- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Did I set up auto payment of estimated taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did I set up auto payment of estimated taxes?

I THINK I set up automatic estimated tax payments. But I'm not sure now what I did. How can I find out if I set that up or not for both federal and NY state?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did I set up auto payment of estimated taxes?

Not sure what you did or think you did. But you cannot set up "automatic" estimated quarterly payments using the TT software. You either need to pay the quarterly estimated tax by mailing checks or money orders or by paying on the IRS and state tax web sites.

https://ttlc.intuit.com/questions/1901670-how-do-i-contact-my-state-department-of-revenue

Your only proof that you paid your tax will be your own bank or credit card records.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did I set up auto payment of estimated taxes?

Yeah, I just can't remember exactly what I did where. Whether in TT or a website, but here is a snip from an confirmation email I received about the NYS one and it sure looks like it was from turbotax:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did I set up auto payment of estimated taxes?

@mtiede Again---not possible. And there is no "snip" of an email attached to your post.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did I set up auto payment of estimated taxes?

Look again, the snip was removed from my post because of "bad html", so I edited it, saved the snip and uploaded it instead of pasting it. I think it shows up now.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did I set up auto payment of estimated taxes?

I'll have to find the fed and state websites to be sure, I guess, but the NYS one WAS paid.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did I set up auto payment of estimated taxes?

I seem to recall that NY did allow setting up d.debit of the next year's quarterly estimates with the submission of the e-filed "NY" tax return thru TTx.

But that's only for the NY state quarterly estimates (California might too?...don't recall for sure on that one)

For Fed/IRS you have to do it separately form the tax return submission.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did I set up auto payment of estimated taxes?

uh oh. I'm thinking maybe I was GOING TO set up the feds and never did. I fear I'm going to be paying a penalty now... That is what I get for doing my returns early. I forget what I did it was so long ago.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did I set up auto payment of estimated taxes?

@mtiede Yeah, you have to set up those FEDeral quarterly estimates outside of TTX...other than perhaps printing out vouchers if you don't pay them Online separately at the IRS's DirectPay website.

______________________

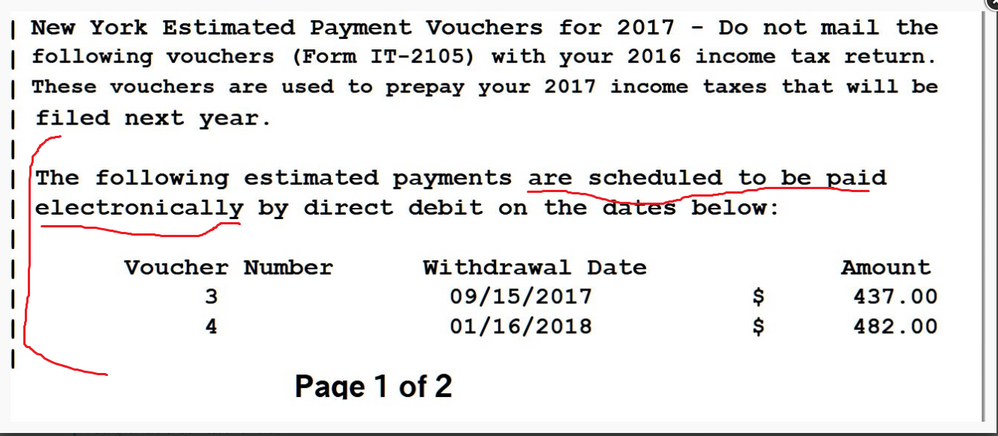

For NY, you should download a new PDF copy of your tax file, and check the NY Electronic filing instructions sheet...it should show what/when you had the NY payments set up for. Here's one printout I saw from back in 2017 for NY estimated payments (when pre-arranged properly, but only for the final two quarters):

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did I set up auto payment of estimated taxes?

I was JUST searching the NYS forms for estimated taxes and didn't discover that yet. But I think it must be there. I could have sworn I set up the feds too so that my wife wouldn't have to remember to send them in (she has always done that bit). But as I was going through the bank accounts today, I didn't notice a withdrawal for feds. I think I'm going to have to pay some penalties for late payment... bummer (although I saw that 1st quarter payment wasn't due until July 15 this year so maybe I'll get it figured out in time)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did I set up auto payment of estimated taxes?

I found the PDF that I had already stored on disk and it does say the estimated taxes are scheduled to be paid as in your example. And the amount agrees with what was taken out. So NYS is safe. Now to find something about feds, I hope. Otherwise, I'll have to call them on Monday and see what to do about it... I hate this stuff...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did I set up auto payment of estimated taxes?

You don't necessarily have to call the IRS. Not much they could do about it anyhow (if you can even get thru) ...just make a double/triple payment now and take what comes. Or, if you/spouse are getting W-2 income, increase your Federal tax withholding at your employers...and that may overcome any penalty being applied (W-2 Fed tax withholding is assumed to have been done evenly over the year...even when it isn't).

___________________

Also, I haven't seen anywhere that 2022 2nd quarter estimates are delayed until 15 June...July. I'm pretty sure it was still June 15th 2022. (For 2020 estimates...2nd quarter was delayed until July 15th).

But maybe someone else knows better.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did I set up auto payment of estimated taxes?

Did you find the federal 1040ES slips in the pdf? I think they are at the beginning. Did you mean The second one is due JUNE 15? Pay ghd second one now and increase it for the 1st missed one. You can just cross out the amount and write in a new amount. Or You can pay directly on the IRS website https://www.irs.gov/payments

Be sure to pick the right kind of payment and year.....2022 Estimate

The 1040ES quarterly estimates are due April 18 June 15, Sept 15 and Jan 17, 2023.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Did I set up auto payment of estimated taxes?

Here is IRS instructions. 2022 Due dates are on page 3 and of course on each 1040ES slip

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

teamely5

New Member

az148

Level 3

catoddenino

New Member

jstan78

New Member

mswright5911

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill