- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Where do I enter federal income tax withheld for Form 1099-K?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter federal income tax withheld for Form 1099-K?

Software version:

2021 desktop self-employed version

Background info:

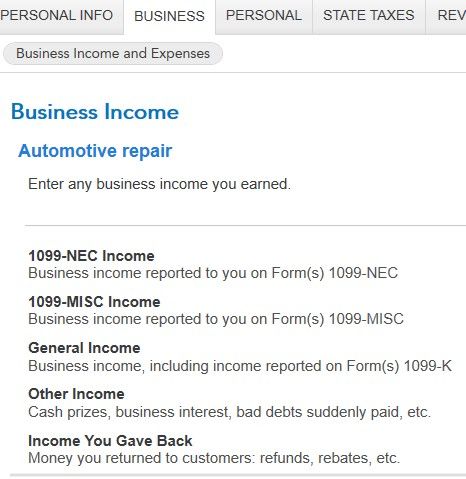

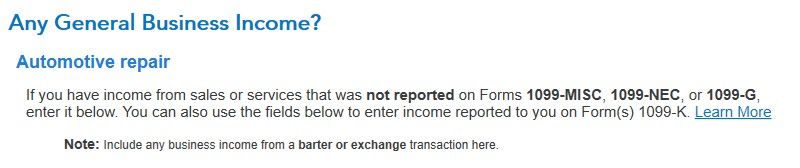

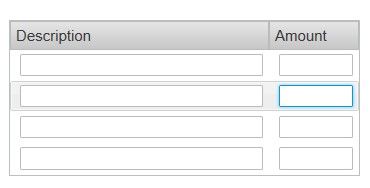

I got the 1099-K from my merchant service provider for 2021. In Turbo Tax, under General Income, I put the amount from the 1099-K box 1a. But then there are no more prompts to input the federal taxes withheld from box 4.

Questions:

Where do I enter the federal tax withheld? Should I just enter my income under the 1099-NEC section instead?

I attached screen shots of the Turbo Tax sections I'm talking about.

Any help would be greatly appreciated!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter federal income tax withheld for Form 1099-K?

Enter withholding on forms other than a W2 or 1099R under

Federal Taxes (or Personal for H&B)

Deductions and Credits

Then scroll way down to Estimates and Other Taxes Paid

Other Income Taxes - Click the Start or Update button

Next page scroll down to bottom section Other Income Taxes Paid

Click Start or Update by Withholding not already entered on a W-2 or 1099

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter federal income tax withheld for Form 1099-K?

Enter withholding on forms other than a W2 or 1099R under

Federal Taxes (or Personal for H&B)

Deductions and Credits

Then scroll way down to Estimates and Other Taxes Paid

Other Income Taxes - Click the Start or Update button

Next page scroll down to bottom section Other Income Taxes Paid

Click Start or Update by Withholding not already entered on a W-2 or 1099

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter federal income tax withheld for Form 1099-K?

Thank you kindly!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

loggetter

New Member

shikhiss13

New Member

rlb1920

Returning Member

Jbob5

New Member

Vermillionnnnn

Returning Member

in Education