in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- child tax credit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

child tax credit

I only received 500 child tax credit instead of 2000. she was born in august and has a social security number, turbotax amendment forms will not let me update her status and now we aren't qualifying to receive the 2021 child credit advance.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

child tax credit

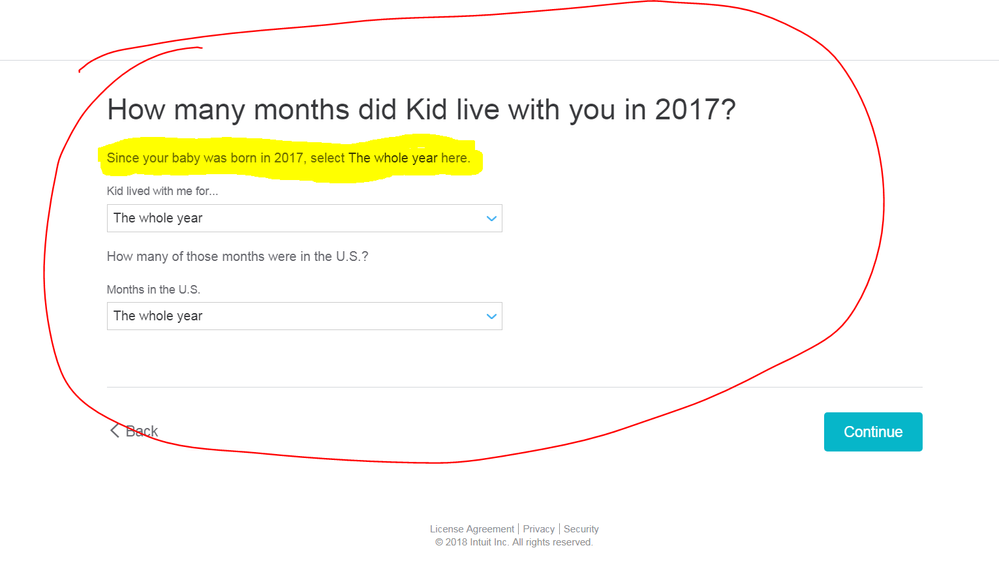

If line 19 on your 2020 1040 had $500 then you probably told TurboTax that the child lived with you for 5 months instead of 12 months (or you answered another question incorrectly). The tax law says that a child born *anytime* in 2020 is deemed to have lived with you the whole year.

You should amend 2020 so that you get the proper credit. Unfortunately amended returns are taking 6 months of longer to process so it will be too late to qualify for the advance 2021 payments.

You should *wait* until your return has been processed and you receive your refund or conformation that any tax due has been paid. (If you file an amended return while you first return is being processed it can cause extended delays for both returns if two returns are in the system at the same time). In addition, if the IRS makes any change on your original return, you might end up having to amend the amendment – a sticky process that can take a year or more).

-- Then you can start the amend process.

It is suggested that it be mailed certified with return receipt (or other tracking service) to verify that the IRS receives it. That is the only proof of mailing that the IRS will accept.

-- Amended returns can be mailed or e-filed - allow 8-12 weeks - can take up to 16 weeks (4 months) for processing. (Because of the IRS huge backlog it will probably take 6-8 months to process).

See this TurboTax FAQ for help with amending:

https://ttlc.intuit.com/questions/1894381-how-to-amend-change-or-correct-a-return-you-already-filed

You can check the status of your amended return here but allow 3 weeks after filing for it to show up:

https://www.irs.gov/filing/wheres-my-amended-return

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

child tax credit

if she was born in 2020, you were supposed to indicate that she lived with you all year. if you did not she would not be a qualifying child and the credit would be limited to the $500. you can file an amended return to indicate she lived with you all year. an amended return can take 6 months to process. this error may prevent you from getting any advance CTC payments, but you can claim the credit on your 2021 return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

child tax credit

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

joeylawell1234

New Member

donnapb75

New Member

linda11mom

New Member

KimberlyFondren86

New Member

girishapte

Level 3