- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- I received a CP12 - is this s turbotax bug?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a CP12 - is this s turbotax bug?

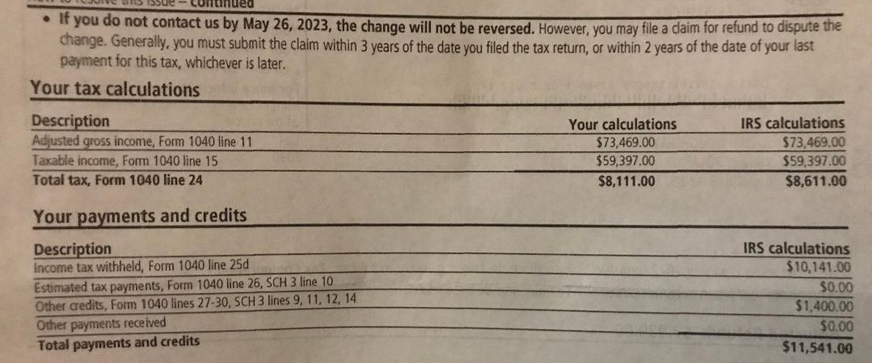

See attached CP12 snippet. Not sure what to do about this. Is IRS correct or turbotax? Is this a bug in turbotax? Now I'm afraid to send in my state taxes. My taxes are quite simple or so I thought. Any advice appreciated. Thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a CP12 - is this s turbotax bug?

Please see this Help Article for details concerning a CP12 notice from the IRS.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a CP12 - is this s turbotax bug?

Thank you Heather. I did see that article but it gives me no clue as to why TT calculated my total tax as 8111 but the IRS calculates my total tax as 8611. The reason I use TT is to avoid letters like this from the IRS. The CP12 states “We changed the amount of tax shown on your return because the amount entered was incorrect based on your taxable income and filing status.” I checked my w2 inputs - all correct. So what could this be - I like the TT calculation better, but the IRS always wins, right? No new shoes this year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a CP12 - is this s turbotax bug?

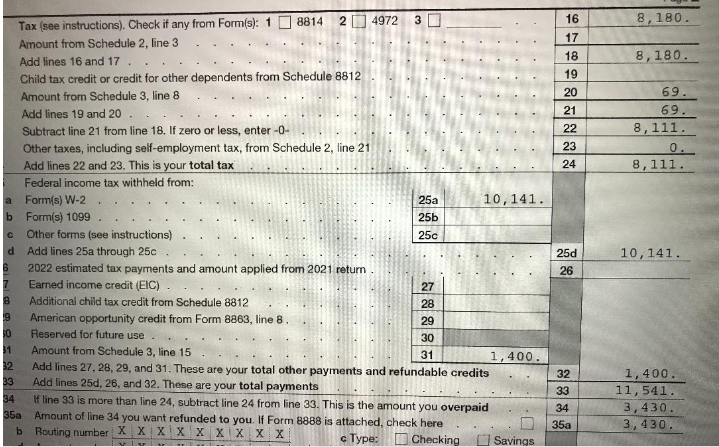

Thank you for the screen shot, but it is missing a lot of detail. What are the values on lines 16 through 23 (inclusive) on your 1040? That's where your $500 goes missing.

Tell us on what line the $500 appears on your tax return, and we can start there.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a CP12 - is this s turbotax bug?

Thanks Bill. Anything you need. I'm stumped.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a CP12 - is this s turbotax bug?

If the letter doesn't give you an explanation, then you should call the IRS using the phone number on the letter.

One possibility -- since the amount is exactly $500 more than what TurboTax reflects for tax -- is that the IRS is assessing a repayment of the First-Time Homebuyer Credit for a home purchased in 2008. Five-hundred dollars is the most common repayment amount of this credit.

According to the TurboTax Help article How do I repay the 2008 first-time homebuyer credit?:

If you took advantage of the 2008 First-Time Homebuyer Credit (which was actually an interest-free loan), you'll repay it in equal portions for 15 years, starting with your 2010 tax return.

Your repayment is an additional tax that will either lower your refund or increase your tax bill through tax year 2025. If you got the full $7,500 credit, the additional tax is $500 per year; otherwise, if you got less than that, your repayment is 6.66% of the total loan amount.

You might also request a tax transcript to help you understand what's going on. See the IRS' Transcript Types and Ways to Order Them for guidance.

You can then use Section 8A, Master File Codes - Transaction, MF and IDRS Collection Status, Freeze and IDRS Status 48, Restrictive and Filing Requirements in the 2022 version of Document 6209 - ADP and IDRS Information to decipher what the transcript is reflecting.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a CP12 - is this s turbotax bug?

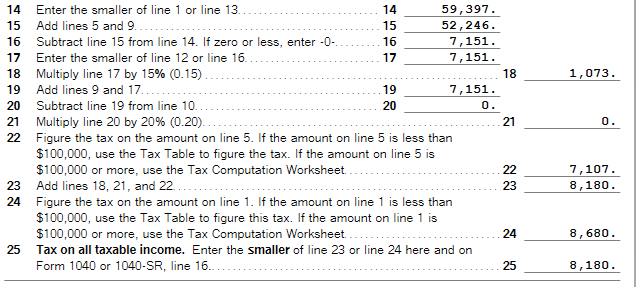

No useful explanation - see my quote from prior post - “…the amount entered was incorrect…”. And no home buying in the 2008 period. I did scrape up my courage and call the IRS. I was dreading them asking me a tax related question and me having nothing but “uhhhhhh”. But it went well, very nice lady but we didn’t solve it. She did ask me about that home buyer program btw. The one thing she did mention is that the tax tables aren’t always the only thing used to calculate tax owed. She said something about qualified dividends might affect this. I did have some dividend income - around 3000. She was unsure how exactly that applied and I didn’t know what to ask. Hopefully this is a clue.

I will go ahead and request that transcript. Thanks everyone.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a CP12 - is this s turbotax bug?

The rest of the story - with a happy ending:

I was able to determine that the value on 1040 line 16 comes from the Qualified Dividend and Capital Gains Worksheet - see attached. The worksheet clearly states (line 25) to use the smaller of the values and that's exactly what turbo tax did. So I got back on the phone with the IRS. It took five calls which totaled several hours over multiple days (and a lot of swearing). Had a different agent every time because they are not allowed to call me back if phone call gets dropped (more swearing). Eventually I got transferred up to someone and I explained the worksheet I was looking at. Agent said "well I don't have your worksheet". I described my issue with lines 23-25 and explained that I think the IRS made a mistake. I asked if they could obtain blank worksheet and I would read off all of my values so they could assess. So we did that and after waiting on hold expecting to be disconnected, they came back and said that they were making the adjustment based on the worksheet and that I would be receiving additional refund amount of $500. No explanation of why IRS made this adjustment in the first place. Hoping this helps others who may have had this same experience. Thanks again for all who helped!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a CP12 - is this s turbotax bug?

did you by chance mail in your return? the reason I ask is that paper returns must be hand entered by a clerk. if they miss or misenter line 3a your type of issue is possible. if you e-filed i have no explanation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a CP12 - is this s turbotax bug?

Hi Mike - yes this was a mail-in return. Maybe it time to e-file…

thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a CP12 - is this s turbotax bug?

YEP ... the IRS data input operator must have missed the qualifying dividends on the form 1040 line 3a. Last I heard the data input operator error rate was 20% or more so efiling when at all possible is the ONLY way to file. Errors on computor filed returns is less than .001%. And since efiling is free everyone who can SHOULD.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

thereseozi

Level 2

sharonewilkie

New Member

InTheRuff

Returning Member

johntheretiree

Level 2

CWP2023

Level 1