- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Hi @DianeW777 thank you for your reply.

To make it super simple, imagine I have 2 ESPP transactions from the same employer. My employer included the discount amount of the first transaction on my W2 but DID NOT include the discount amount of the second transaction in my W2.

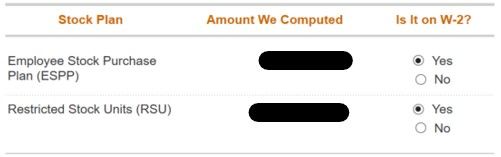

The problem is that TT assumes that compensation income from different ESPP transactions from the same employer is either ALL INCLUDED on the W2 or NONE INCLUDED on the W2 (regardless or short term or long term, regardless of qualifying or disqualifying disposition, TT lumps them all under one row when it asks if the compensation was included on your W2). This is the screen that TT gives me, if I answer YES for the ESPP row it will be wrong, if I answer NO it will also be wrong.

So far I have only seen TT ask you separately the "is it on W2?" if it is a different type of asset like an RSU (in the pic) or if you use a different employer name.

cc: @DawnC in case you have a solution for this situation.

Thank you for trying to help with this,