- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- My 2019 tax return has not been processed yet and it was accepted March 28th, 2020

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 2019 tax return has not been processed yet and it was accepted March 28th, 2020

@WhereIsMyRefund wrote:

We electronically filed by the April 15th deadline this year and have yet to receive any updates from the IRS. We really rely on that refund and especially now. I have confirmation that it is received, but it is still being processed...whatever that means. I have the hotline to call, but it is just an automated maze. Anyone have any suggestions?

After the tax return has been Accepted by the IRS (meaning only that they received the return) it will be in the Processing mode until the tax refund has been Approved and then an Issue Date will be available on the IRS website.

See this IRS website for federal tax refund FAQ's - https://www.irs.gov/refunds/tax-season-refund-frequently-asked-questions

If over 21 days since being Accepted by the IRS and the tax refund is still Processing you can call the IRS and speak with an IRS agent concerning your tax refund.

Call the IRS: 1-800-829-1040 hours 7 AM - 7 PM local time Monday-Friday

When calling the IRS do NOT choose the first option re: "Refund", or it will send you to an automated phone line.

So after first choosing your language, then do NOT choose Option 1 (refund info). Choose option 2 for "personal income tax" instead.

Then press 1 for "form, tax history, or payment".

Then press 3 "for all other questions."

Then press 2 "for all other questions."

- When it asks you to enter your SSN or EIN to access your account information, don't enter anything.

- After it asks twice, you will get another menu.

Press 2 for personal or individual tax questions.

Then press 4 for all other inquiries

It should then transfer you to an agent.

Or you can contact your local IRS office. See this IRS website for local IRS offices - http://www.irs.gov/uac/Contact-Your-Local-IRS-Office-1 or call 1-844-545-5640 to set up an appointment

Or you may want to contact a Taxpayer Advocate in your area. See this IRS website for Taxpayer Advocate in your area and a toll free number - http://www.irs.gov/Advocate/Local-Taxpayer-Advocate

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 2019 tax return has not been processed yet and it was accepted March 28th, 2020

So I did my tax return with TurboTax I already got my I've already got my state back and it says that my tax returns are still pending when it comes available the site will be uploaded it was accepted on April 27th and I still have not gotten anything

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 2019 tax return has not been processed yet and it was accepted March 28th, 2020

My federal return was accepted on February 15th, and still nothing. When I go to irs.gov, it says my federal return hasn't been processed and I'm passed the due date, and even when I go to their "Where's my Refund?" tool, it can't find anything.

I'm assuming that Covid is the culprit for all the insane delays, but any time the IRS tells me I'm late, I get nervous....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 2019 tax return has not been processed yet and it was accepted March 28th, 2020

@jsnlomberg wrote:My federal return was accepted on February 15th, and still nothing. When I go to irs.gov, it says my federal return hasn't been processed and I'm passed the due date, and even when I go to their "Where's my Refund?" tool, it can't find anything.

I'm assuming that Covid is the culprit for all the insane delays, but any time the IRS tells me I'm late, I get nervous....

You didn't say "how" you filed, but I'll assume you efiled. The Coronavirus situation mainly delayed mailed paper returns, but also some efiled returns if any required review/manual processing, etc.

If you efiled successfully and it was indeed accepted, you should be able to find evidence of it at the IRS website, unless you are not entering the correct information. Here are some things you can check.

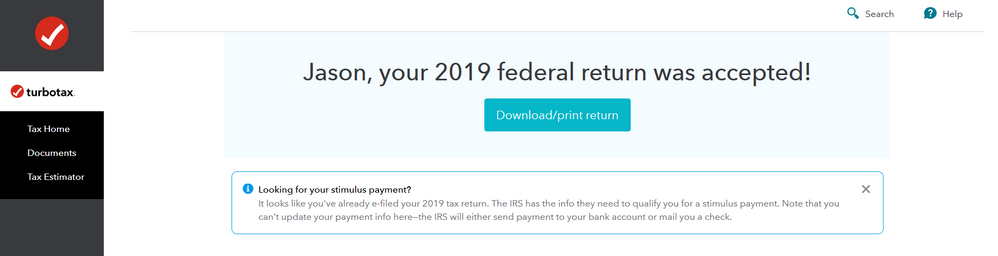

If you efiled, you should double-check to be sure the return was efiled successfully and accepted. If you used Online TurboTax, you can sign into your Online Account and check the efile status at the Tax Home.

If the info at the Tax Home confirms it was accepted, you can use the "Where's My Refund" tool at the IRS website below to check on the status of your Federal refund.

https://www.irs.gov/Refunds

NOTE: When using that tool, be sure to enter the correct SSN and filing status. Use only the Federal refund amount, and not any total refund amount that includes a state refund. The amount to use is on your Federal Form 1040, Line 21a.

You can also try phoning the IRS refund hotline. I've seen it work for some users before when the WMR tool didn't.

