in Events

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Where is the question on whether ESPP ordinary income is included on W2

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the question on whether ESPP ordinary income is included on W2

My ESPP compensation income is not included in my W2. I have confirmed that both with my employer HR team and by adding all my paychecks.

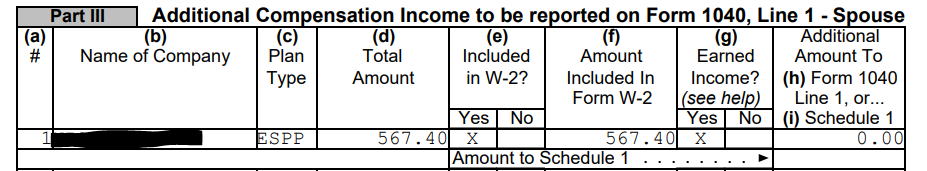

I went through the entire guided interview in Investment Income, subsection Stocks, Cryptocurrency, Mutual Funds,...etc. entered what I paid for the stock plus the employee discount. However, it was not added to my Form 1040 line 1 compensation income, which exactly matches my W2. When I look at the test PDF of my tax return, it has a worksheet entitled "Summary of Compensation Income from Employee Stock Transactions."

On it, I see the correct compensation income from each of my ESPP sales. However, I see this table:

Clearly it's not adding to my Form 1040 line 1 because it thinks it's already in the W2. How do I tell it that it is not included in the W2? It asks if the ESPP is for a company with a W2 on this return, which it is, but in past years it used to ask if this compensation income was in the W2 and now no longer does.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the question on whether ESPP ordinary income is included on W2

Yes, the ESPP income is usually included in Box 1 on your W-2. Often there is a notation in Box 14 as to the amount of ESPP.

However, if it is not, you can you can delete the sale and report it using the "ESPP" step by step interview.

When you answer "No" to the question on the ""Your Employer Stock Plan Results" TurboTax will add the compensation it's calculated on line 7 of Form 1040.

Click this link for more info on ESPP Not Included on W-2.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the question on whether ESPP ordinary income is included on W2

As I mentioned, my ESPP compensation income is not included in my W2. I have confirmed that both with my employer HR team and by adding all my paychecks.

I went through the entire guided interview in Investment Income, subsection Stocks, Cryptocurrency, Mutual Funds,...etc. entered what I paid for the stock plus the employee discount and was not able to trigger that question. I have deleted the entire 1099B and started over several times and cannot figure out how to trigger it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the question on whether ESPP ordinary income is included on W2

If you are working in Turbo Tax online, here are the steps.

- As you start entering your stock sales, the program will eventually ask Do these sales include any employee stock, here you say yes.

- Then as you begin entering your stock information, under sale information>what type of investment did you sell>select Employee Stock purchase plan (ESPP) Then enter the sale information.,

- Next screen asks, Adjust your cost basis to ensure your best outcome. Then select I can't find it, I need some help

- Then there will be a screen asking you is it from an employer with an existing W2 or is one without. Make one selection or the other.

- Next screen will say Now, we'll walk you through entering the rest of your sales info. Select sounds good.

- Next screen is where you enter your ESPP sales information. If compensation income was not included on a W2, put 0.

- Finish the section.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the question on whether ESPP ordinary income is included on W2

Hi. Thanks for this discussion.

I imported my 1099-B from the broker (or whatever its called) website, and the RSU and ESPP 1099-B was imported into TT. I then went through each of the lines of groups of stock that were sold, and updated the supplemental information by adding in the various prices TT asks for from the 3922 (price on purchase date, grant date, paid price etc). Every time I entered each, for ESPP, my tax due went lower and lower, because the cost basis was going higher, because the cost basis updated to not take into account the 15%, which I believe is correct.

I have both long term and short term covered (I dont know if that is qualifying or disqualifying) on my 1099-B.

I also left Box 2 (which asks whether it is an ordinary gain or loss) for each of these stocks unchecked, because there was no box 2 on the 1099-B.

At the end, when I said done with all the 1099-B accounts, it asked me whether any of the ESPP are included in my W2 (it didn't say anything about ordinary as the OP in this post is asking). For RSU I said yes, but for ESPP, I wasn't sure, so I clicked No, and my tax due jumped up back to the amount that it was before I started entering all the supplemental 3922 information. So all those hours of figuring that out was wasted. What was the point of TT asking me all those questions about updating the cost basis if it will ignore all that anyway?

Other information I know is that ESPP is pre-tax.

The W2 does mention RSU in box 14. I don't see ESPP specifically listed, but could be in box 1.

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the question on whether ESPP ordinary income is included on W2

With ESPP, when the company buys the shares for you, you do not owe any taxes. You are exercising your rights under the ESPP. When you sell the stock, the discount that you received when you bought the stock is generally considered additional compensation to you, so you have to pay taxes on it as regular income.

- If you hold the stock for a year or less before you sell it, any gains will be considered compensation and taxed as such.

- If you hold the shares for more than one year, any profit will be taxed at the usually lower capital gains rate.

How much of the stock sale price is compensation and how much is capital gain depends on whether your stock sale is a qualifying disposition or a disqualifying disposition.

Disqualifying disposition:

You sold the stock within two years after the offering date or one year or less from the exercise (purchase date).

- In this case, your employer will report the bargain element as compensation on your Form W-2, so you will have to pay taxes on that amount as ordinary income.

- The bargain element is the difference between the exercise price and the market price on the exercise date.

- Any additional profit is considered capital gain (short-term or long-term depending on how long you held the shares) and should be reported on Schedule D.

Qualifying disposition:

You sold the stock at least two years after the offering (grant date) and at least one year after the exercise (purchase date).

- If so, a portion of the profit (the “bargain element”) is considered compensation income (taxed at regular rates) on your Form 1040.

- Any additional profit is considered long-term capital gain (which is taxed at lower rates than compensation income) and should be reported on Schedule D, Capital Gains and Losses.

Please see this TurboTax article for more information and examples. This article also offers examples.

Contact your employer or their payroll office for more information if you are not sure how the compensation portion of the employee stock was shown on your W-2. It may be included in your Box 1 wages and listed separately in Box 14.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the question on whether ESPP ordinary income is included on W2

It appears that this question asking you to check that the employee stock plan amounts were included on your W-2 is now missing from TurboTax 2023 Premier. In my opinion, this question was critical to verify that the total of the employee stock plan transactions entered in TurboTax matched the employee stock plan amounts on shown on the W-2.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the question on whether ESPP ordinary income is included on W2

I ran into a similar issue this year with 2023 Premier. You have to follow a very specific workflow to force the W2 question to trigger. For any investment that is an ESPP you must:

1. Select "Employee stock purchase plan (ESPP)" in the initial individual investment sale workflow screen.

2. After completing the rest of the initial screen and clicking continue, you will reach the "Adjust your cost basis to ensure your best outcome" screen. On this screen you must select "I can't find it and need help". This will take you through the step by step workflow where you enter additional information such as what employer it was related to, discount, and details from the form 3922.

3. After completing this for all stocks and clicking through the rest of the Investment income workflow, you will be presented with the W2 questions.

I found it very unintuitive. If you select "I found my adjusted cost basis" it will not trigger the rest of the ESPP workflow or the W2 question. I only discovered this through a few hours of trial and error.

- « Previous

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Raph

Community Manager

humbolta

Level 2

hjw77

Level 2

delinah100

Level 2

statusquo

Level 3