- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

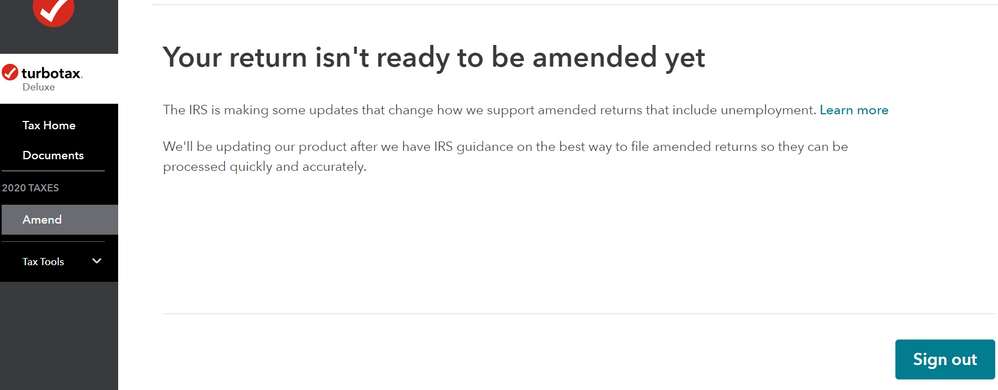

- I need to amend my return but it's not letting me. It's saying... "Your return isn't ready to be amended Yet?"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to amend my return but it's not letting me. It's saying... "Your return isn't ready to be amended Yet?"

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to amend my return but it's not letting me. It's saying... "Your return isn't ready to be amended Yet?"

I recommend waiting to ensure you don't have to file another amended return after amending. The IRS is issuing guidance based upon all of the latest changes but as taxes can be complex, there are many layers that are affected. Therefore, even if you were to amend your return now and mail it in, there is a high likelihood that you will need to amend again since the IRS has not issued official guidance on the remaining forms affected.

You will not miss out on the latest stimulus payments. If once everything has been updated, you determine you were eligible for the third stimulus payment, the IRS will either issue you the payment based upon your amended return or you will be able to claim the Recovery Rebate Credit on your 2021 income tax return.

Recovery Rebate Credit for 2021 tax return

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to amend my return but it's not letting me. It's saying... "Your return isn't ready to be amended Yet?"

Have you already e-filed the 2020 federal tax return and received the federal tax refund or if taxes were owed have you paid the taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to amend my return but it's not letting me. It's saying... "Your return isn't ready to be amended Yet?"

Yes, already efiled

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to amend my return but it's not letting me. It's saying... "Your return isn't ready to be amended Yet?"

already received my tax return too

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to amend my return but it's not letting me. It's saying... "Your return isn't ready to be amended Yet?"

@lisaandchuck65 wrote:

Yes, already efiled

Why are you amending the tax return? If you are amending to add the unemployment compensation exclusion, the IRS requests that the 2020 federal amended tax return not be filed at this time. Awaiting further guidance from the IRS for this issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to amend my return but it's not letting me. It's saying... "Your return isn't ready to be amended Yet?"

I need to remove a dependent

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to amend my return but it's not letting me. It's saying... "Your return isn't ready to be amended Yet?"

@lisaandchuck65 wrote:

I need to remove a dependent

Then you should be able to amend the 2020 tax return. Delete the dependent in the My Info section of the program.

See this TurboTax support FAQ on amending a tax return originally completed and filed using the 2020 TurboTax editions - https://ttlc.intuit.com/community/amending/help/how-do-i-amend-my-return/01/27439

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to amend my return but it's not letting me. It's saying... "Your return isn't ready to be amended Yet?"

I've tried clicking on "amend my return" and it says the forms not ready yet?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to amend my return but it's not letting me. It's saying... "Your return isn't ready to be amended Yet?"

@lisaandchuck65 wrote:

I've tried clicking on "amend my return" and it says the forms not ready yet?

The Form 1040-X was made available across all TurboTax platforms on 03/26. Are you using the TurboTax online editions? If so, close the program and clear cache and cookies on your web browser and then sign back onto our online account - https://myturbotax.intuit.com/

See this TurboTax support FAQ for clearing cache - https://ttlc.intuit.com/community/troubleshooting/help/how-to-clear-your-cache/01/26135

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to amend my return but it's not letting me. It's saying... "Your return isn't ready to be amended Yet?"

