- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

My ESPP compensation income is not included in my W2. I have confirmed that both with my employer HR team and by adding all my paychecks.

I went through the entire guided interview in Investment Income, subsection Stocks, Cryptocurrency, Mutual Funds,...etc. entered what I paid for the stock plus the employee discount. However, it was not added to my Form 1040 line 1 compensation income, which exactly matches my W2. When I look at the test PDF of my tax return, it has a worksheet entitled "Summary of Compensation Income from Employee Stock Transactions."

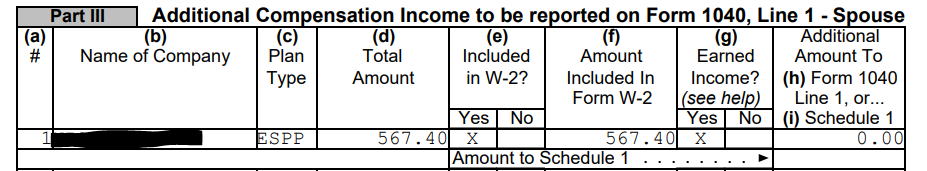

On it, I see the correct compensation income from each of my ESPP sales. However, I see this table:

Clearly it's not adding to my Form 1040 line 1 because it thinks it's already in the W2. How do I tell it that it is not included in the W2? It asks if the ESPP is for a company with a W2 on this return, which it is, but in past years it used to ask if this compensation income was in the W2 and now no longer does.