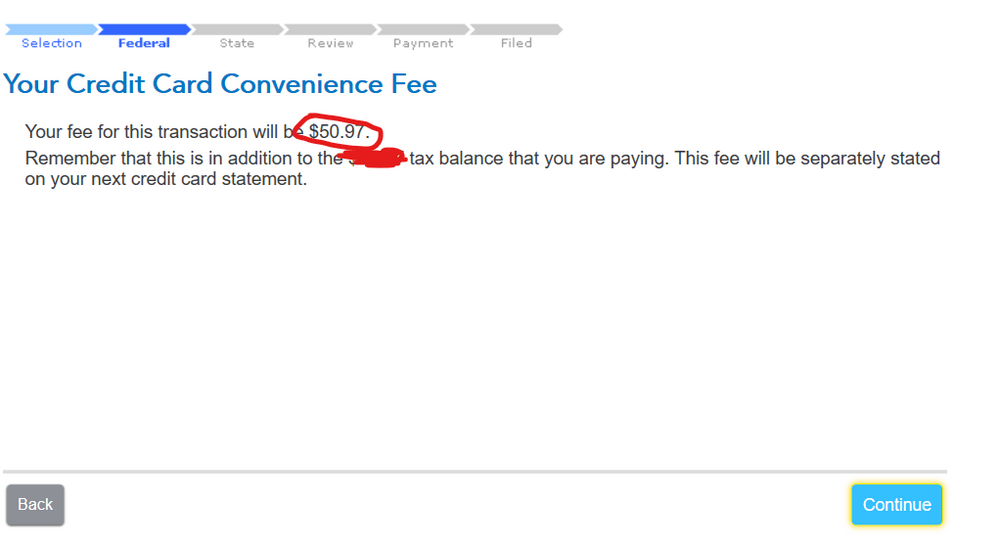

Sure, I will contact the support. It is a bug of the software. I have been charged twice. Please see the image.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e-file rejected

I do not no why my efile as rejected. I am disabled and can not do mailing. I payed a lot for this I must have e file status please help. I was filing 2019 taxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e-file rejected

My error was using the wrong year $ amount they ask for . They want the amount shown

on your 2018 return not the current return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e-file rejected

I got rejected twice , I went back to turbo tax , but it shows 0 , seems like I have to restart everything all over. Is that so ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

e-file rejected

What if i dont have my tax return of 2018 to get my AGI...what do i do now. Ii fule 2 weeks ago im rejected

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

miranda-tulloc

New Member

Randy16

Returning Member

paul-d-house

New Member

dk69603duk

Returning Member

dk69603duk

Returning Member