- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- I need to amend my return but it's not letting me. It's saying... "Your return isn't ready to be amended Yet?"

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to amend my return but it's not letting me. It's saying... "Your return isn't ready to be amended Yet?"

How would I amend directly with the IRS? Go to the website???

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to amend my return but it's not letting me. It's saying... "Your return isn't ready to be amended Yet?"

@lisaandchuck65 wrote:

How would I amend directly with the IRS? Go to the website???

If you are amending for the unemployment exclusion, then see this IRS website for how the IRS will be handling the exclusion starting in May - https://www.irs.gov/newsroom/irs-to-recalculate-taxes-on-unemployment-benefits-refunds-to-start-in-m...

The IRS does not want you to amend the 2020 tax return for the exclusion so the TurboTax program will not let you amend for that reason.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to amend my return but it's not letting me. It's saying... "Your return isn't ready to be amended Yet?"

Something else!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to amend my return but it's not letting me. It's saying... "Your return isn't ready to be amended Yet?"

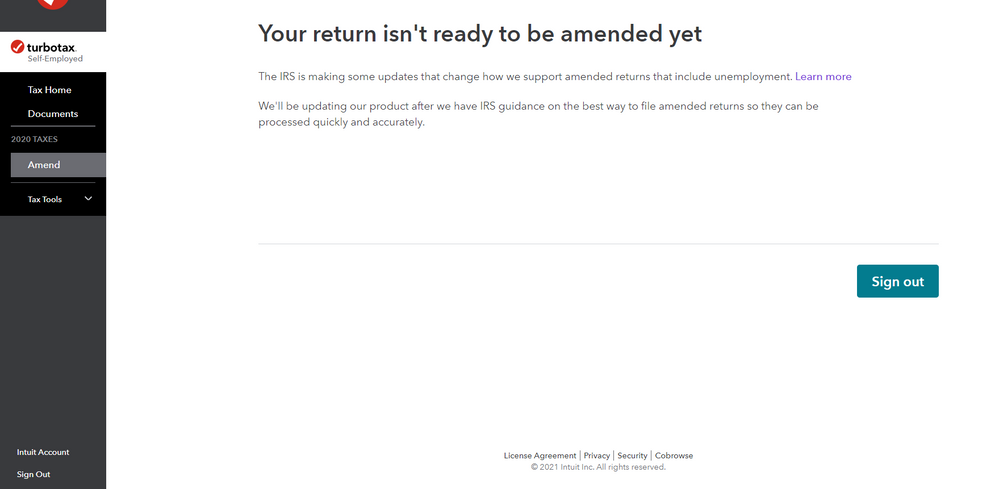

DoninGA Why are you so insistent that 2020 amendment feature is available 3/26 when it is not, at least for some TT users? Below is a screenshot from 4/2/2021. Tried deleting cookies, using a different browser. I need to amend Form 8949 as my 1099-B was missing cost base (sold employee shares). Looks like I'm stuck indefinitely until TurboTax clarifies what's going on.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to amend my return but it's not letting me. It's saying... "Your return isn't ready to be amended Yet?"

@Mike237 I can only go by what I see using the online and desktop editions to amend a 2020 tax return. That is why I post screenshots. But it does appear that many users cannot yet amend their tax returns.

TurboTax has issued this support FAQ for why you cannot amend your tax return - https://ttlc.intuit.com/community/amend-tax-return/help/why-can-t-i-amend-my-return/01/2122917

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to amend my return but it's not letting me. It's saying... "Your return isn't ready to be amended Yet?"

That does not mean that the amend software is not there but that "your" tax return contains information that the IRS has put an amend hold on until they decide how to handle it.

Apparently your return contains a 1099-G for unemployment that the IRS says not to amend to claim and the IRS will handle that internally. But many taxpayers have other reasons to amend and the IRS has not figured out how to handle that conflict yet.

Since amended returns are currently taking 4-6 months to process, any unemployment rebate credit will be paid by the IRS long before the amended return is even processed.

You have 3 years to amend.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to amend my return but it's not letting me. It's saying... "Your return isn't ready to be amended Yet?"

A lot of people need to amend for something else rather than unemployment. But because they have "unemployment compensation" within their return, TurboTax and the IRS are making them wait as well. What if new calculations make people eligible for the stimulus check and because we are not allowed to amend, we miss out on that?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to amend my return but it's not letting me. It's saying... "Your return isn't ready to be amended Yet?"

I recommend waiting to ensure you don't have to file another amended return after amending. The IRS is issuing guidance based upon all of the latest changes but as taxes can be complex, there are many layers that are affected. Therefore, even if you were to amend your return now and mail it in, there is a high likelihood that you will need to amend again since the IRS has not issued official guidance on the remaining forms affected.

You will not miss out on the latest stimulus payments. If once everything has been updated, you determine you were eligible for the third stimulus payment, the IRS will either issue you the payment based upon your amended return or you will be able to claim the Recovery Rebate Credit on your 2021 income tax return.

Recovery Rebate Credit for 2021 tax return

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to amend my return but it's not letting me. It's saying... "Your return isn't ready to be amended Yet?"

I need to amend my WV state return. I have to add WV taxes that were taken out of my husbands job. The wrong W2 was sent and it just showed MD taken out. We had already filed by the time we realized the mistake.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to amend my return but it's not letting me. It's saying... "Your return isn't ready to be amended Yet?"

Please see this TurboTax Help article for guidance in amending your WV return: I need to amend my state return - TurboTax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to amend my return but it's not letting me. It's saying... "Your return isn't ready to be amended Yet?"

I filed in early March. I received both State and Federal refunds already. However, I need to amend because these new calculations will allow me to have extra benefits. We have 1099-G involved in our return (my wife and I). I know I cannot amend right now because of the unemployment issue, however when I go to amend, my federal amount is larger than the original amount. Why? I ask this because our MAGI will be $150,013 after the unemployment exclusion. So technically I will not be eligible for anything until I amend and put $100 into my tradition IRA to drop our MAGI to $149,013.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to amend my return but it's not letting me. It's saying... "Your return isn't ready to be amended Yet?"

TurboTax is still working with the IRS to resolve any issues that may occur when amending a return that has unemployment benefits. Until all issues are resolved, amend will not be available in TurboTax for returns that have unemployment benefits.

This article has more information and a link to be notified when amend will be available to you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to amend my return but it's not letting me. It's saying... "Your return isn't ready to be amended Yet?"

Im needing to amend mark the place where it says yea i can be claimed as a dependent on someone elses taxes so my grandma can get hers filed.i didnt mark that answer when i filed,so how can i get this done?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to amend my return but it's not letting me. It's saying... "Your return isn't ready to be amended Yet?"

yes i have received mine and told it has to be amended

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to amend my return but it's not letting me. It's saying... "Your return isn't ready to be amended Yet?"

My grandma who is allowed to claim me she cant because of the mistake made on my taxes.Her taxes was rejected because of it.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

markhowlett

New Member

scornedtorrent

New Member

johnsonbruce

New Member

clogans1

New Member

johnswanson363

New Member