- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- I need to file 2021 est. taxes. The instructions say to search for 1040-es and use the Jump to link. In my 2020 return, I can't enter a search term. What do I do now?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to file 2021 est. taxes. The instructions say to search for 1040-es and use the Jump to link. In my 2020 return, I can't enter a search term. What do I do now?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to file 2021 est. taxes. The instructions say to search for 1040-es and use the Jump to link. In my 2020 return, I can't enter a search term. What do I do now?

You can no longer send in 2020 estimated payments which is why that section of the 2019 program is probably no longer operational. If you need to make 2021 estimated payments you can either use the 2020 program or get the forms from your state and/or the fed websites. Or google them.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to file 2021 est. taxes. The instructions say to search for 1040-es and use the Jump to link. In my 2020 return, I can't enter a search term. What do I do now?

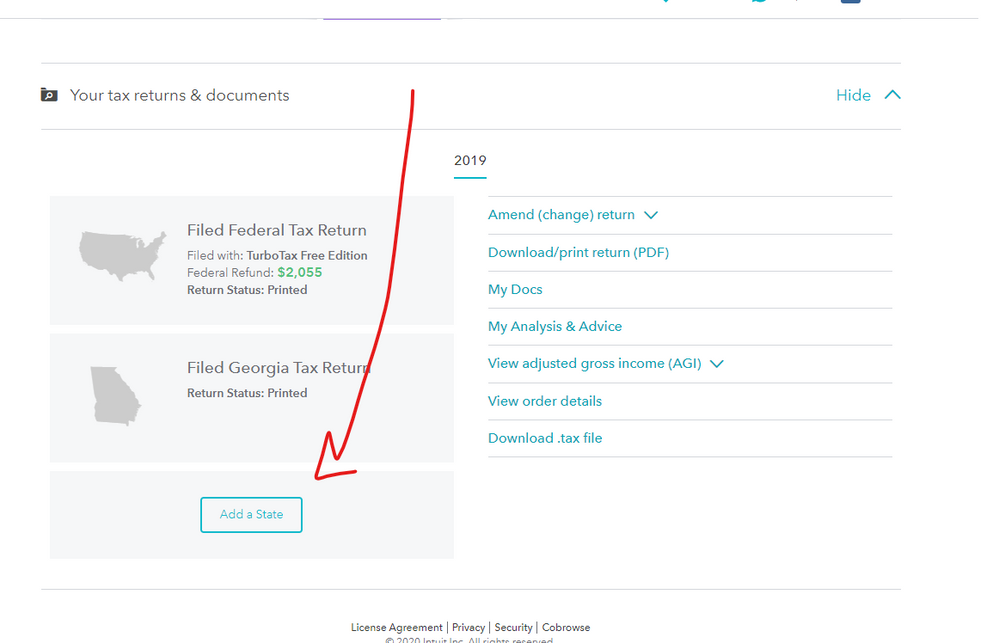

Ok ... you have to get IN TO the program and not just stop at the landing screen ... scroll down and click on ADD A STATE ...

How do I make estimated tax payments?

https://ttlc.intuit.com/replies/3301258

Can TurboTax calculate next year's federal estimated taxes?

https://ttlc.intuit.com/replies/4242911

Can TurboTax calculate the estimated payments for next year's state taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to file 2021 est. taxes. The instructions say to search for 1040-es and use the Jump to link. In my 2020 return, I can't enter a search term. What do I do now?

This did not solve my problem. I WAS in the program, not on the landing page. I had completely opened my 2019 return. I still can't get the search to work no matter what tab I am on. (When I try to add a state, it wants to charge me since I've already filed the one free state return.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to file 2021 est. taxes. The instructions say to search for 1040-es and use the Jump to link. In my 2020 return, I can't enter a search term. What do I do now?

@aferrarese22 wrote:

This did not solve my problem. I WAS in the program, not on the landing page. I had completely opened my 2019 return. I still can't get the search to work no matter what tab I am on. (When I try to add a state, it wants to charge me since I've already filed the one free state return.)

What are you trying to do with the TurboTax 2019 program? Are you using the TurboTax 2019 software installed on your personal computer? If so, are you using Windows or Apple as your operating system?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to file 2021 est. taxes. The instructions say to search for 1040-es and use the Jump to link. In my 2020 return, I can't enter a search term. What do I do now?

You can no longer send in 2020 estimated payments which is why that section of the 2019 program is probably no longer operational. If you need to make 2021 estimated payments you can either use the 2020 program or get the forms from your state and/or the fed websites. Or google them.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to file 2021 est. taxes. The instructions say to search for 1040-es and use the Jump to link. In my 2020 return, I can't enter a search term. What do I do now?

First of all are you using the Online web version or the Desktop installed program? Then try searching for W4 (not 1040ES)

Search by typing in W4. Hit the Enter or Return key to get the Jump to w4 link to show up. Go to the W4 page and it will ask if you want to Change your W4. Click on NO. The next page will start the Estimates.

See my screen shot on this post,

https://ttlc.intuit.com/community/taxes/discussion/re-federal-estimated-taxes-for-2021/01/2199266/hi...

OR go to

Federal Taxes or Personal (Home&Business version)

Other Tax Situations

Other Tax Forms

Form W-4 and Estimated Taxes - Click the Start or Update button

Say No to W4. When you get to the W4 and Estimated Taxes section, say you want to adjust your income to go though all the screens.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to file 2021 est. taxes. The instructions say to search for 1040-es and use the Jump to link. In my 2020 return, I can't enter a search term. What do I do now?

Here are the 1040ES instructions and blank forms (where to mail is on page 4)

https://www.irs.gov/pub/irs-pdf/f1040es.pdf

Or you can pay on the IRS website. Be sure to pick 2021 1040ES payment

https://www.irs.gov/payments

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to file 2021 est. taxes. The instructions say to search for 1040-es and use the Jump to link. In my 2020 return, I can't enter a search term. What do I do now?

This is what I needed to know - that I can't use Turbo Tax 2020 to calculate or submit estimated taxes for 2021. I have downloaded the form and worksheet from .gov and will do this manually.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to file 2021 est. taxes. The instructions say to search for 1040-es and use the Jump to link. In my 2020 return, I can't enter a search term. What do I do now?

You can still use the 2020 program to complete 2021 estimated payments if you wish however you cannot efile them ... payments would have to be mailed or done on the IRS website directly.

You can calculate your 2021 estimated taxes and generate the payment vouchers by doing this:

- With your tax return open, search for 1040-es (be sure to include the dash) and select the Jump to link.

- Answer No to the question Do you want to change your W-4 withholdings for 2021?

- Answer the questions about things like your 2020 filing status, income, and deductions.

- Eventually, you'll come to the Print Vouchers? screen. Answer Yes and we'll include your 2021 1040-ES payment vouchers when you print a copy of your return later.

After you file ... to open the account ... log in and scroll down and click on ADD A STATE. Just do NOT make any changes to the return ... ONLY use the estimated payment section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to file 2021 est. taxes. The instructions say to search for 1040-es and use the Jump to link. In my 2020 return, I can't enter a search term. What do I do now?

Sorry you got some people confused when you said you opened your 2019 return in your second post. You meant your 2020 return.

Yes you do use the 2020 return to prepare estimates for 2021. Search for W4 (not 1040ES).

To prepare estimates for next year you need to be in your current return. But be careful not to change anything in your actual return.

In TurboTax Online, sign in to your account.

Select Tax Home in the left menu.

Scroll down to Your tax returns & documents.

Select 2020, and then select Add a State (you're not actually adding a state, this just gets you back into your return so you can make changes).

Search by typing in W4. Hit the Enter or Return key to get the Jump to w4 link to show up. Go to the W4 page and it will ask if you want to Change your W4. Click on NO. The next page will start the Estimates.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to file 2021 est. taxes. The instructions say to search for 1040-es and use the Jump to link. In my 2020 return, I can't enter a search term. What do I do now?

This is where I started. I tried to do this exactly, but I can't get the search to work. I can't get to the Jump to link you reference. I will just use the paper forms.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to file 2021 est. taxes. The instructions say to search for 1040-es and use the Jump to link. In my 2020 return, I can't enter a search term. What do I do now?

I tried this too. When I click Add a State, it takes me to a page to purchase another state filing (since I already filed a state return). I have given up trying to use Turbo Tax and will just use the paper forms.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to file 2021 est. taxes. The instructions say to search for 1040-es and use the Jump to link. In my 2020 return, I can't enter a search term. What do I do now?

@aferrarese22 wrote:

I tried this too. When I click Add a State, it takes me to a page to purchase another state filing (since I already filed a state return). I have given up trying to use Turbo Tax and will just use the paper forms.

The Add a State option is only for those who use the TurboTax online editions, Not the users of the TurboTax desktop users who have the software installed on their personal computer.

Click on Search in the upper right of the desktop program screen. Type in 1040-es and press enter

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to file 2021 est. taxes. The instructions say to search for 1040-es and use the Jump to link. In my 2020 return, I can't enter a search term. What do I do now?

Oh are you using the Desktop installed program? Sorry we gave you steps for the Online Turbo Tax. What version do you have? Like Deluxe, Premier or Home & Business?

Open your return and Go to….

Federal Taxes or Personal (Deskop Home & Business)

Other Tax Situations

Other Tax Forms

Form W-4 and Estimated Taxes - Click the Start or Update button

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to file 2021 est. taxes. The instructions say to search for 1040-es and use the Jump to link. In my 2020 return, I can't enter a search term. What do I do now?

I am looking for my 2020 tax transfers

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

bertkesj

New Member

user17605411005

New Member

umiboo

New Member

pbx5851

Returning Member

taxsavage

New Member