in Events

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Where is the question on whether ESPP ordinary income is included on W2

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the question on whether ESPP ordinary income is included on W2

Hi @DianeW777 denoting the correct "noncovered" may allow you to appropriately adjust the basis on the 8949, but I don't believe it impacts whether or not the ordinary income was appropriately reported in the W2. This would need to be adjusted at the income level on your 1040, which in prior years there was the option during the workflow to select if it has already been reported in your W2 or if it needs to be added as ordinary income.

When I select covered or noncovered in the flow, in neither instance does it appropriately add back the income to the total income line when I go to tool > View Tax Summary.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the question on whether ESPP ordinary income is included on W2

The actions that needs to take place in TurboTax Desktop version are shown below. The following link is helpful as well.

The steps to this screen are entered below for your convenience.

- Open your TurboTax account (Desktop Only)

- Scroll to Investment Income > Stocks, Mutual Funds, Bonds, Other > Update > Edit beside the ESPP stock sale

- Continue > Edit > Enter the requested details for this stock > Choose the Sale Category > Continue

- Continue or review your information on Less common items > Done

- Yes stock was acquired through employee stock plan > No do not remember this answer for all sales > Continue

- Select Employee stock purchase plan (ESPP) > Continue > Select Company > Enter number of shares sold > Select owner

- Continue > Select I have all my info ..... > Continue > Enter your information under short or long term as applicable

- Notice the compensation is shown at the bottom > Continue until you come back to the summary screen for this ESPP sale

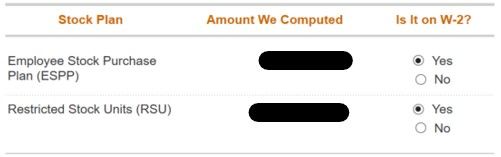

- Done > Done > Done > Your Employee Stock Plan Results screen appears with the selection for the W-2

- Select Yes or No based on your situation

- See the images below.

This should allow you to complete this transaction and finish your tax return. Thank you for your patience.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the question on whether ESPP ordinary income is included on W2

For 2019 I added the information from my 1099-B and 3922 and there was no question about whether the ESPP ordinary income was included on W2. I am unable to find in Turbotax 2019. Was this question not in Turbotax 2019?

Does this mean there is a problem if the ESPP ordinary income / discount was not included in the W2?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the question on whether ESPP ordinary income is included on W2

No, the question is there. Follow the steps below to reach the question for the ordinary income to be added to the W-2.

The actions that need to take place in TurboTax Desktop version are shown below. The following link is helpful using Situation 1.

The steps to this screen are entered below for your convenience.

- Open your TurboTax account (Desktop Only)

- Scroll to Investment Income > Stocks, Mutual Funds, Bonds, Other > Update > Edit beside the ESPP stock sale

- Continue > Edit > Enter the requested details for this stock > Choose the Sale Category > Continue

- Continue or review your information on Less common items > Done

- Yes stock was acquired through employee stock plan > No do not remember this answer for all sales > Continue

- Select Employee stock purchase plan (ESPP) > Continue > Select Company > Enter number of shares sold > Select owner

- Continue > Select I have all my info ..... > Continue > Enter your information under short or long term as applicable

- Notice the compensation is shown at the bottom > Continue until you come back to the summary screen for this ESPP sale

- Done > Done > Done > Your Employee Stock Plan Results screen appears with the selection for the W-2

- Select Yes or No based on your situation

- See the images below.

This should allow you to complete this transaction and finish your tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the question on whether ESPP ordinary income is included on W2

I pulled up Turbotax Premier 2019 to look at what I did. Your steps were similar to what I had done except on step 7 I did "Walk me through adding more info (recommended)". In that case it prompted me to enter my discount and my form 3922 information. If you do that way it doesn't show you the compensation income for that entry.

I didn't realize if I keep clicking through it gave me the total compensation income and W2 choice (for all ESPP entries not just the single one). It looks like I did correctly list "no" last year.

Thank you for your help. Think I am going to upgrade and use Premier again!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the question on whether ESPP ordinary income is included on W2

On this portion in TurboTax, where I "check that the following employee stock plan amounts were included in box 1 wages", the "Amount We Computed" by TurboTax is $0.26 more than the amount that shows up on the W-2.

Do I still answer "YES"? even though the amount doesn't exactly match? should I be concerned about this difference???

(If I answer "NO", my refund amount is a lot lower, and there's no way for me to correct the $0.26 difference.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the question on whether ESPP ordinary income is included on W2

Yes, you can answer YES. The 26 cents is due to rounding, which is allowed. You already paid tax on that W-2 income and if you answer NO there, you will be paying tax on it twice. And no one has to pay taxes on income twice. @rw34394

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the question on whether ESPP ordinary income is included on W2

Hi @DianeW777

Thanks for listing the steps below, they work for me. However TT assumes that all ESPP transactions within the same Institution/Account are either included or not included in the W2 which is not the case for me. TT asks the question "is it on W2?" only once for total of all transactions and not for each transaction individually. I have 9 transactions in the same Institution/Account and one of them is not included in the W2 all other 8 are included in the W2. What steps can I follow in TT to report this properly ? (I would prefer not to mess with the forms directly).

