- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

@mtiede Yeah, you have to set up those FEDeral quarterly estimates outside of TTX...other than perhaps printing out vouchers if you don't pay them Online separately at the IRS's DirectPay website.

______________________

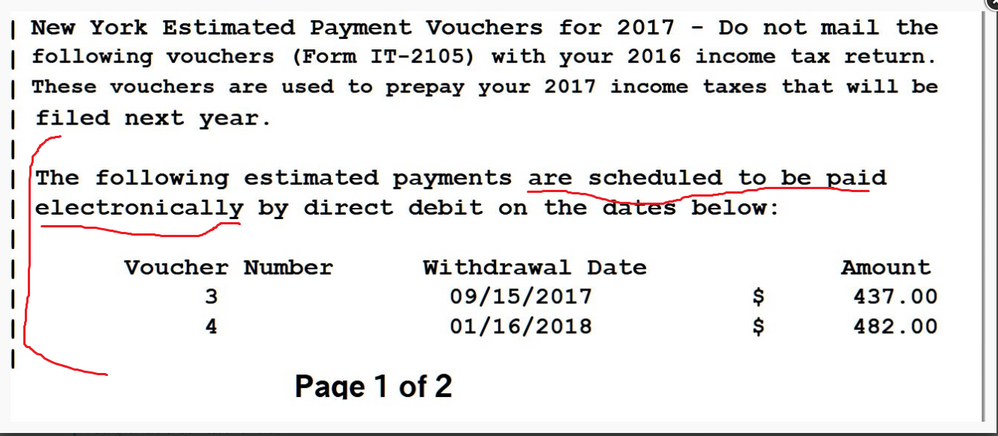

For NY, you should download a new PDF copy of your tax file, and check the NY Electronic filing instructions sheet...it should show what/when you had the NY payments set up for. Here's one printout I saw from back in 2017 for NY estimated payments (when pre-arranged properly, but only for the final two quarters):

____________*Answers are correct to the best of my knowledge when posted, but should not be considered to be legal or official tax advice.*

June 26, 2022

11:08 AM