800-829-1954

If the IRS "Where's My Refund" tool says it is still being processed, we can tell you how to reach the IRS to inquire about the delay.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 2019 tax return has not been processed yet and it was accepted March 28th, 2020

Yep, my e-filing was actually rejected twice, but then it was filed successfully and accepted on 2/15.

I've tried using the "Where's my refund?" tool several times, but it keeps coming up with a weird error and not finding any evidence of my filing.

What am I missing?

I suppose I'll check the tool again after its planned outage (Sept. 5-8).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 2019 tax return has not been processed yet and it was accepted March 28th, 2020

@ jsnlomberg wrote: "I've tried using the "Where's my refund?" tool several times, but it keeps coming up with a weird error and not finding any evidence of my filing."

I don't know what the "weird error" is and why you are getting it, but as you mentioned the WMR tool is down 9/5-9/8. Did you look at your actual return and use the refund amount on your Form 1040, Line 21a? And did you try the IRS refund hotline I provided? I don't know if the hotline is working this weekend or not, but it's fast and easy to try. After the holiday weekend, if still unsuccessful, you can phone the IRS and ask a live IRS agent about it.

Due to the Coronavirus, some of the IRS call centers had been closed for several weeks, some are now operating with reduced personnel, and others are gradually opening back up. Users have been reporting that they are finally now reaching someone. But it may not be easy. Here is the normal method to reach a live IRS agent when they are operating smoothly.

IRS: 800-829-1040 (7AM-7 PM local time) Monday-Friday

When calling the IRS do not choose the first choice re: "Refund", or it will send you to an automated phone line.

- First choose your language. Then listen to each menu before making the selection.

- Then press 2 for "personal income tax".

- Then press 1 for "form, tax history, or payment".

- Then press 3 "for all other questions."

- Then press 2 "for all other questions."

- It may then ask for your SSN, but do not enter it. Just wait. If it asks for SSN a second time, still do not enter it.

- Then it will get "tired", and you'll get another menu. Choose 2 for "personal".

- Then in the next menu choose 4 for "all other inquiries", and it should transfer you to an agent but expect a long wait.

- I usually use a speakerphone so I can work on something else while waiting.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 2019 tax return has not been processed yet and it was accepted March 28th, 2020

I'd tried the "Where's my refund?" tool before the planned outage, but I suppose it's possible it wasn't working properly even beforehand. I did use the total federal refund that you mentioned. I'll try again on Tuesday after Labor Day (and/or try for a live agent after the outage on 9/9).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 2019 tax return has not been processed yet and it was accepted March 28th, 2020

I just used the "Where's my refund?" tool and got the following response from the IRS:

"Your tax return is still being processed."

Since February 15th! I know it's not your fault, I just can't believe it's taking this long to process, even with COVID.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 2019 tax return has not been processed yet and it was accepted March 28th, 2020

Believe it.

To call the IRS:IRS: 800-829-1040 hours 7 AM - 7 PM local time Mon-Fri

Listen to each menu before making the selection.

First choose your language. Press 1 for English.

Then do NOT choose the first choice re: "Refund", or it will send you to an automated phone line.

Instead, press 2 for "personal income tax".

Then press 1 for "form, tax history, or payment".

Then press 3 "for all other questions."

Then press 2 "for all other questions." It should then transfer you to an agent.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 2019 tax return has not been processed yet and it was accepted March 28th, 2020

Finally, finally, finally...7 1/2 months after the the IRS accepted my federal return, they finally processed it and issued my refund. And they even amended it to give me more back than I expected, so I'm not complaining. But still...7 1/2 months!

Happy it's over with. Thought I might be filing for 2020 with the previous year's still pending...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 2019 tax return has not been processed yet and it was accepted March 28th, 2020

I paper filed my return in March, still nothing from IRS website... They always told me not to re-file, but I am not even sure IRS did accept my return. The year of 2020 is just insane.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 2019 tax return has not been processed yet and it was accepted March 28th, 2020

MAILED RETURNS

The IRS has just started to work through millions of mailed returns that have been piling up in trailers during the pandemic. All you can do is watch the IRS refund site to see when your return makes it to the surface and goes into processing. Sorry.

Per the IRS website IRS Operations During COVID-19: Mission-critical functions continue:

IRS operational status and alternatives

Processing Delays for Paper Tax Returns: Taxpayers should file electronically through their tax preparer, tax software provider, or IRS Free File.

We’re experiencing delays in processing paper tax returns due to limited staffing. If you already filed a paper return, we will process it in the order we received it.

Do not file a second tax return or contact the IRS about the status of your return.

If you mail a tax return (or a payment) to the IRS, it is a good idea to use a mailing service that will track it like UPS or certified mail so you will know it was received.

When you mail a tax return, you need to attach any documents showing tax withheld, such as your W-2’s or any 1099’s.

TurboTax will not know anything about your mailed return, and will continue to show “Ready to Mail” on your account. TurboTax will not know that you put your tax return in an envelope and took it to a mailbox. TurboTax does not get updates on mailed (or e-filed) returns.

