- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- My EE savings Bond matured in May 2020, but I did not redeem it until 2022. I have to report the savings bond interest on 2020 1040X, but how do I this in Turbo Tax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My EE savings Bond matured in May 2020, but I did not redeem it until 2022. I have to report the savings bond interest on 2020 1040X, but how do I this in Turbo Tax?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My EE savings Bond matured in May 2020, but I did not redeem it until 2022. I have to report the savings bond interest on 2020 1040X, but how do I this in Turbo Tax?

No. You enter the amount you received in 2022 for those bonds on your 2022 tax return. That is the year you received the income and that is the year that you enter it for.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My EE savings Bond matured in May 2020, but I did not redeem it until 2022. I have to report the savings bond interest on 2020 1040X, but how do I this in Turbo Tax?

No, as xmasbaby0 posted, you need to report your 2022 1099-INT on your 2022 tax return. Taxable income is reported in the year received.

To enter your 1099-INT in TurboTax you can follow these steps:

- Sign in to your TurboTax account and open or continue your return

- Select Federal from the menu, then Wages & Income

- Locate the section titled Investments & Savings and select Show More, then select Start or Revisit next to Interest on 1099-INT

- Select Yes on the screen Did you receive any investment income? then Continue

- If you see the screen Your investments & savings or Here's your 1099-INT info, select Add investments or Add another 1099-INT, then Continue

- On the next screen, select how you want to enter your Form 1099-INT:

- If you want to import your form, search for your brokerage or financial institution. Sign in to your online account and select Get my form

- If you want to upload a copy of your form or manually enter the info, select Enter a different way, and follow the instructions to enter your 1099-INT

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My EE savings Bond matured in May 2020, but I did not redeem it until 2022. I have to report the savings bond interest on 2020 1040X, but how do I this in Turbo Tax?

I received a 1099-INT from my bank for 2023 showing my checking account interest in Box 1 and the U.S. Savings Bond interest I received in Box 3. The bonds were issued in 1986 so the interest is over $5,000. I correctly entered the 1099-INT because I can see it on the TurboTax Federal Worksheet. My problem is that my TurboTax Montana State Tax Return is showing the same “total taxable interest” as my Federal return but U.S. Series EE Savings Bond interest is state tax free. How do I fix this since TurboTax didn’t reduce my “total taxable interest” by $5,000? Thanks for your help! 🙏🏽

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My EE savings Bond matured in May 2020, but I did not redeem it until 2022. I have to report the savings bond interest on 2020 1040X, but how do I this in Turbo Tax?

Yes, you are correct, the US savings bond interest should not be taxed to Montana (MO). The US bond interest will be listed under 'Subtractions'.

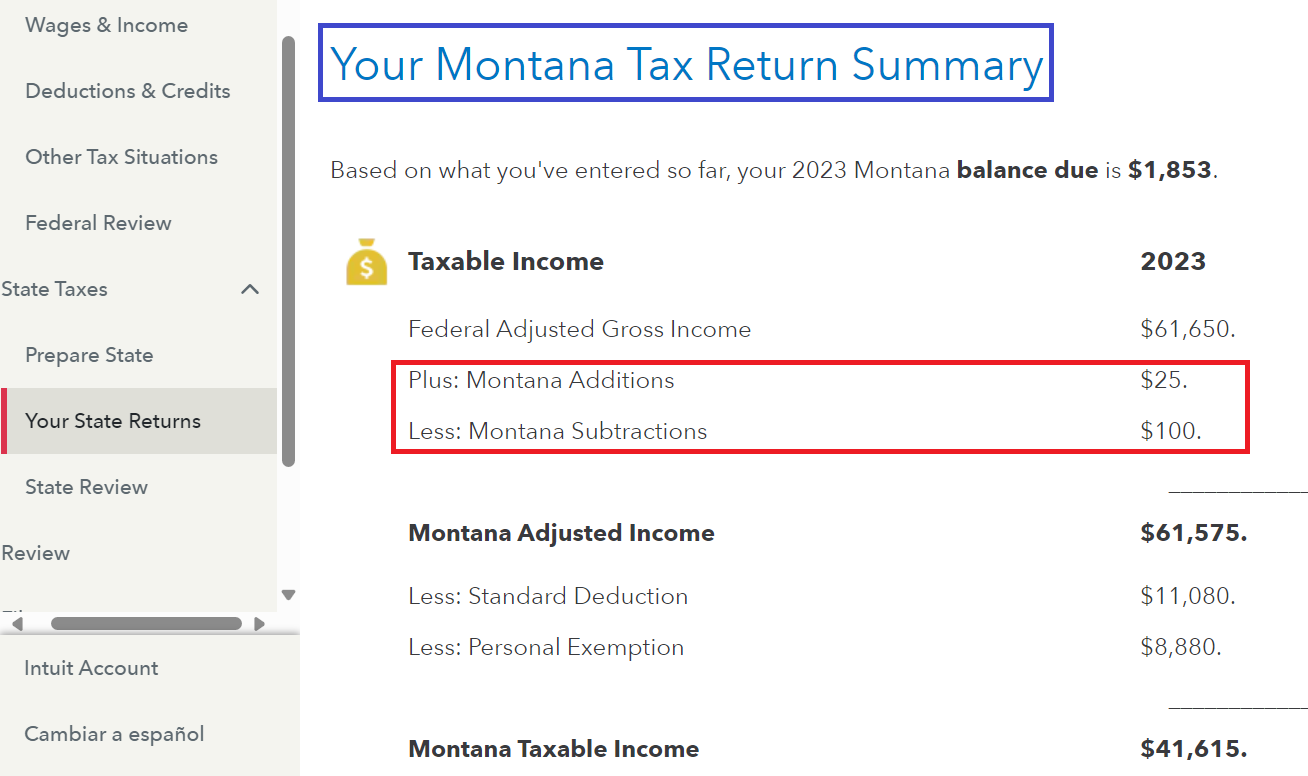

Review the income for interest and, if applicable, dividends. On the 'Your Montana Tax Return Summary' you are able to see the removal of the US Bond interest. TurboTax does this automatically without any intervention on your part. When you finish walking through the return you can see the 'Plus: Montana Additions' and 'Less: Montana Subtractions'. In my scenario I had $100 in US Bond interest (Box 3, Form 1099-INT) and $25 of tax exempt interest that was not from Montana. See the image below to review the summary:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

SandyG19

Level 2

HollyP

Employee Tax Expert

Illia

Level 2

tcondon21

Level 2

cirithungol

Returning Member