in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- We are 80+ years old. We were NOT required and did not take RMDs for the year 2020. How do I get Turbo tax to accept this fact?

Announcements

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We are 80+ years old. We were NOT required and did not take RMDs for the year 2020. How do I get Turbo tax to accept this fact?

Topics:

posted

April 4, 2021

11:48 AM

last updated

April 04, 2021

11:48 AM

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

2 Replies

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We are 80+ years old. We were NOT required and did not take RMDs for the year 2020. How do I get Turbo tax to accept this fact?

Assuming you have a 1099-R, perhaps you mistakenly told the program it was from a qualified plan, when you should have indicated it was from a non-qualified plan? Just a wild guess here since there's no other information provided for me to work with. Might want to work back through the 1099-R section again and check that.

April 4, 2021

11:57 AM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We are 80+ years old. We were NOT required and did not take RMDs for the year 2020. How do I get Turbo tax to accept this fact?

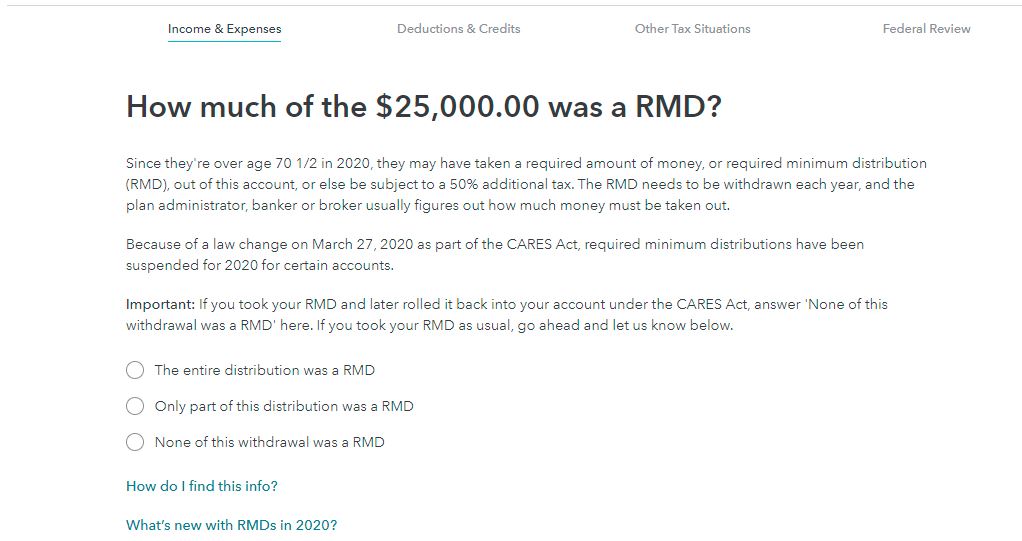

After you enter the 1099-R, you can indicate that an RMD was not required. (See below)

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 4, 2021

11:59 AM

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

hjh33414

Level 1

mtgguy

New Member

ttla97-gmai-com

New Member

postman8905

New Member

jimdeissler

New Member