When the IRS finally opens its mail and begins to process mailed returns you can check the status on the IRS site. https://www.irs.gov/refunds

State returns have to be mailed to the state.

https://ttlc.intuit.com/questions/1899433-how-do-i-track-my-state-refund

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 2019 tax return has not been processed yet and it was accepted March 28th, 2020

I still don’t have my taxes processed... it’s been 4 months

I filed late but my goodness. Now I can’t get the next round of stimulus checks because I don’t have this done yet. 😕

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 2019 tax return has not been processed yet and it was accepted March 28th, 2020

There are a lot of delays for federal refunds. Did you mail your return or e-file?

If you mailed it:

MAILED RETURNS

The IRS has just started to work through millions of mailed returns that have been piling up in trailers during the pandemic. All you can do is watch the IRS refund site to see when your return makes it to the surface and goes into processing. Sorry.

Per the IRS website IRS Operations During COVID-19: Mission-critical functions continue:

IRS operational status and alternatives

Processing Delays for Paper Tax Returns: Taxpayers should file electronically through their tax preparer, tax software provider, or IRS Free File.

We’re experiencing delays in processing paper tax returns due to limited staffing. If you already filed a paper return, we will process it in the order we received it.

Do not file a second tax return or contact the IRS about the status of your return.

If you mail a tax return (or a payment) to the IRS, it is a good idea to use a mailing service that will track it like UPS or certified mail so you will know it was received.

When you mail a tax return, you need to attach any documents showing tax withheld, such as your W-2’s or any 1099’s.

TurboTax will not know anything about your mailed return, and will continue to show “Ready to Mail” on your account. TurboTax will not know that you put your tax return in an envelope and took it to a mailbox. TurboTax does not get updates on mailed (or e-filed) returns.

When the IRS finally opens its mail and begins to process mailed returns you can check the status on the IRS site. https://www.irs.gov/refunds

State returns have to be mailed to the state.

https://ttlc.intuit.com/questions/1899433-how-do-i-track-my-state-refund

Or......

Did you e-file? Did you click a big orange button that said “Transmit my returns now?”

When you e-file your federal return you will receive two emails from TurboTax. The first one will say that your return was submitted. The second email will tell you if your federal return was accepted or rejected. If you e-filed a state return, there will be a third email to tell you if the state accepted or rejected your state return.

First, check your e-file status to see if your return was accepted:

https://turbotax.intuit.com/tax-tools/efile-status-lookup/

If the IRS accepted it, what does it say here?

Or does your account say “Ready to Mail?”

Note: If it says “Ready to Mail” or “Printed” that means YOU have to mail it yourself. TurboTax does not mail your tax return for you.

If your e-file was accepted:

To check on regular tax refund status via automated phone, call 800-829-1954. (This line has no information on Economic Impact Payments.)

https://turbotax.intuit.com/tax-tools/efile-status-lookup/

TurboTax gives you an estimated date for receiving your refund based on a 21 day average from your date of acceptance, but it can take longer. Many refunds are taking longer during the pandemic.

Once your federal return has been accepted by the IRS, only the IRS has any control. TurboTax does not receive any updates from the IRS. Your ONLY source of information about your refund now is the IRS.

You need your filing status, your Social Security number and the exact amount (line 20 of your Form 1040) of your federal refund to track your Federal refund:

To track your state refund:

https://ttlc.intuit.com/questions/1899433-how-do-i-track-my-state-refund

https://ttlc.intuit.com/questions/1901548-why-do-some-refunds-take-longer-than-others

If you chose to have your TurboTax fees deducted from your federal refund, that will take some extra time, while the third party bank handles the refund processing.

https://www.irs.gov/refunds/tax-season-refund-frequently-asked-questions

The stimulus check is an advance on a credit you can receive on your 2020 tax return. If something went wrong or you did not get the stimulus check this year, you can get it when you file your 2020 return in early 2021—if you are eligible.It will end up on line 30 of your 2020 Form 1040.

https://ttlc.intuit.com/community/tax-topics/help/how-will-the-stimulus-package-impact-me/00/1393859

We know that the IRS is already revising the 2020 Form 1040 to include the 2nd stimulus, but that change will entail a lot of re-programing at the IRS and for the tax software programs. It may be at least a month — or longer— before the forms are changed. Do NOT be in a hurry to file your 2020 tax return until more is known. Give some extra time to the IRS and the software programmers so that the software can handle the new 2nd stimulus, so that you can get it all by filing ONE time. It is never a good idea to file too early; filing your 2020 return too soon may result in a lot of extra confusion that can be avoided if you wait and file a little later.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My 2019 tax return has not been processed yet and it was accepted March 28th, 2020

I electronically filed, and it was accepted by the IRS 4 months ago. My state does not require me to file a state tax return.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

nestog33

New Member

regena767lott

New Member

gamedayned1

New Member

chrisdanna

New Member

Justineraegallo

New Member