- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

Yes, you are correct, the US savings bond interest should not be taxed to Montana (MO). The US bond interest will be listed under 'Subtractions'.

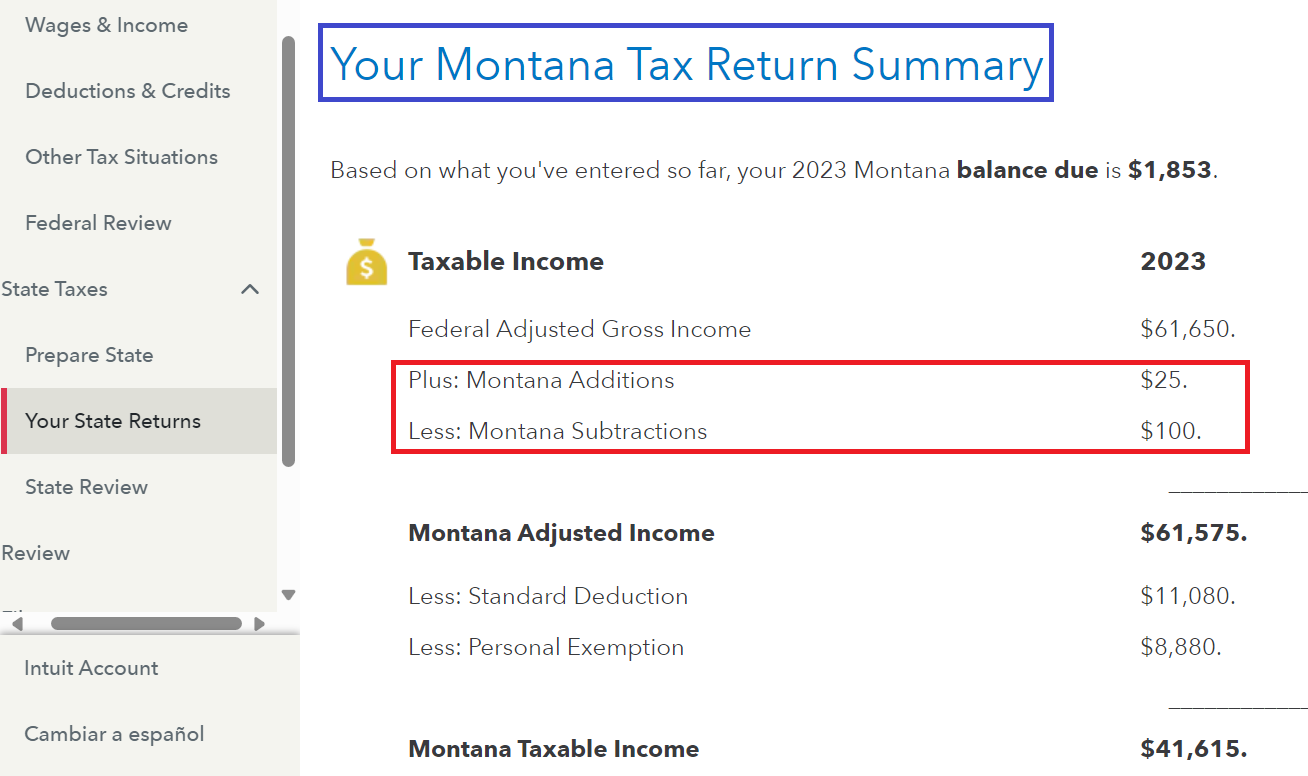

Review the income for interest and, if applicable, dividends. On the 'Your Montana Tax Return Summary' you are able to see the removal of the US Bond interest. TurboTax does this automatically without any intervention on your part. When you finish walking through the return you can see the 'Plus: Montana Additions' and 'Less: Montana Subtractions'. In my scenario I had $100 in US Bond interest (Box 3, Form 1099-INT) and $25 of tax exempt interest that was not from Montana. See the image below to review the summary:

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 30, 2024

8:12 AM