- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Code 806 w2 or 1099 withholding

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Code 806 w2 or 1099 withholding

I already filed my taxes and received $1109 direct deposit.

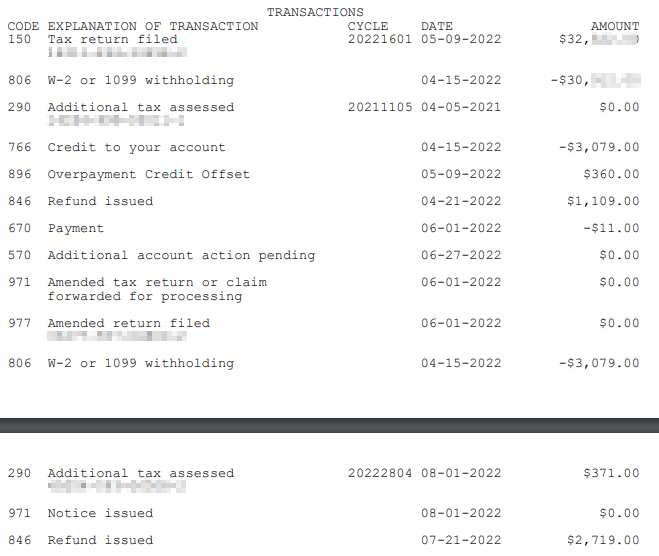

Today I received IRS check for $2719. Checked my account online and it shows this.

I think it is for the $3079 excess social security tax that I paid through my second employer (I switched jobs mid year).

Didn't they already gave me a credit for that on my initial tax return?

Also what is the additional tax assessed $371, do I need to wait for a notice?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Code 806 w2 or 1099 withholding

@nejidoreb123 wrote:.....what is the additional tax assessed $371, do I need to wait for a notice?

You can wait for a notice or call customer service.

https://www.irs.gov/faqs/irs-procedures/refund-inquiries/refund-inquiries-20

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Code 806 w2 or 1099 withholding

Definitely, you'd have to wait or call in for an explanation.

BUT

If you overpaid SS from two jobs, that indicates a fairly high income....perhaps your income was high enough that you were also subject to the additional 0.9% Medicare tax assessed on high wage earners. (i.e. the extra $371)

Read:

Topic No. 560 Additional Medicare Tax | Internal Revenue Service (irs.gov)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Code 806 w2 or 1099 withholding

How did you calculate the extra $371? My social security wages between the two jobs is ~192k, SS withheld is ~12k total, so I overpaid by $3079.

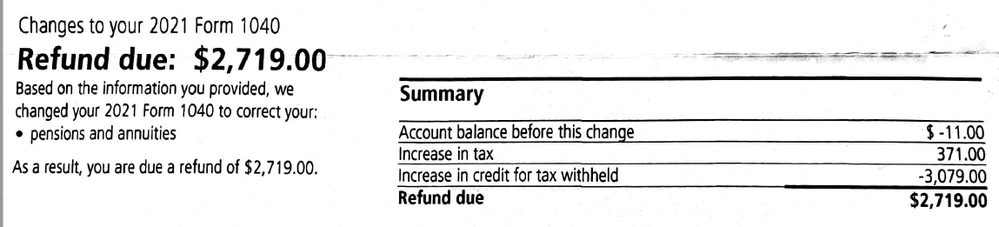

It seems like they already gave a credit of $3079 in the first return for the excess social security withholding. Then they refunded another $3079 minus 11 (which I paid for changes in amended return) minus 371 (for new tax due).

Here is the CP21B notice. I'm not really sure why $3079 is processed twice? Am I eligible to cash the refund?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Code 806 w2 or 1099 withholding

Don't know if this means anything or goes together but did anyone notice that 371 is 360+11?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Code 806 w2 or 1099 withholding

Yes that is weird. The $360 is penalty for my excess Roth contribution. The $11 is when I amended my return I added 1099-INT and had to pay extra.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Code 806 w2 or 1099 withholding

@VolvoGirl wrote:

Don't know if this means anything or goes together but did anyone notice that 371 is 360+11?

Yes, and 371 + 2719 = 3090. Then if you subtract the $11 (-11) that equals $3079.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ackt

New Member

Sarisabella

New Member

KLM1965

New Member

user17723939636

New Member

poncho_mike

Level 4