- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

The rest of the story - with a happy ending:

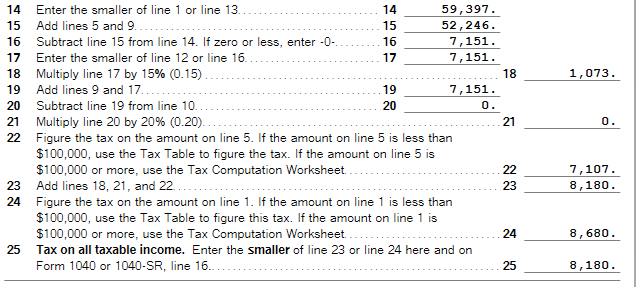

I was able to determine that the value on 1040 line 16 comes from the Qualified Dividend and Capital Gains Worksheet - see attached. The worksheet clearly states (line 25) to use the smaller of the values and that's exactly what turbo tax did. So I got back on the phone with the IRS. It took five calls which totaled several hours over multiple days (and a lot of swearing). Had a different agent every time because they are not allowed to call me back if phone call gets dropped (more swearing). Eventually I got transferred up to someone and I explained the worksheet I was looking at. Agent said "well I don't have your worksheet". I described my issue with lines 23-25 and explained that I think the IRS made a mistake. I asked if they could obtain blank worksheet and I would read off all of my values so they could assess. So we did that and after waiting on hold expecting to be disconnected, they came back and said that they were making the adjustment based on the worksheet and that I would be receiving additional refund amount of $500. No explanation of why IRS made this adjustment in the first place. Hoping this helps others who may have had this same experience. Thanks again for all who helped!