The ESPP transaction that is not reported in my W2 is a Long Term, Covered, Qualifying Disposition for which the Bargaining Element (the discount I received) is not reported in the W2. All other transactions are Disqualifying Dispositions and they are included in my W2 box1 and in box14 as ESPP DD (disqualifying disposition)

Thank you in advance for your direction,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the question on whether ESPP ordinary income is included on W2

It depends. You must add this as a separate sales transaction. If you reach a summary page with all of your transactions reported, except for this, you would choose add more sales underneath the transactions already reported.

- Enter the information like it is a stock sale.

- After entering, answer the questions asking if this was a sale of employee stock.

- Then enter the type of employee stock. In this case ESPP

- When it mentions what job did this come from, your employer should be listed. Select it. Then enter the number of shares sold.

- Next screen I suggest you choose Walk me Through Adding more Information because this will help you enter the discount you received plus 3922 information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the question on whether ESPP ordinary income is included on W2

Hi @DaveF1006 ,

Thanks for your reply. I followed your directions however TT continues to ask the question "is it on W2?" only once for the total Compensation Income of all the transactions from the same employer. I experimented changing the Institution and Account number just to check and TT still added them all together and asked the question "is it on W2?" only once.

I need to answer the question independently for each transaction because I have 9 transactions from the same Employer, in the same Institution and Account and one of them is not included in the W2 all other 8 are included in the W2. What steps can I follow in TT to report this properly ? (I would prefer not to mess with the forms directly).

I found out experimenting that if I change the employer then TT will ask the question "is it on W2?" once for each employer, however this is not my case, and it still assumes that all transactions from one employer are either all included or all excluded from the W2 which seems to be a fundamental error.

cc: @DawnC , @DianeW777 in case you have a solution for this situation.

Thanks in advance for your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the question on whether ESPP ordinary income is included on W2

The goal is for the tax gain or loss to be accurate. For this reason you could make one or two entries that would take care of the issue.

Any amount that is already included in the W-2 should be part of your cost basis. Make two entries if these stocks are both short and long term or one entry if they are either all short term or all long term.

- Manually add a stock sale for the combined amount (or amounts for one short term and one long term entry). The cost basis will be the amount that was included in the W-2, the sales price will be zero.

- Select the correct holding period

- Enter Various as the date acquired

- Enter the appropriate date of sale

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the question on whether ESPP ordinary income is included on W2

Hi @DianeW777 thank you for your reply.

To make it super simple, imagine I have 2 ESPP transactions from the same employer. My employer included the discount amount of the first transaction on my W2 but DID NOT include the discount amount of the second transaction in my W2.

The problem is that TT assumes that compensation income from different ESPP transactions from the same employer is either ALL INCLUDED on the W2 or NONE INCLUDED on the W2 (regardless or short term or long term, regardless of qualifying or disqualifying disposition, TT lumps them all under one row when it asks if the compensation was included on your W2). This is the screen that TT gives me, if I answer YES for the ESPP row it will be wrong, if I answer NO it will also be wrong.

So far I have only seen TT ask you separately the "is it on W2?" if it is a different type of asset like an RSU (in the pic) or if you use a different employer name.

cc: @DawnC in case you have a solution for this situation.

Thank you for trying to help with this,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the question on whether ESPP ordinary income is included on W2

@tavocp You should try to use the net result of what was not included in the W-2 after answering only one of the questions. The question does come after all transactions have been entered for the stock and for this reason there is not a screen that comes up for each transaction or each employer.

There could be an issue if there is short term and long term losses unless you simply enter one or the other as a separate sale explained earlier.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the question on whether ESPP ordinary income is included on W2

Has anyone run into this issue in the latest online version for the 2021 tax year? I'm using Premier online - the instructions provided seem to be for TT Desktop.

I went through the full ESPP workflow, it allowed me to adjust the basis for ordinary income, but never asked me if the ordinary income was on my W2. I have deleted the entire thing and started over about 3 times and cannot for the life of me get it to trigger the W2 question.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is the question on whether ESPP ordinary income is included on W2

The value of your ESPP stock may be included in box 14 of your W-2. TurboTax guidance for Box 14 on the W-2 provides the following:

"Box 14 is where your employer can include extra info about anything they want to report to the IRS....Examples of what an employer might add here include:

...Employee stock benefits (RSUs, ESPPs, etc.)"

In our test return, we did not see a question in the Investment Income section that related specifically to ESPP ordinary income. Rather, as per TurboTax instructions, in Investment Income, subsection Stocks, Cryptocurrency, Mutual Funds,...etc. we entered what we paid for the test stock plus the employee discount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Raph

Community Manager

humbolta

Level 2

hjw77

Level 2

delinah100

Level 2

statusquo

Level 3