- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

How did you calculate the extra $371? My social security wages between the two jobs is ~192k, SS withheld is ~12k total, so I overpaid by $3079.

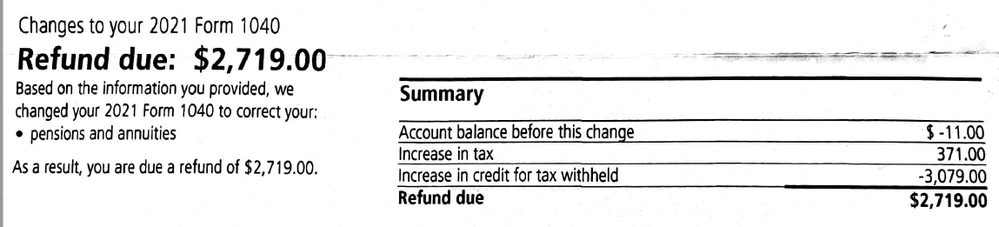

It seems like they already gave a credit of $3079 in the first return for the excess social security withholding. Then they refunded another $3079 minus 11 (which I paid for changes in amended return) minus 371 (for new tax due).

Here is the CP21B notice. I'm not really sure why $3079 is processed twice? Am I eligible to cash the refund?

August 1, 2022

4:10 PM