- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Need a copy of 2019 tax return

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need a copy of 2019 tax return

@tiptoes Will what be available soon? What are you trying to do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need a copy of 2019 tax return

@tiptoes If you mean you want a copy of your 2019 tax return

You have to access your own account and/or print it for yourself using exactly the same account and user ID that you used when you prepared the return.

Many people have multiple TT accounts and forget how to access them. Log out of the account you are in now.

Account recovery

https://myturbotax.intuit.com/account-recovery/

https://ttlc.intuit.com/questions/1901535-forgot-your-turbotax-online-user-id-or-password

Or did you use the desktop version of TurboTax? If so, the files are on your own hard drive or any backup device you used like a flash drive.

https://ttlc.intuit.com/questions/1901486-how-many-turbotax-accounts-do-i-have

https://ttlc.intuit.com/questions/1901535

https://ttlc.intuit.com/questions/1901659-find-your-tax-data-file-in-mac

https://ttlc.intuit.com/questions/1900721-find-your-tax-data-file-tax-file-in-windows

To get a copy of your previously filed returns prepared with online TurboTax https://ttlc.intuit.com/questions/1900748-how-do-i-get-a-copy-of-a-return-i-filed-in-turbotax-online

SAVE YOUR TAX RETURN !

EVERY year before mid-October you should save a copy of your tax return as a pdf and print a copy of it for your records. That way you will not be searching online frantically when you need it for a lender, FAFSA forms, your next tax return, etc.

https://ttlc.intuit.com/questions/1900937-why-should-i-save-a-pdf-copy-of-my-return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need a copy of 2019 tax return

I am looking to copy my 2019 and 2018 tax returns. I know I saved them but now I cannot find them

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need a copy of 2019 tax return

@Gilbert Gross wrote:

I am looking to copy my 2019 and 2018 tax returns. I know I saved them but now I cannot find them

You have to sign onto your 2019 online account using the exact same User ID you used to create the online account.

Close all TurboTax windows on your web browser (including this one). Copy and paste the account recovery website link onto a new web browser window and run the tool.

Use this TurboTax account recovery website to get a list of all the User ID's for an email address. Run the tool against any email addresses you may have used - https://myturbotax.intuit.com/account-recovery

If none of the user ID's received will access your 2019 account, then use the option shown in blue on the account recovery website, "Try something else"

If you used the desktop CD/Download editions installed on your computer, the only copy of your tax data file and any PDF's will be on the computer where the return was created. TurboTax does not store online any returns completed using the desktop editions.

To access your prior year tax returns sign onto the TurboTax website with the User ID you used to create the account - https://myturbotax.intuit.com/

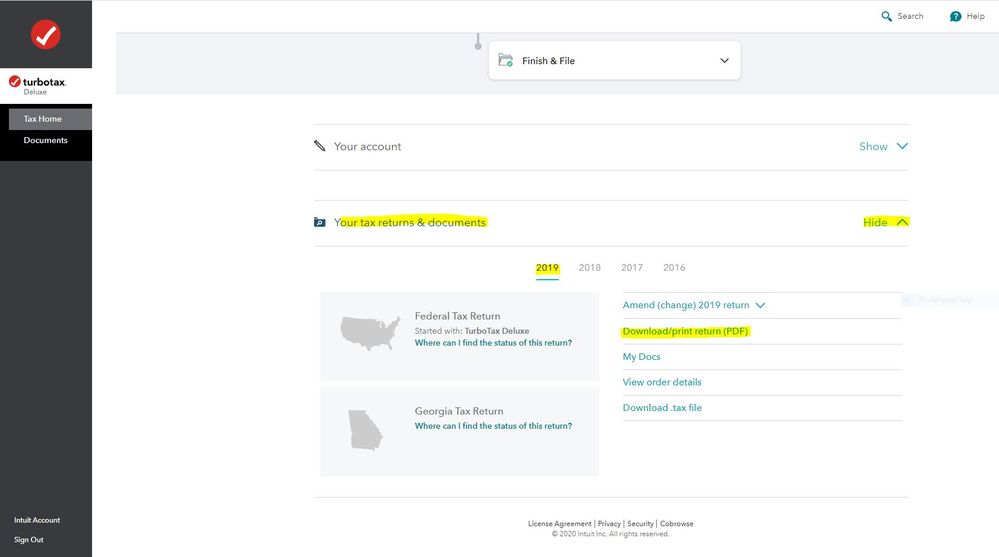

Scroll down to the bottom of the screen and on the section Your tax returns & documents click on Show. Click on the Year and Click on Download/print return (PDF)

OR -

You may have to start a 2020 tax return before the links on the Tax Home web page become available. In that case start the 2020 tax return with the User ID you used for the 2019 return. Once some basic information has been transferred over, Tax Home should be visible on the left column. Click on Tax Home and then the other links will be shown as in this screenshot.

To access your prior year online tax returns sign onto the TurboTax website with the User ID you used to create the account - https://myturbotax.intuit.com/

Scroll down to the bottom of the screen and on the section Your tax returns & documents click on Show. Click on the Year and Click on Download/print return (PDF)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need a copy of 2019 tax return

I need a copy of 2019 tax return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need a copy of 2019 tax return

@Roberta616 wrote:

I need a copy of 2019 tax return

To access your prior year online tax returns sign onto the TurboTax website with the User ID you used to create the account - https://myturbotax.intuit.com/

Scroll down to the bottom of the screen and on the section Your tax returns & documents click on Show. Click on the Year and Click on Download/print return (PDF)

If you used the desktop CD/Download editions installed on your computer, the only copy of your tax data file and any PDF's will be on the computer where the return was created. TurboTax does not store online any returns completed using the desktop editions.

