- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

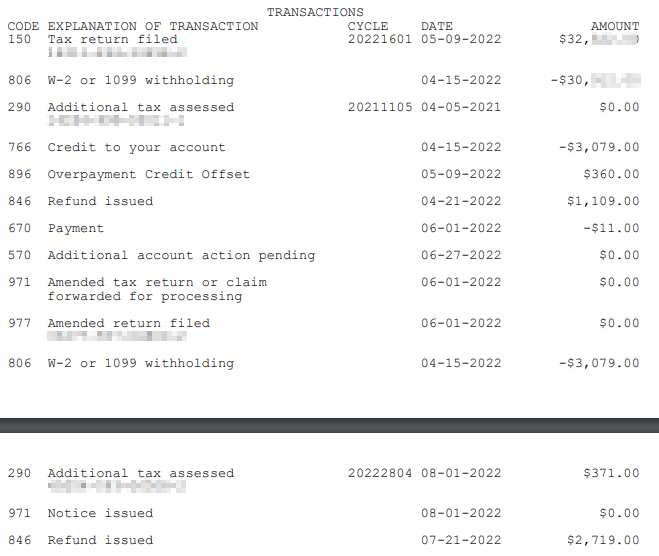

Code 806 w2 or 1099 withholding

I already filed my taxes and received $1109 direct deposit.

Today I received IRS check for $2719. Checked my account online and it shows this.

I think it is for the $3079 excess social security tax that I paid through my second employer (I switched jobs mid year).

Didn't they already gave me a credit for that on my initial tax return?

Also what is the additional tax assessed $371, do I need to wait for a notice?

July 29, 2022

11:17 AM