- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Federal income taxes owed and paid for a prior tax year a...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I deduct federal taxes paid for prior years - 2016 or 2015 - that were paid in 2017?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I deduct federal taxes paid for prior years - 2016 or 2015 - that were paid in 2017?

Federal income taxes owed and paid for a prior tax year are not reported on nor deductible on a federal tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I deduct federal taxes paid for prior years - 2016 or 2015 - that were paid in 2017?

Federal income taxes owed and paid for a prior tax year are not reported on nor deductible on a federal tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I deduct federal taxes paid for prior years - 2016 or 2015 - that were paid in 2017?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I deduct federal taxes paid for prior years - 2016 or 2015 - that were paid in 2017?

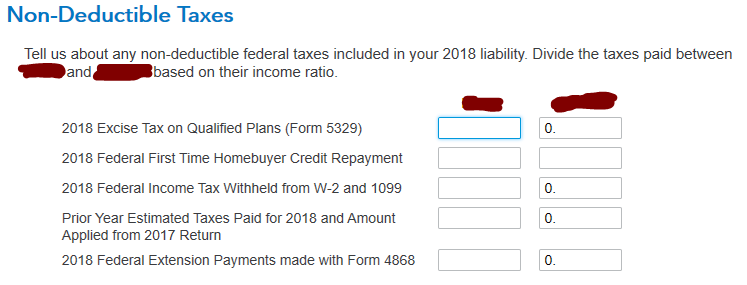

@xmasbaby0 I'm way behind on my 2019 return and working through it now. I'm in the State Return and I am to the question about "Prior Year Federal Tax." We paid tons of taxes in 2019 for years 2017 and 2018, so when I follow the directions given; adding all of the payments (not interest or fees) and then divide the amount between my spouse and I based on our income ratio, it spikes the state (Iowa) refund hugely. I'm nervous I haven't done this correctly and if I submit it, that it will come back to haunt me. Is this really a thing? 2019 was just a very atypical year for us, so I am fearful this anomaly will send up a red flag? It just seems too good to be true.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I deduct federal taxes paid for prior years - 2016 or 2015 - that were paid in 2017?

...ugh, and the next page confused me further. Wouldn't the extension payments be included on the previous page for "Prior Year Federal Tax." Sure I submitted it with my extension, but it was applied to my overall 2018 obligation, so wouldn't listing it here, too, under "2018 Federal Extension Payments made" be reporting it twice?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Agately

New Member

cramanitax

Level 3

Sarmis

New Member

chiroman11

New Member

dabbsj58

New Member