Or go to this IRS website for free federal tax return transcripts - https://www.irs.gov/individuals/get-transcript

For a fee of $43 you can get a complete federal tax return from the IRS by completing Form 4506 - http://www.irs.gov/pub/irs-pdf/f4506.pdf

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need a copy of 2019 tax return

@Roberta616 wrote:

I need a copy of 2019 tax return

READ the answer directly above your post.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need a copy of 2019 tax return

I need to get a copy of my 2019 tax return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need a copy of 2019 tax return

@Popkorn wrote:

I need to get a copy of my 2019 tax return

To access your prior year online tax returns sign onto the TurboTax website with the User ID you used to create the account - https://myturbotax.intuit.com/

Scroll down to the bottom of the screen and on the section Your tax returns & documents click on Show. Click on the Year and Click on Download/print return (PDF)

If you used the desktop CD/Download editions installed on your computer, the only copy of your tax data file and any PDF's will be on the computer where the return was created. TurboTax does not store online any returns completed using the desktop editions.

Or go to this IRS website for free federal tax return transcripts - https://www.irs.gov/individuals/get-transcript

For a fee of $43 you can get a complete federal tax return from the IRS by completing Form 4506 - http://www.irs.gov/pub/irs-pdf/f4506.pdf

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need a copy of 2019 tax return

I just need a copy of the form 1040 ES 2019- which is for Jan 15, 2020 so I can send in a payment. I can fin it on the tax forms page - general information but it won't print. Please help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need a copy of 2019 tax return

@petreadwell wrote:

I just need a copy of the form 1040 ES 2019- which is for Jan 15, 2020 so I can send in a payment. I can fin it on the tax forms page - general information but it won't print. Please help.

An estimated tax payment for tax year 2019 is no longer being accepted by the IRS. Only estimated tax payments for tax year 2021 are being accepted.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need a copy of 2019 tax return

i filled taxes in 2019 and never got the money i was owed

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need a copy of 2019 tax return

@b2fountain wrote:

i filled taxes in 2019 and never got the money i was owed

Did you e-file your tax return and was it accepted?

Only the IRS and your State control when and if a Federal or State tax refund is Approved and Issued.

You complete your tax return by finishing all 3 Steps in the File section. In Step 3, to e-file your tax return, you must click on the large Orange button labeled "Transmit my returns now".

After completing the File section and e-filing your tax return you will receive two emails from TurboTax. The first email when your tax return was transmitted and the second email when the tax return has either been accepted or rejected.

Note - Once a tax return has been Accepted by the IRS or a State, TurboTax receives no further information concerning the tax return or the status of any tax refund. Only the taxpayer listed on the tax return can obtain the status of a tax refund or a tax return.

To check the status of an e-filed return, open up your desktop product or log into your TurboTax Online Account. You can find your status within the TurboTax product.

If accepted by the IRS use the federal tax refund website to check the refund status - https://www.irs.gov/refunds

If accepted by the state use this TurboTax support FAQ to check the state tax refund status - https://ttlc.intuit.com/questions/1899433-how-do-i-track-my-state-refund

After the tax return has been Accepted by the IRS (meaning only that they received the return) it will be in the Processing mode until the tax refund has been Approved and then an Issue Date will be available on the IRS website.

See this IRS website for federal tax refund FAQ's - https://www.irs.gov/refunds/tax-season-refund-frequently-asked-questions

If over 21 days since being Accepted by the IRS and the tax refund is still Processing you can call the IRS and speak with an IRS agent concerning your tax refund.

Call the IRS: 1-800-829-1040 hours 7 AM - 7 PM local time Monday-Friday

When calling the IRS do NOT choose the first option re: "Refund", or it will send you to an automated phone line.

So after first choosing your language, then do NOT choose Option 1 (refund info). Choose option 2 for "personal income tax" instead.

Then press 1 for "form, tax history, or payment".

Then press 3 "for all other questions."

Then press 2 "for all other questions."

- When it asks you to enter your SSN or EIN to access your account information, don't enter anything.

- After it asks twice, you will get another menu.

Press 2 for personal or individual tax questions.

Then press 4 for all other inquiries

It should then transfer you to an agent.

Or you can contact your local IRS office. See this IRS website for local IRS offices - http://www.irs.gov/uac/Contact-Your-Local-IRS-Office-1 or call 1-844-545-5640 to set up an appointment

Or you may want to contact a Taxpayer Advocate in your area. See this IRS website for Taxpayer Advocate in your area and a toll free number - http://www.irs.gov/Advocate/Local-Taxpayer-Advocate

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need a copy of 2019 tax return

I have obviously misplaced it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need a copy of 2019 tax return

Need copy of 2019 tax return, emailed to me ASAP. Thanks

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

katrinaklein

New Member

thedutch97

New Member

ce3cce21a96a

New Member

hairmasterd1-yah

New Member

thelegendarydiva

New Member