Yes, I'm using online platform. I'll try that...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to amend my return but it's not letting me. It's saying... "Your return isn't ready to be amended Yet?"

After getting Your return isn't ready to be amended yet message with my online version (received corrected W2) I talked to a TT agent today (3/31/20201) who said that amendments can't be done in TT yet, and I that can amend directly with the IRS instead. Otherwise I just need to wait. No ETA. This contradicts earlier TT message that amendment function became available 3/25/2021. Hope TT could do a better job informing customers.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to amend my return but it's not letting me. It's saying... "Your return isn't ready to be amended Yet?"

@Mike237 Have no idea who you spoke with from TurboTax but they are mistaken. The IRS Form 1040-X for tax year 2020 is available in all the TurboTax platforms, online and desktop, effective 03/26/2021.

See this TurboTax support FAQ on amending a tax return originally completed and filed using the 2020 TurboTax editions - https://ttlc.intuit.com/community/amending/help/how-do-i-amend-my-return/01/27439

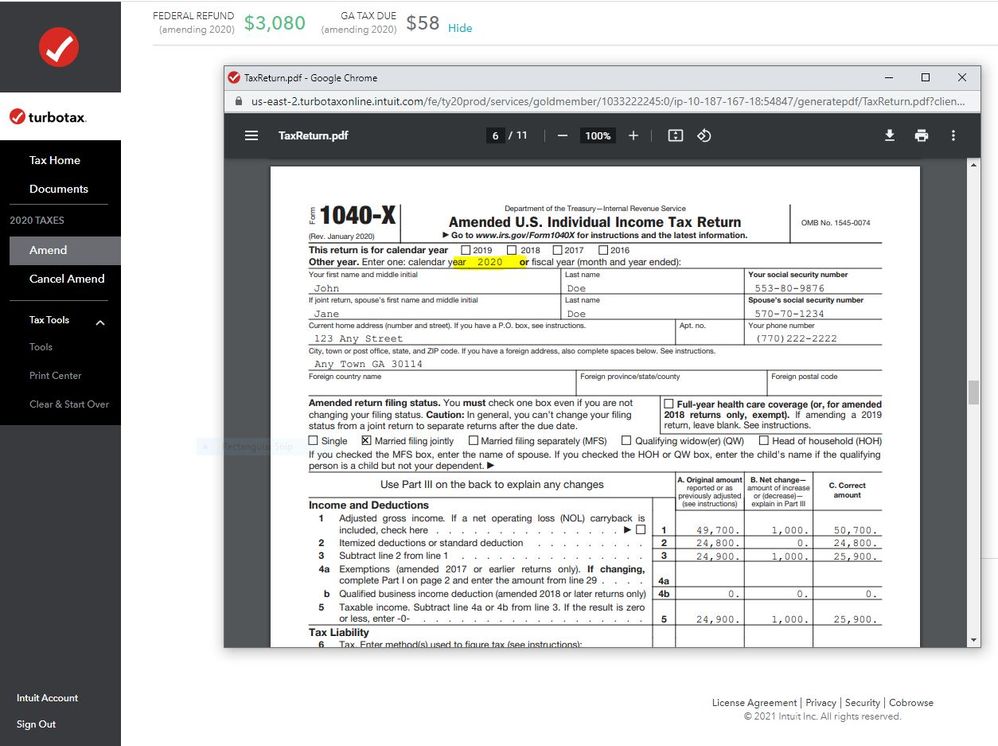

Here is a screenshot of a Form 1040-X for 2020 from the TurboTax online Free edition -

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to amend my return but it's not letting me. It's saying... "Your return isn't ready to be amended Yet?"

Thank you, but it still saying "YOUR RETURN ISN'T READY TO BE AMENDED YET".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to amend my return but it's not letting me. It's saying... "Your return isn't ready to be amended Yet?"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to amend my return but it's not letting me. It's saying... "Your return isn't ready to be amended Yet?"

@lisaandchuck65 wrote:

Thank you, but it still saying "YOUR RETURN ISN'T READY TO BE AMENDED YET".

It depends on why you are amending the 2020 tax return. Are you amending for the unemployment compensation exclusion or for something else?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

johnsonbruce

New Member

clogans1

New Member

johnswanson363

New Member

thompsonangel539

New Member

jruszkai

New Member